The small cap segment of the market, which is often overlooked by institutional investors due to liquidity issues, is generally home to hidden gems stocks. After more than a year of relative under-performance, as investor interest begins to pick up in this segment of the market, now may be a good time to begin hunt for hidden gems stocks. To assist our readers with this exercise, we ran a couple of screens to dig out an initial list of stocks. The result is the assortment of 10 hidden gems stocks we present below.

What are hidden gems stocks?

Hidden gems stocks are shares of quality companies with strong underlying business and growth prospects, but for some reason are yet to be discovered by the investor community.

In short, hidden gems stocks represent quality businesses that are yet to receive investor interest.

They are generally found in the small cap space, as institutional investors, with large AUMs, cannot allocate meaningful assets in them and therefore institutions do not find sufficient motivation to research them.

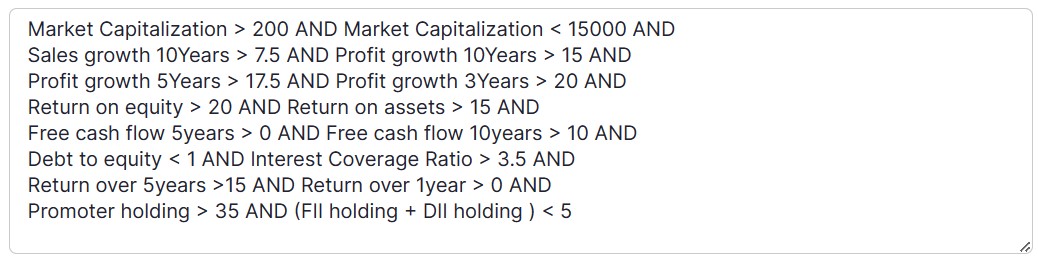

To dig-out hidden gems stocks from the universe of publicly traded stocks in BSE, we run a 2 step screen:

- First, we ran a screen to list out quality stocks,

- Then, we ran a second screen on the results to filter out only the undiscovered stocks

Our objective interpretation of the word ‘hidden’ in hidden gems stocks are those companies that are under-owned by institutions.

More specifically, we are looking for stocks with institutional ownership of 5% or less, domestic and foreign combined.

Methodology: How to find hidden gems stocks

We use the following screen:

Running the above screen gave us the following 15 stocks:

| Name | ROE% | Sales Var 10Y% |

|---|---|---|

| Guj. Themis Bio. | 50.35 | 29.42 |

| Supreme Petroch. | 50.52 | 9.98 |

| Praveg | 52.22 | 25.64 |

| Sandur Manganese | 50.46 | 28.68 |

| Godawari Power | 52.08 | 10.12 |

| Vinyl Chemicals | 41.04 | 15.14 |

| Sarthak Metals | 38.81 | 16.35 |

| Shivalik Bimetal | 31.87 | 15.11 |

| Apcotex Industri | 28.11 | 14.24 |

| Raghav Product. | 24.47 | 25.11 |

| Themis Medicare | 28.34 | 9.6 |

| Roto Pumps | 25.38 | 8.69 |

| Avantel | 25.58 | 14.97 |

| Sr.Rayala.Hypo | 21.45 | 17.98 |

| Saksoft | 21.89 | 14.62 |

| Median: 15 Co. | 31.87 | 15.11 |

We discuss 5 stocks from the above list in more detail below.

Tanfac Industries

Tanfac Industries Ltd is a joint sector company promoted by Anupam Rasayan India Limited® and Tamil Nadu Industrial Development Corporation (TIDCO). The manufacturing facilities are spread over 60 acres in the chemical complex of SIPCOT Industrial Estate, Cuddalore. Cuddalore is 20 KM South of Pondicherry, about 200 KM south of Chennai, India. The company began commercial production in March 1985 and is amongst the leading producers of Hydrofluoric Acid and its derivatives.

Tanfac is engaged in the manufacture of Anhydrous Hydrofluoric acid, Sulphuric Acid, Oleum. Aluminium Fluoride, Potassium Fluoride, Potassium Bifluoride, Boron Trifluoride Complexes, Calcium Sulphate (Gypsum), IsoButyl Acetophenone, Acetic Acid, Peracetic Acid and Poly Aluminium Chloride, etc.

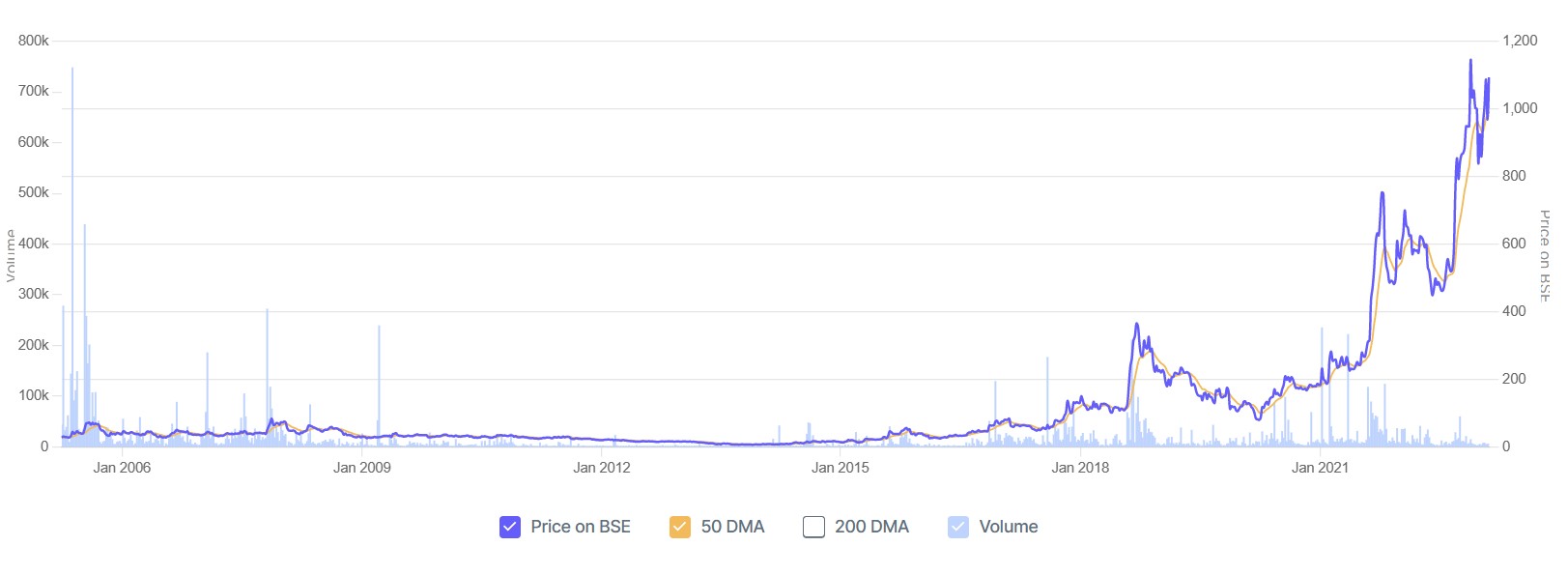

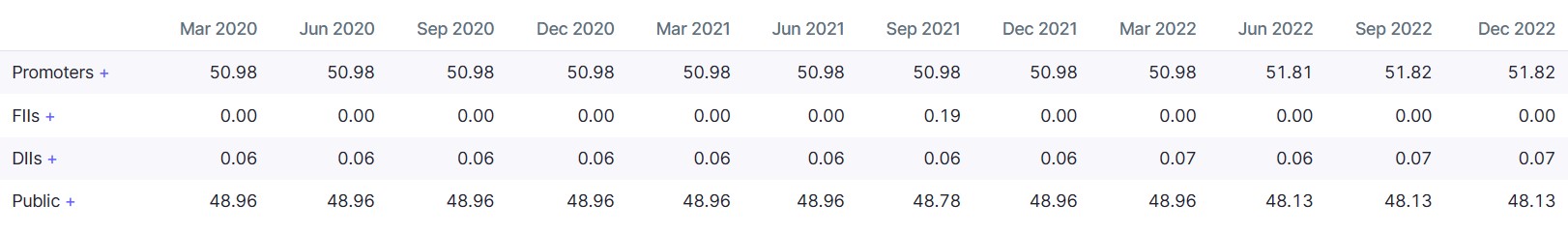

Share holding pattern

- Promoters 51.82%, while public holds the remaining 48.13%.

- DIIs hold 0.07% while FIIs have no stake.

While there has been zero institutional interest in the company in the past decade, stock price during the same period has grown at 52% CAGR, handsomely rewarding patient shareholders.

Supreme Petrochem

Supreme Petrochem Ltd (SPL) owns and operates state-of-the art production facilities from two locations in India, the first at Amdoshi – Wangani Village near Nagothane in District Raigad Maharashtra and the Second in New Manali Town near Chennai in Tamil Nadu.SPL exports its Products to more than 100 Countries around the Globe.

The Styrenics facility at Amdoshi – Wangani Manufactures: Polystyrene (PS), Expandable Polystyrene (EPS), Specialty Polymers and Compounds (SPC), Extruded Polystyrene Foam Boards (XPS), Styrene Methyl Methacrylate (SMMA)

The Infrastructure at the facility is geared to handle upto a million tons of Polymers.

The New Manali Town facility manufactures Expandable Polystyrene (EPS).

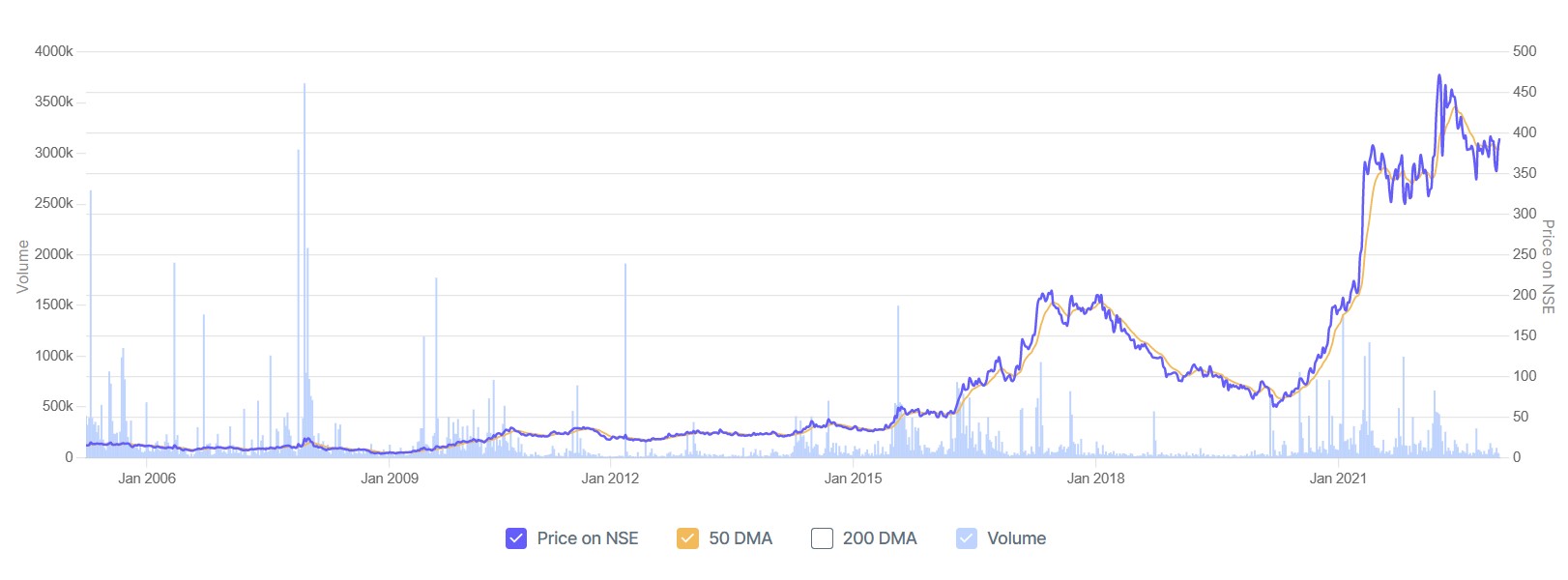

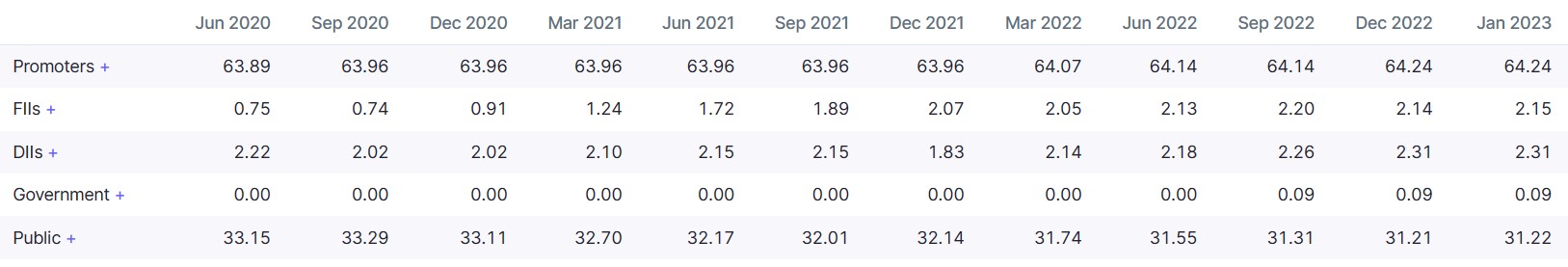

Share holding pattern

- Promoters hold 64.24%, while public 31,22%; FII & DII hold 2.15% & 2.31% respectively.

- Promoter holding has marginally increased over the years.

Stock has given a healthy return of 29% over the past 10 years.

Praveg

Incorporated in 2016 after the merger of Praveg Communications Limited with Sword and Shield Pharma limited; Praveg Communications (India) Limited is an advertising company with core competence in Exhibition and Event Management. The company is also engaged into providing services to the Hospitality sector, Publications and Real Estate marketing.

The Company has been catering to a diverse clientele, including Gujarat State Government, large Corporates and renowned entrepreneurs, reflecting its versatility. Praveg’s wide range of portfolio includes execution of large-scale projects across the nation and in the USA, China, South Korea, Africa, Europe and in the Middle East. The company has set up its branches nationally and internationally.

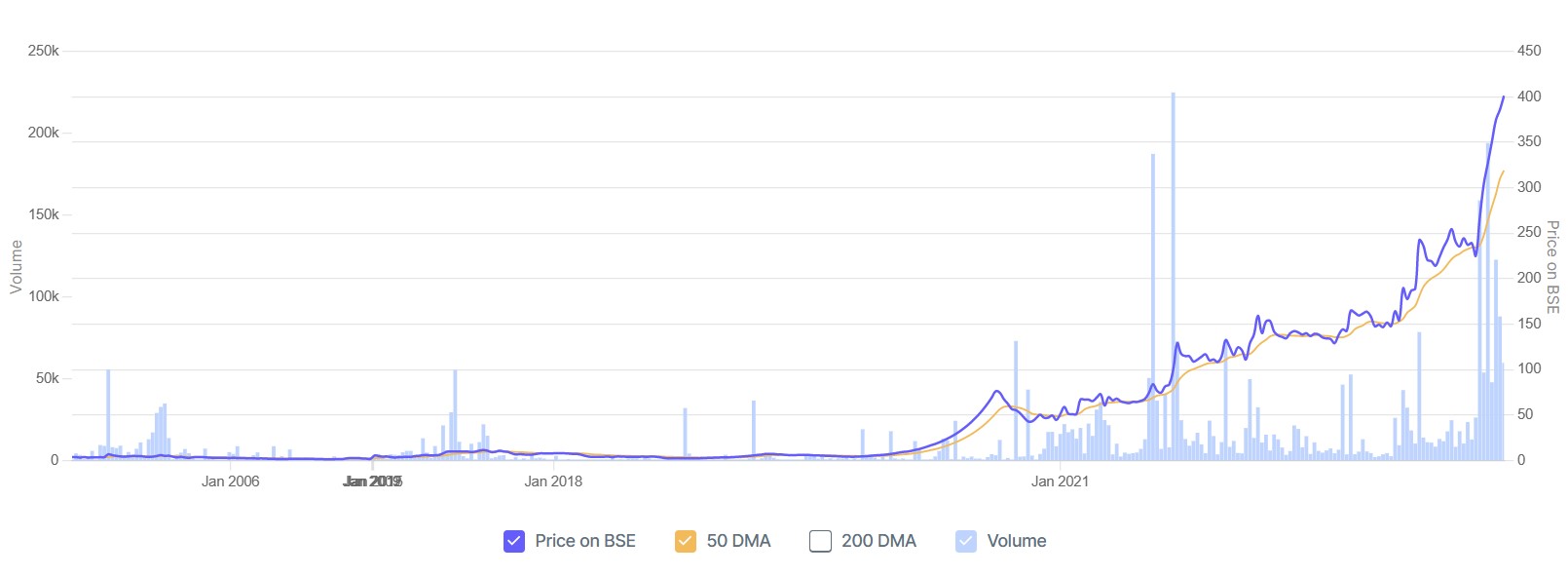

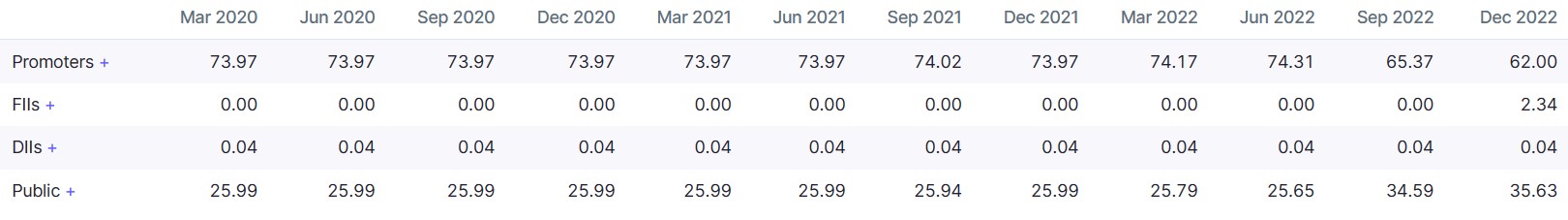

Share holding pattern

- Promoter 62.0%, FII 2.34%, DII 0.04% and public 35.63%

- Promoter holding has declined over the past 3 years.

Stock has grown by whopping 118% CAGR in past 5 years.

Apcotex India

Apcotex India is one of the leading producers of Synthetic Rubber (NBR & HSR) and Synthetic Latex (Nitrile, VP latex, XSB & Acrylic latex) based on styrene-butadiene chemistry and butadiene-acrylonitrile chemistry in India.

The company caters to various markets including paper, tyre cords, carpets, construction, textiles, footwear, gloves, automotive components, rice dehusking rollers, hoses and specialty products.

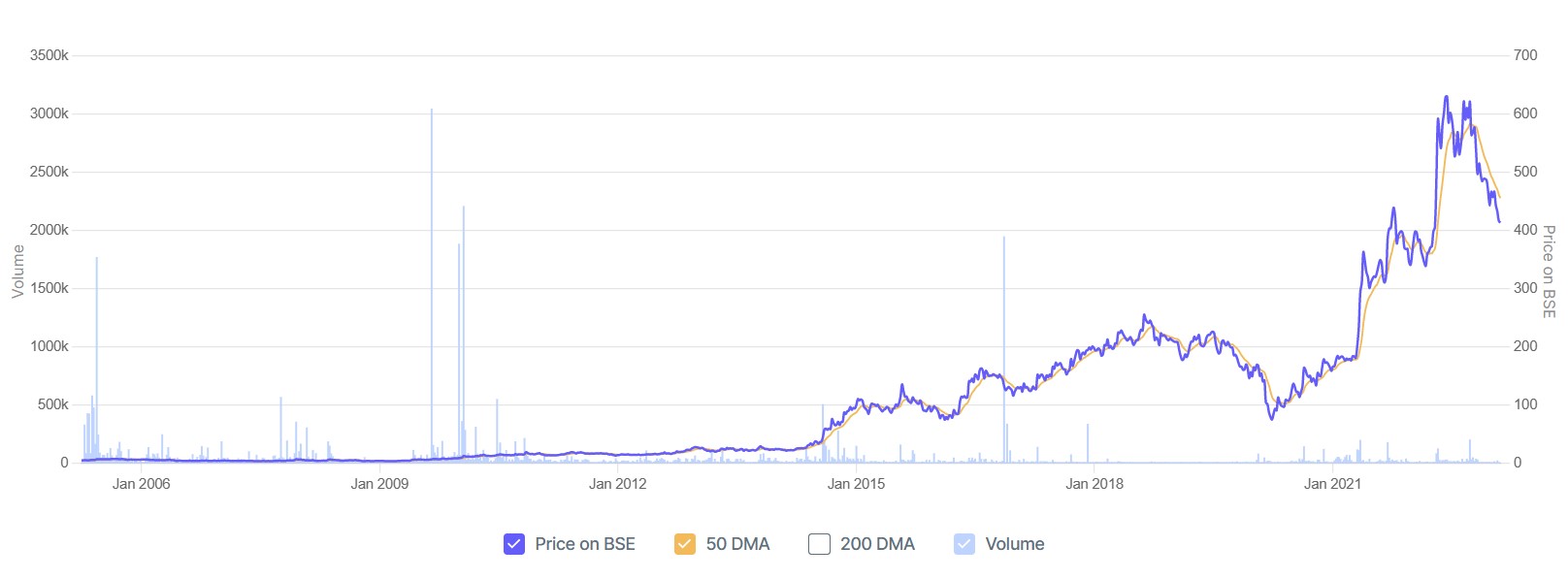

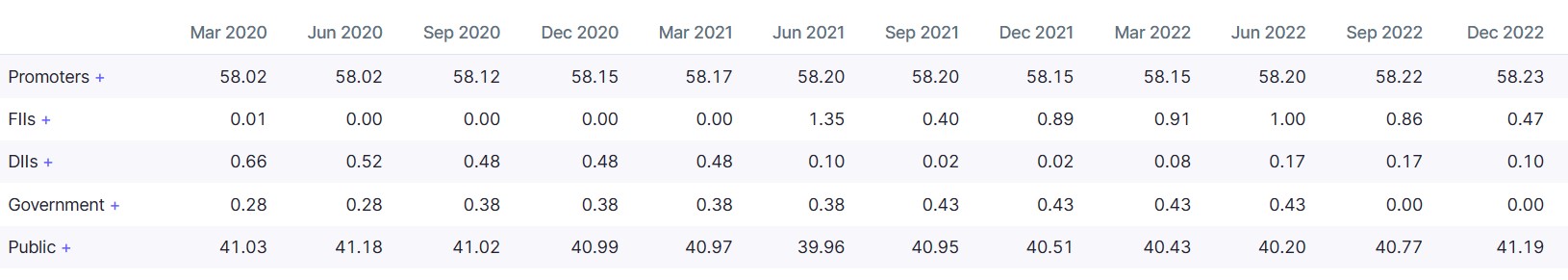

Share holding pattern

- Promoters 58.23%, Public 41.19%, FII 0.47% and DII 0.10%

- Promoter holding has marginally increased in the past 3 years.

While institutional interest in this company has been historically low, the stock has returned 34% CAGR in the past 10 years.

Vinyl Chemicals

Vinyl Chemicals (India) Limited, a Parekh Group Company, was promoted by Pidilite Industries Limited (PIL) in 1986. The Company is currently engaged in the business of trading in Chemicals viz. Vinyl Acetate Monomer (VAM).

Earlier, the Company was engaged in the business of manufacturing VAM in its plant located at Mahad in Raigad District, Maharashtra, India. The Company had a major share of business of this product in India. In December 2007, the said manufacturing unit was de-merged into PIL, its Promoter Company, for strategic reasons.

Post-demerger, the Company’s main focus remains in trading of VAM, which is now imported/sourced from various Global suppliers and distributed/traded in India.

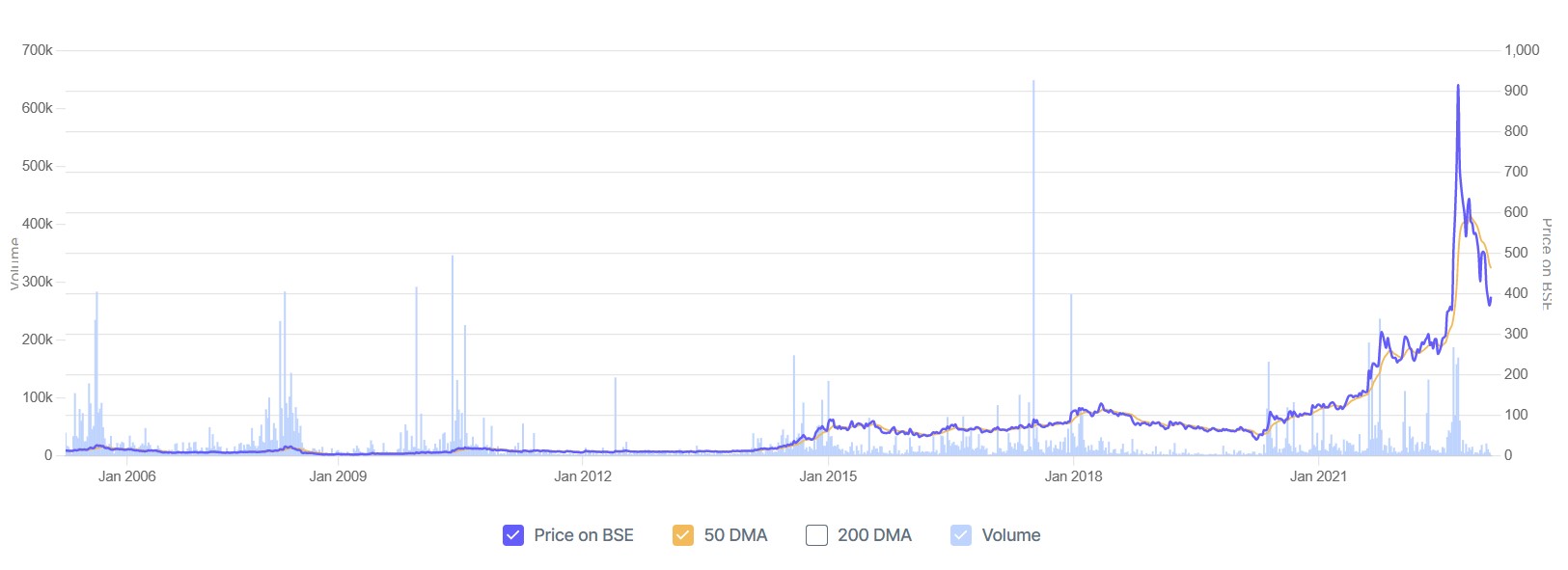

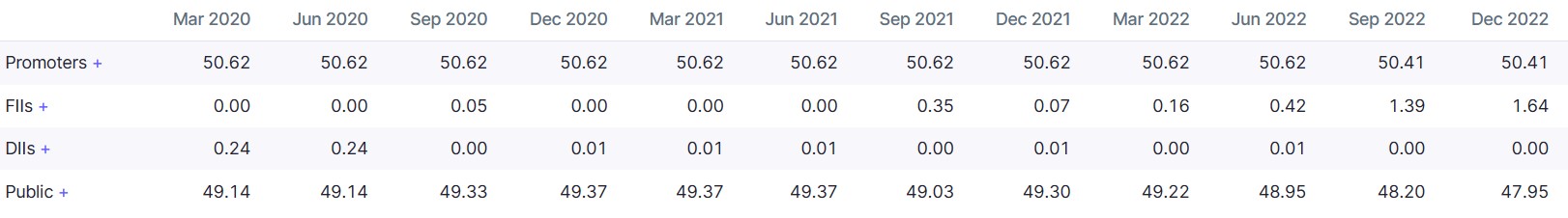

Share holding pattern

- Promoters 50.41%, public 47.95%, DII 0.17% and FII 1.64%

- Promoter holding is virtually unchanged for past 10 quarters

While total institution holding is less than 2%, stock has given a 45% return over past 10 years.

Conclusion

As markets try to come out of the shadows of pandemic and economic activity starts picking up, its time for investors to take a hard look at their portfolios and do some clean-up, replacing the non-performers with the emerging leaders.

To that effort, have presented an initial list of companies which we hope will assist you in your hunt for hidden gems stocks.

We will continue to refresh the list. Should you wish to receive updates to this list and similar stories, drop a note, or comment below to stay connected.

If you enjoyed reading the article share it with a friend or colleague.

Credits

- Graphic credits – screener.in

- Company overview credits – Reuters & Company Websites