This article presents high quality small-cap stocks to buy now in India, in 2023, with significant upside potential. The following topics are covered:

What are small cap stocks

SEBI through it’s order dated 6th October 2017, has defined large cap, mid cap and small cap stocks as follows:

- Large Cap: 1st -100th company in terms of full market capitalization

- Mid Cap: 101st -250th company in terms of full market capitalization

- Small Cap: 251st company onwards in terms of full market capitalization

Based on current market capitalization, small cap stocks therefore, translates roughly into companies with market cap of roughly 15,000 crores or less.

Characteristics of small cap stocks

Low Liquidity

Small cap stocks are less liquid than large cap or mid cap stocks due to limited size. This can sometime limit the amount of capital one can deploy on a single small cap stock.

High Volatility

Due to the same reasons, small cap stocks are usually more volatile. A buy order of 10 crores from an AMC for a small cap stock whose market cap is 100 crores will probably lead to upper circuit, likewise, a sell order of similar magnitude could lead to lower circuit.

Under Valued

Also, for the same reasons, small cap stocks tend to be undervalued relative to large and mid-cap stocks. Inability to deploy meaningful capital into these stocks results in limited motivation from fund houses to properly research these stocks.

High-Risk, High-Return

Potential for up or downside gains is significant with small cap stocks. It is far easier for a company with 100 crores sales to double its revenue than one with 100,000 crores sales. Unfortunately, the reverse is also true.

Top 10 small cap companies in India based on past 10-year returns

As of end FY20, top 10 small cap stocks are as follows:

| Stock | 10Y Gain | Sector |

|---|---|---|

| La Opala RG | 3319% | Glass Products |

| V-Guard Industries | 2357% | Electrical Equipments |

| Cera Sanitaryware | 1675% | Ceramics |

| Can Fin Homes | 1643% | Finance |

| Indo Count Industries | 1121% | Textile |

| Aegis Logistics | 1006% | Logistics |

| TTK Prestige | 970% | Consumer Durables |

| Aarti Drugs | 948% | Pharma |

| Excel Industries | 891% | Chemicals |

| Ratnamani Metals & Tubes | 835% | Steel |

Is investing in small cap stocks a good strategy?

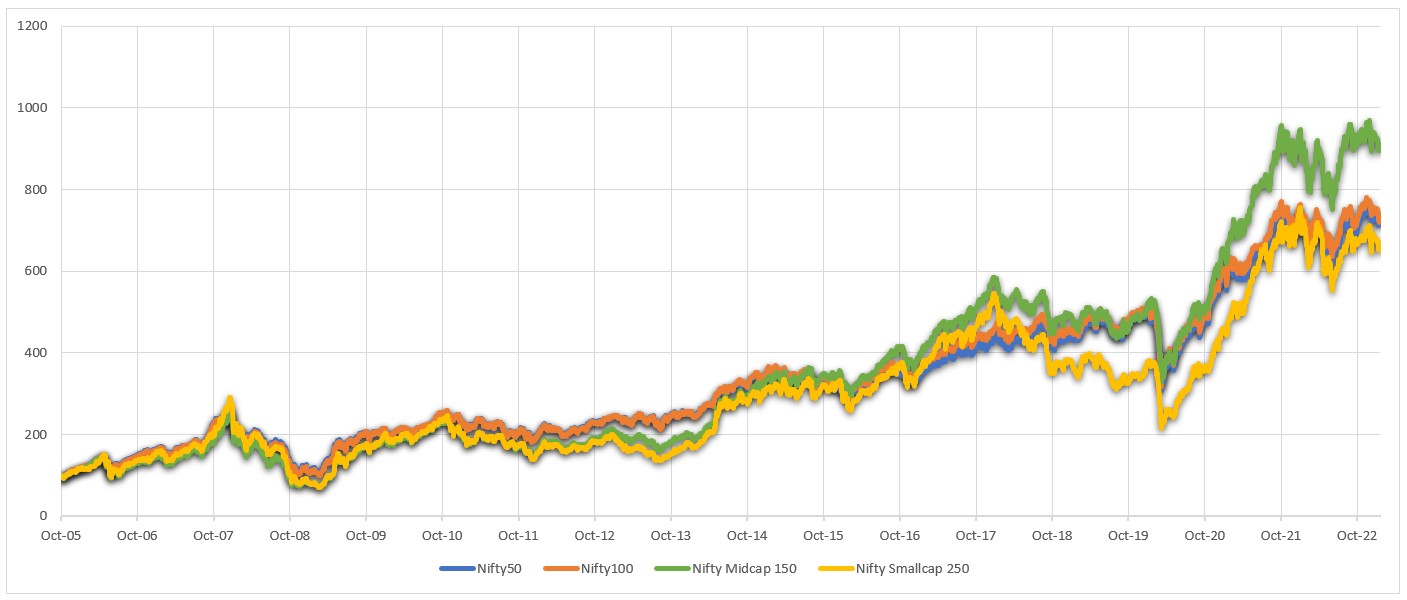

The easiest way, and perhaps the crudest way to know this is to compare the historical performance of the Nifty Smallcap index vis-a-vis its peers. The below chart has this comparison.

As you can see, starting October 2005 – date, the Nifty Smallcap 250 index has actually underperformed the Nifty 100 (Largecap), Nifty Midcap 150 and the Nifty 50 index.

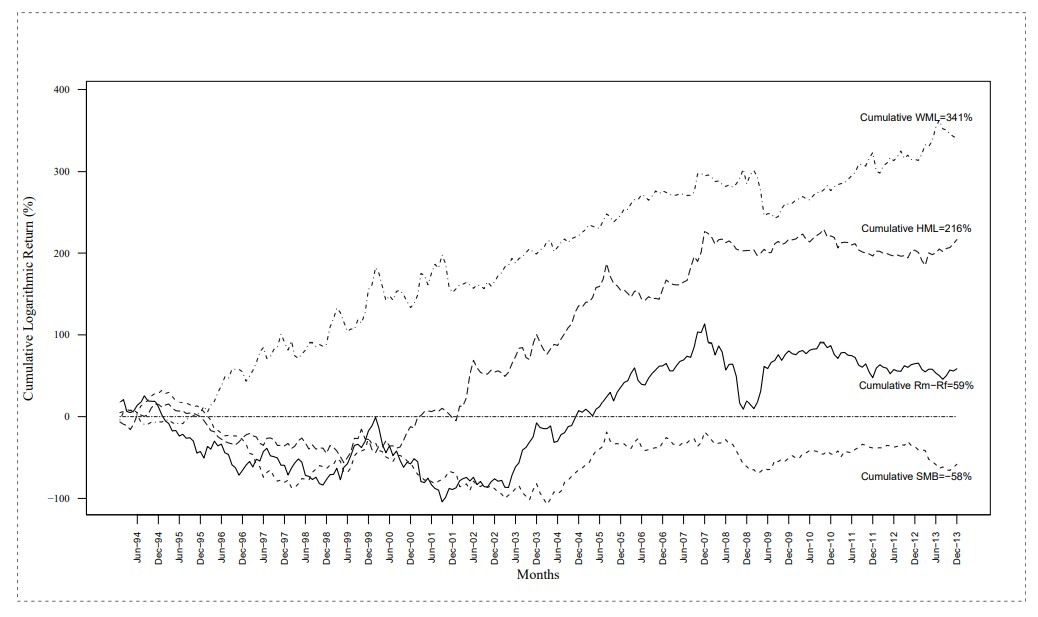

Academic studies on Factor Returns on the Indian market have also shown that SIZE factor generates negative returns in the Indian maket.

4 Factor returns in the Indian Market, Agarwalla, S. K., Jacob, J. and Varma, J. R. (2013), Four factor model in Indian equities market, Working Paper W.P. No. 2013-09-05, Indian Institute of Management, Ahmedabad.

One lakh invested in La Opala in FY10 is worth nearly 35 lakhs today! Also note that as much as half of the best small cap stocks from the last decade were top consumer brands.

How to find best small cap stocks to buy

Given that size alone may not contribute to excess portfolio returns, investing successfully in smallcap stocks requires combining size with other factors such as fundamentals (value, quality, etc), momentum, etc.

The usual starting point is to screen the traded stock universe by putting an upper limit on the market capitalization for small cap stocks. We look for a highly profitable business with strong cash-flows and low debt that is maintaining a consistent but high growth rate. This will give us an initial list which can be refined further.

15 best small cap stocks for 2023

Running this screen gives us a list of following 15 stocks:

| Name | ROE% | Sales Var 10Y% | PSR |

|---|---|---|---|

| Hinduja Global | 125.01 | 7.7 | 1.71 |

| Guj. Themis Bio. | 50.35 | 29.42 | 5.86 |

| Refex Industries | 21.82 | 26.62 | 0.53 |

| Permanent Magnet | 25.98 | 10.7 | 4.23 |

| Rajratan Global | 43.82 | 13.51 | 4.22 |

| ION Exchange | 26.53 | 8.11 | 2.35 |

| Monarch Networth | 40.13 | 16.51 | 4.96 |

| RHI Magnesita | 29.33 | 20.82 | 5.91 |

| Avantel | 25.58 | 14.97 | 4.38 |

| Vinyl Chemicals | 41.04 | 15.14 | 0.69 |

| Shivalik Bimetal | 31.87 | 15.11 | 5.97 |

| Stylam Industrie | 21.19 | 20.26 | 2.1 |

| Saksoft | 21.89 | 14.62 | 2.52 |

| Roto Pumps | 25.38 | 8.69 | 4.69 |

| Fineotex Chem | 23.4 | 16.52 | 5.42 |

Of these 15 stocks, 6 stocks, namely, IOL Chemicals, Sh. Jagdamba Polymers, KMC Speciality, Associated Alcohols, Chamanlal Setia, Transpek Industries. are already introduced in our best multibagger stocks article. Additionally, 2 stocks, Poly Medicure & Vidhi Speciality was discussed under Hidden Gems Stocks sections. Rest 7 stocks are introduced below.

Fineotex Chemical Ltd

Fineotex Chemical is one of the leading manufacturers of chemicals for textiles, construction, water-treatment, fertilizer, leather and paint industry. Fineotex manufactures and provides entire range of products for Pretreatment Process, Dyeing Process, Printing Process and Finishing Process for the textile processing to customers across the globe.

Fineotex Group was established in 1979 by Mr. Surendra Tibrewala. FCL was incorporated as a public limited company in 2007. The company got listed on Bombay Stock Exchange in March 2011 and listed on the National Stock Exchange in January 2015.

Stylam Industries Ltd

Stylam Industries is engaged in the manufacturing of decorative laminates under the brand name “STYLAM” and exports its products primarily to European and South East Asian countries.

It manufactures a wide range of high-quality interior and exterior designing products including a range of Laminates, PreLam Boards, Exterior Cladding and Acrylic Solid Surface, etc.

Company has a Production capacity of Approx. 20 million sheets of laminates annually.

Roto Pumps Ltd

Roto Pumps is the pioneer manufacturer of Progressive Cavity Pumps in India.

Company provides pumping solutions to a diverse range of industries including Wastewater, Sugar, Paper, Paint, Oil & Gas, Chemicals & Process, Ceramics, Food & Beverages, Renewable Energy & Power, Mining & Explosives, Marine & Defense.

The co. is successfully exporting to more than 50 countries, has association with more than 10,000 customers & have installed more than 250,000 pumps. Head office is in Noida, Uttar Pradesh.

Refex Industries Ltd

Refex Industries Limited (RIL) is a specialist manufacturer and re-filler of Refrigerant gases that are replacements for Chloro-fluoro-carbons. These are used primarily as refrigerants, foam blowing agents, and aerosol propellants.

The Co additionally offers services for Handling and Disposing Fly Ash, crushing of uncrushed coal, Coal trading to power plants; and is also into Power Trading.

Permanent Magnets Ltd

Permanent Magnets Ltd (PML) is a leading manufacturer of Magnents and Magnetic assemblies, shunt assemblies & brass terminals, Alnico Cast. The company is based in Mumbai and is the flagship Company of Taparia Group which has a TO of USD 800M.

PML operates through the 4 divisions viz. Magnets and Magnetic Assemblies, Hiperm, Shunts, and Current Transformers. Company’s products cater to industries like Automobiles (ICE and EV/HEV), Aerospace, Defence, Medical, Safety, Energy meters.

Conclusion

Investing in small cap stocks is a high-risk, high-reward game. It is important to understand the strength of the underlying business before considering to invest.

Picking small cap stocks wisely can be highly rewarding. As we presented in this article, the top 10 small cap stocks generated huge returns in the past decade.

We also presented 15 stocks that have potential to generate strong returns going forward. You must thoroughly research the underlying business of these companies further before considering to invest.

This article is for information purposes only and may not be considered as investment advice. Please do your own research, or subscribe to our stock advisory service for formal advice.

Credits

- Charts – Screener

Very insightful information indeed.

https://arthikdisha.com/does-mutual-funds-past-performance-influence-your-investment-decision/

I do completely agree with you. Really glad for keeping the service fees bare minimum as found in your services tab.

https://arthikdisha.com/best-small-cap-mutual-fund-reliance-small-cap-fund/