In this article we discuss merits of investing in best dividend paying stocks and identify various types of high dividend stocks in India for investing. We cover the following sub-topics:

- Research findings on high dividend yield strategy

- Investing in high dividend stocks in India

- Highest dividend paying stocks last 10 years in India

- 15 High dividend blue chip stocks in India

- Highest dividend paying penny stocks in India

- Top 50 dividend paying stocks in India

- 10 best dividend paying stocks for the long term in India

- Conclusion

Research findings on high dividend yield strategy

Let’s begin by summarizing these researches. They are as follows:

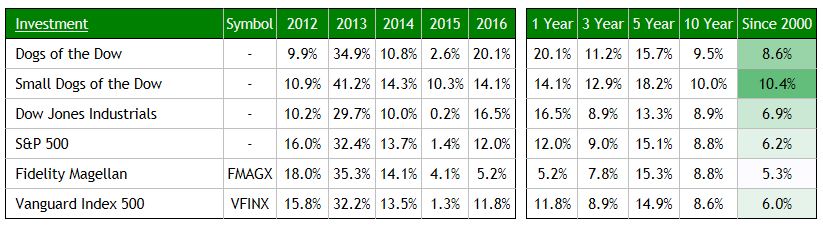

1. Dogs of the Dow.

This strategy popularized by Michael B. O’Higgins in 1991, proposes to invest equally in ten high dividend yield stocks that are DIJA constituents, and rebalance annually. Proponents of this strategy argue that blue-chip companies do not alter their dividend to reflect trading conditions and, therefore, the dividend is a measure of the average worth of the company; the stock price, in contrast, fluctuates through the business cycle. This should mean that high dividend yield stocks, with a high dividend relative to stock price, are near the bottom of their business cycle and are likely to see their stock price increase faster than low-yield companies.

From 2000 – date, this strategy has performed well, outperforming DIJA & S&500.

Source: Dogs of the Dow Total Return: Dog Years

2. David Dreman’s Contrarian Strategies

David Dreman in his investment classic, Contrarian Investment Strategies explored this strategy in detail. Dreman took 1500 largest companies from Compustat database and studied them for a period of 27 years beginning January 1 1970, through 31 December 1996. Companies were sorted into 5 equal groups based on dividend yields and rebalanced quarterly. Annual returns are as shown below.

| Low | 2 | 3 | 4 | High | Market | |

| Dividend | 8.0% | 5.4% | 3.9% | 2.2% | 0.7% | 4.0% |

| Appreciation | 8.1% | 12.1% | 11.2% | 11.6% | 11.5% | 10.9% |

| Total | 16.1% | 17.5% | 15.1% | 13.8% | 12.2% | 14.9% |

The best dividend paying stocks outperformed the market by 1.2%, and stocks with low or no yield by 4%.

Analysis of the composition of returns showed that almost half of the annual returns of the high dividend yield stocks came from the yield itself. Further, annual price appreciation of the highest yielding group was lower than any of the other worse groupings.

In summary, results indicated, buying high dividend yield stocks beats the market, although the price appreciation may be lower, and the total returns may be lesser compared to other contrarian strategies such as – Low P/E, P/CF and P/BV.

3. James P O’Shaughnessy’s findings

James P O’Shaughnessy in What Works on Wall Street, elaborately described the impact of dividend yields on stock returns. His findings are broadly in-line with other studies, although his results indicated that the effects of high dividend yield on returns were more pronounced for large cap stocks.

Using data from S&P Compustat database spanning over a period of 52 years beginning December 1951 through December 2003, he observed that cumulative returns of 50 Large Cap high dividend yield stocks (stocks with market cap > average, or mostly top 15% stocks) exceeded the Large Stocks universe by more than double (~143%), while returns of high yield All Stocks (stocks with mcap > 185M) were marginally better than All Stocks universe in general (cumulative ~ 18%).

Criticism

These results are not entirely without criticism. Many of these studies uses equally weighted portfolios, balanced periodically (annually or quarterly). Equally weighted portfolios perform better than their price weighted counterparts as we saw in one of the previous articles. As such, it has been argued by some that the superior performance of Dogs of the Dow strategy in particular, is at least in part due to the equal weightage of the constituents, as DIJA is a price weighted index.

With this global data in context, let’s turn our focus back to the Indian market.

Investing in high dividend stocks in India

First, the obvious question: does investing in high dividend stocks produce superior returns in India?

The easiest way to check that is to compare returns of benchmark Nifty 50 Total Returns Index, with Nifty Dividend Opportunities Total Return Index. The later is a strategy index that invests in high dividend stocks in India.

For a 12 year period starting 2008 through to 2019, the Dividend Opportunities Index generated an annual return of 8.61%, beating the Nifty 50 index (7.14%) by nearly 1.5% a year.

Now that we know that investing in high dividend stocks can be a valid strategy, let’s try to identify the highest dividend paying stocks in India.

Highest dividend paying stocks last 10 years in India

To generate this list, we added up the total dividend paid by the stocks for the past 10 years and divided by average market capitalization over the same period and arrived at the average historical dividend yield.

Additionally, we put a filter on market capitalization (m-cap >250 crores) to remove very small companies to arrive at the below list of 25 highest dividend paying stocks last 10 years in India.

| Name | Avg. 5Y Div Yld% | TTM Div Yld% |

|---|---|---|

| Vardhman Acrylic | 11.14 | 48.12 |

| Vedanta | 7.14 | 24.37 |

| Hindustan Zinc | 5.39 | 14.87 |

| Styrenix Perfor. | 8.54 | 13.49 |

| NMDC | 6.56 | 11.97 |

| Hinduja Global | 5.37 | 10.42 |

| I O C L | 7.23 | 10.28 |

| Banco Products | 5.67 | 9.97 |

| REC Ltd | 6.9 | 9.43 |

| Power Fin.Corpn. | 5.47 | 8.48 |

| PTC India | 6.08 | 8.12 |

| PNB Gilts | 7.04 | 7.95 |

| Natl. Aluminium | 5.7 | 7.8 |

| Coal India | 5.75 | 7.56 |

| Indus Towers | 6.18 | 7.18 |

| Polyplex Corpn | 7.89 | 6.82 |

| PTL Enterprises | 5.74 | 6.21 |

| H P C L | 5.41 | 5.88 |

| Cheviot Company | 6.13 | 5.32 |

| SJVN | 6.95 | 5 |

| B P C L | 7.37 | 4.66 |

| HEG | 7.29 | 3.86 |

| NxtDigital | 7.33 | 3.51 |

| Sanofi India | 5.54 | 3.29 |

| Graphite India | 7.69 | 2.85 |

Next we try to identify a list of high dividend blue chip stocks in India.

15 High dividend blue chip stocks in India

Blue chip stocks generally mean shares of nationally recognized, well established and financially sound companies. Using a simple filter on market capitalization (m-cap > 25,000 crores) and sorting by dividend yield, we have the following list of 15 high dividend blue chip stocks in India

| Name | Div Yld TTM% | Div Yld 5Y Avg% |

|---|---|---|

| Vedanta | 24.37 | 7.14 |

| Hindustan Zinc | 14.87 | 5.39 |

| NMDC | 11.97 | 6.56 |

| Hinduja Global | 10.42 | 5.37 |

| I O C L | 10.28 | 7.23 |

| REC Ltd | 9.43 | 6.9 |

| Power Fin.Corpn. | 8.48 | 5.47 |

| PTC India | 8.12 | 6.08 |

| Natl. Aluminium | 7.8 | 5.7 |

| Coal India | 7.56 | 5.75 |

| Indus Towers | 7.18 | 6.18 |

| Polyplex Corpn | 6.82 | 7.89 |

| H P C L | 5.88 | 5.41 |

| SJVN | 5 | 6.95 |

| B P C L | 4.66 | 7.37 |

Highest dividend paying penny stocks in India

In the US, stocks below one dollar (roughly 75 rupees today) are referred to as penny stocks. In the context of Indian markets, considering 100 rupees as the cut-off, and ranking by dividend yield, following 15 stocks may be considered as highest dividend paying penny stocks in India.

| Name | Div Yld TTM% | Div Yld 5Y Avg% |

|---|---|---|

| Southern Gas | 69.83 | 32.14 |

| Vardhman Acrylic | 48.12 | 11.14 |

| I O C L | 10.28 | 7.23 |

| PTC India | 8.12 | 6.08 |

| PNB Gilts | 7.95 | 7.04 |

| Natl. Aluminium | 7.8 | 5.7 |

| PTL Enterprises | 6.21 | 5.74 |

| SJVN | 5 | 6.95 |

Finally, we look at the best dividend paying stocks for long term in India.

Top 50 dividend paying stocks in India

The easiest way to find this is to look into the constituents of Nifty Dividend Opportunities 50 Index itself. Below, we have the constituents of Nifty Dividend Opportunities 50 Index, sorted by dividend yield, as of end October, 2020:

| Company Name | Symbol | Div Yld% |

|---|---|---|

| Vedanta Ltd. | VEDL | 13.99 |

| Steel Authority of India Ltd. | SAIL | 10.07 |

| Indian Oil Corporation Ltd. | IOC | 10.02 |

| REC Ltd. | RECLTD | 9.9 |

| Power Finance Corporation Ltd. | PFC | 8.84 |

| National Aluminium Co. Ltd. | NATIONALUM | 7.85 |

| Coal India Ltd. | COALINDIA | 7.53 |

| Oil & Natural Gas Corporation Ltd. | ONGC | 7.25 |

| Indus Towers Ltd. | INDUSTOWER | 7.18 |

| GAIL (India) Ltd. | GAIL | 7.02 |

| Power Grid Corporation of India Ltd. | POWERGRID | 6.96 |

| CESC Ltd. | CESC | 6.25 |

| Oracle Financial Services Software Ltd. | OFSS | 6.22 |

| Oil India Ltd. | OIL | 6 |

| Hindustan Petroleum Corporation Ltd. | HINDPETRO | 5.98 |

| Hindustan Zinc Ltd. | HINDZINC | 5.45 |

| Petronet LNG Ltd. | PETRONET | 5.24 |

| NTPC Ltd. | NTPC | 5.16 |

| ICICI Securities Ltd. | ISEC | 4.92 |

| Bharat Petroleum Corporation Ltd. | BPCL | 4.69 |

| Nippon Life India Asset Management Ltd. | NAM-INDIA | 4.42 |

| Tech Mahindra Ltd. | TECHM | 4.34 |

| Tata Steel Ltd. | TATASTEEL | 4.3 |

| Redington Ltd. | REDINGTON | 3.73 |

| HCL Technologies Ltd. | HCLTECH | 3.7 |

| Bajaj Auto Ltd. | BAJAJ-AUTO | 3.64 |

| Hero MotoCorp Ltd. | HEROMOTOCO | 3.52 |

| ITC Ltd. | ITC | 3.34 |

| Sun TV Network Ltd. | SUNTV | 3.05 |

| Mahanagar Gas Ltd. | MGL | 2.94 |

| Cyient Ltd. | CYIENT | 2.86 |

| Colgate Palmolive (India) Ltd. | COLPAL | 2.76 |

| BSE Ltd. | BSE | 2.67 |

| Chambal Fertilizers & Chemicals Ltd. | CHAMBLFERT | 2.59 |

| Angel One Ltd. | ANGELONE | 2.21 |

| MphasiS Ltd. | MPHASIS | 2.17 |

| Torrent Power Ltd. | TORNTPOWER | 2.07 |

| Infosys Ltd. | INFY | 2.01 |

| Muthoot Finance Ltd. | MUTHOOTFIN | 1.95 |

| Britannia Industries Ltd. | BRITANNIA | 1.94 |

| Bajaj Holdings & Investment Ltd. | BAJAJHLDNG | 1.92 |

| Bharat Electronics Ltd. | BEL | 1.69 |

| Hindustan Aeronautics Ltd. | HAL | 1.62 |

| Cummins India Ltd. | CUMMINSIND | 1.33 |

| Hindustan Unilever Ltd. | HINDUNILVR | 1.32 |

| Tata Consultancy Services Ltd. | TCS | 1.25 |

| Multi Commodity Exchange of India Ltd. | MCX | 1.15 |

| Larsen & Toubro Ltd. | LT | 1.04 |

| Nestle India Ltd. | NESTLEIND | 1.05% |

| Indiabulls Housing Finance Ltd. | IBULHSGFIN | 0 |

Table: Top 50 dividend paying stocks in India

10 best dividend paying stocks for the long term in India

As you can see, the top 10 best dividend paying stocks in India are giving a dividend yield of 7% or more, which is higher the SBI Fixed Deposit rate as on date.

Below, we provide business overview of the 10 best dividend paying stocks in India:

Vedanta Ltd.

Dividend Yield – 13.9%

Vedanta Ltd is a diversified natural resource group engaged in exploring, extracting and processing minerals and oil & gas. The group engages in the exploration, production and sale of zinc, lead, silver, copper, aluminum, iron ore and oil & gas. It has presence across India, South Africa, Namibia, Ireland, Liberia & UAE.

Presently, India accounts for ~65% of total revenues, followed by Malaysia (9%), China (3%), UAE (1%) and others (22%)

Steel Authority of India Ltd.

Dividend Yield – 10.1%

Steel Authority of India Limited (SAIL) is one of the largest steel-making companies in India is a Maharatna PSU. SAIL produces iron and steel at five integrated plants and three special steel plants, located principally in the eastern and central regions of India and situated close to domestic sources of raw materials.

SAIL has a total crude steel and saleable steel capacity of 19.63 million tonnes per annum and 18.54 million tonnes per annum, respectively, as of March 2022.

Indian Oil Corporation of India Ltd.

Dividend Yield – 10.0%

Indian Oil Corporation Ltd is a Mahratna PSU with business interests covering the entire hydrocarbon value chain – from Refining, Pipeline transportation and marketing of Petroleum products to R&D, Exploration & production, marketing of natural gas and petrochemicals. It has the leadership position in the Oil refining & petroleum marketing sector of India.

IOCL owns 32% of total refining capacity, ~73% of Crude Pipelines, 42% of petrol pumps, 51% LPG distributorships and 48% of Aviation Fuel stations in India.

REC Ltd.

Dividend Yield – 9.9%

REC Limited is engaged in financing and promoting rural electrification projects all over the country.

It provides loans to State Electricity Boards (SEBs), State Government Departments and Rural Electric Cooperatives for rural electrification projects, through its corporate office located at New Delhi and over 20 field units, which are located in most of the states.

Power Finance Corporation Ltd.

Dividend Yield – 8.8%

Power Finance Corporation Ltd is a Mahratna PSU registered with the RBI as an Infrastructure Finance Company. It is engaged in financing infrastructure projects in the Indian Power sector.

National Aluminum Co. Ltd.

Dividend Yield – 7.9%

National Aluminium Company Limited (NALCO), is a Navratna PSU engaged in the manufacturing and selling of Alumina and Aluminium. The Company is the lowest-cost producer of metallurgical grade alumina and lowest-cost producer of Bauxite in the world as per Wood McKenzie report.

NALCO operates a 22.75 lakh TPA Alumina Refinery plant located at Damanjodi in Koraput district of Odisha and 4.60 lakh TPA Aluminum Smelter located at Angul, Odisha.

Coal India Ltd.

Dividend Yield – 7.5%

Coal India Limited (CIL) is a PSU mining company, engaged in the production and sale of coal. The Company offers products, including Coking Coal, Semi Coking Coal, Non-Coking Coal, Washed and Beneficiated Coal, Middlings, Rejects, Coal Fines/Coke Fines, and Tar/Heavy Oil/Light Oil/Soft Pitch.

CIL operates through approximately 82 mining areas spread over eight provincial states of India.

Oil & Natural Gas Corporation Ltd.

Dividend Yield – 7.3%

ONGC is the largest crude oil and natural gas company in India contributing ~71 percent to Indian domestic production. It is a Maharatna PSU and is the most profitable PSU in India.

As of FY21 crude oil contributed to 70% of the revenue while natural gas and Value Added Products (VAPs) contributed to 17% and 13% respectively.

Indus Towers Ltd.

Dividend Yield – 7.2%

Indus Towers Limited is engaged in the business of setting up, operating and maintaining wireless communication towers. The Co. has a tower market share of 33% and tenancy market share of 42% which makes it leader in the telecom tower industry in India.

The company’s customers are Bharti Airtel, Vodafone Idea, Reliance Jio and BSNL.

GAIL (India) Ltd.

Dividend Yield – 7.0%

GAIL is a PSU undertaking engaged primarily in the transmission and marketing of natural gas.

It owns over 11,500 km of natural gas pipelines, over 2300 km of LPG pipelines, six LPG gas-processing units and a petrochemicals facility. It also has a joint-venture interest in Petronet LNG Ltd, Ratnagiri Gas and Power Pvt Ltd, and in the CGD business in several cities. GAIL has wholly owned subsidiaries in Singapore and the US for expanding its presence outside India in the segments of LNG, petrochemical trading and shale gas assets.

Conclusion

In summary, building a portfolio of equally weighted high dividend stocks, balanced periodically (quarterly or annually), generally beats the market, although, the margin of outperformance can be low compared to other contrarian investment strategies. One can use this strategy if seeking for regular income, otherwise, it might not be entirely unreasonable to explore alternative more rewarding strategies.

Disclaimer: This article is for information purpose only and does not constitute financial advice, OR recommendation to buy or sell any stocks. Author may have vested interests. Refer to T&C and full disclaimer. All data as on end October, 2020.

Credits

Reuters India, screener.in, company websites and annual reports for the company overviews