Introduction

Earlier on Monday this week, NIFTY slipped below the 200DMA. As the markets continued to fall, the question doing rounds was: Is the Indian Stock Market crash a mere correction, or beginning of a bear market? We try to examine the past 28 years data and draw some inferences.

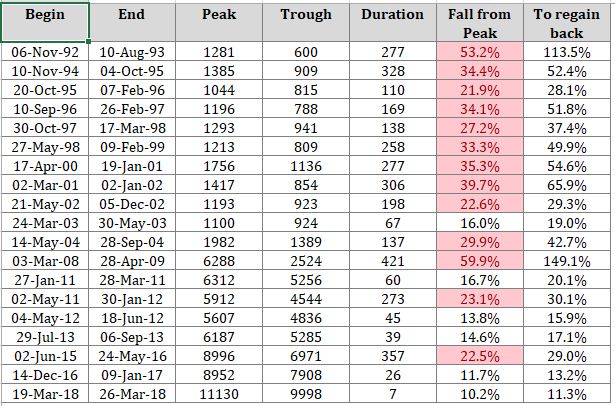

History of Indian stock market crash

In the past 28 years, beginning 3rd July 1990, up until 25th March 2018, NIFTY has dropped below its 200 DMA on 89 occasions – more than thrice every year on average. However, much of these dips have been noise, with number of single-day dips totalling couple of dozen times. To cut out the noise we expected the dip of sustain continuously for a minimum duration, and we picked this duration somewhat arbitrarily to be 15 days (and just to assure, this is not a back-tested right fit number). We expected the reversals to last continuously for at-least half-a-month to consider the penetration authentic. With this smoothening, the number of dips below the 200DMA came down to 18 times in the past 28 years, touching almost once each year, excepting for the following 4 periods:

1. 1990-91 (2 year Harshad Mehta bull market)

2. 2005-2007 (3 year great bull run)

3. 2010 &

4. 2014.

On all four occasions, the uninterrupted rise was followed by bear market with both the multi-year bull runs being followed by falls that dragged the index by more than 50%. On an aggregate level, two-third of these falls in the past 28 years have resulted in bear markets, although if we consider the past ten years data, only 3 out 8 have resulted-in bear markets, all 3 instances preceded by one or multi-year of uninterrupted rise.

Our interpretation of the present stock market crash

Returning to our initial question, is the Indian stock market crash a correction or bear market? 19th March, NIFTY had breached the 200DMA on downside. By close of trade 3rd April if the index remains below the 200DMA continuously, then the fall is likely to be deeper and last longer. If we go with 27 years data, then there is 67% probability of this fall accentuating into a bear market. However, the nearer term 10 year data gives us more hope with the odds down to 38%. And further, if we consider previous year(s) performance, the odds falls to zero.

What also gives hope is the tendency of markets to regress to the mean. Past 10 years compounded return from NIFTY has been 8% against 28 years returns of 13.8% and 37 years of SENSEX returns of 16.2% compounded. Regression to mean would necessitate better performance near term preventing deeper fall.

Conclusion

In conclusion, we are more hopeful than not that this fall may not deepen into a full-blown bear market. Although it is only time that will have the last say.

Also read:

Historical returns of Stocks, Gold and FD in India

Should you invest in Index Funds

Best dividend paying stocks in India

Reference:

1. National Stock Exchange of India

2. Bombay Stock Exchange of India