Invest Smarter with Quant Factor Portfolios. Backed by Research.

ViniyogIndia® brings institutional-grade quantitative research to individual investors, helping you compound wealth through disciplined, data-driven investing.

SEBI-Registered Investment Adviser. Personalised, Research-Backed Guidance.

Core Offerings

Designed to help you invest smarter, using data science and automation.

Model Portfolios

Quant-based stock & ETF portfolios built for long-term growth and disciplined risk control.

learn moreRobo Advisory

Smart automation that simplifies your financial journey — unbiased, data-driven, and free.

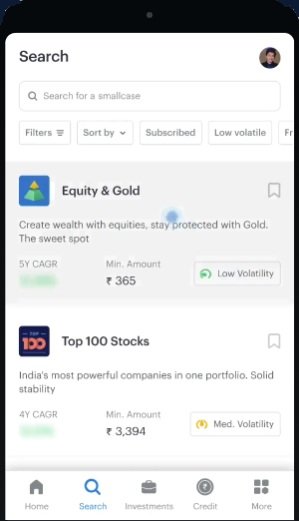

learn moreSmallcases

Quality research meets convenience — invest in our curated portfolios through Smallcase.

learn moreThere is a portfolio for everyone

Our quant research framework identifies factors that drive long-term performance. Each portfolio is tailored to a specific theme — blending data, discipline, and diversification.

Chameleon Quant

Adaptive multifactor portfolio of stocks where the factor exposures are dynamically realigned

Moderately Aggressive

Value Model

Portfolio undervalued but fundamentally strong businesses that are picking up investor interest.

Aggressive

Momentum Model

Curated basket of strongly trending Stocks & ETFs with moderate risk management.

Aggressive

Armadillo Quant

Multifactor, multi-asset portfolio of Stocks & ETFs with strong Risk Management.

Conservative

Integration with leading investment platforms

One-touch investing with your preferred broker

Buy multiple stocks and ETFs in a single click.

Track and manage your portfolios anytime, anywhere.

Invest systematically with flexible SIPs.

Execute orders through your preferred broker account.

Robo Advisory

Smarter financial planning made simple with automation.

Our self-guided Robo Advisory tools help you assess your risk profile, plan your goals, and manage your portfolio – instantly, accurately, and at no extra cost.

Personalized Profiling

Get instant insight into your risk appetite and investor profile

Smart Allocation

Receive personalized asset allocation and portfolio recommendations

Automated Planning

Plan your goals, track progress, and make adjustments with no extra effort

Don’t miss out

Sign up to receive exclusive market insights, key updates, and actionable investment ideas!

We promise not to spam you!

Why Chose Us

Disciplined, research-backed approach. Built on data, not opinions.

Quantitative Factor Investing

Portfolios built using tested factor models — grounded in academic and empirical research.

Data-Driven Insights

Strategies validated on 15+ years of historical data across market cycles to ensure robustness.

SEBI-Registered & Transparent

Registered with SEBI and empanelled with BSE — compliant, transparent, and client-first.

Evidence Over Emotion

Disciplined, rule-backed approach that removes bias and builds confidence through market cycles.

Featured Resources

View all blog posts

Buffet’s Secret & Factor Investing

This article reveals Warren Buffet’s “secret sauce”, and how the same principles of factor investing is used to construct ViniyogIndia.com’s Core Multifactor Portfolios.

featuredpersonal financestrategies

The biggest secret to wealth creation

What is the biggest secret to wealth creation? The answer lies hidden in an ancient Indian chess puzzle devised by the inventor of the game.

Importance of market timing & picking right time to buy stocks

Large section of retail investors relentlessly try to time the market. How effective is it in improving long term returns?

featuredpersonal financestrategies

Historical returns on asset classes in India

Article analyses historical returns of asset classes in India over 39 years, starting 1981. Asset classes studied are Stocks, Gold & FD.