The merits of investing in index funds have been argued by stalwarts like John Bogle of Vanguard Group and Warren Buffett of Berkshire Hathway. Interestingly, Buffett himself never invested in index funds. So should you, the small investor, invest in index funds? In this post we try to explore.

Beating the Street

In our previous article, we had discussed about the benefits of investing in equities over long term. We saw studies conducted in the US, as well as our own results in India, which establishes unequivocally that over long term, returns in equities outperforms any other asset class by a wide margin. One rupee invested in Sensex, Gold and FD in 1981, would have grown to become Rs 221.72 today, as opposed to Rs 25.6 in Gold and 29.06 in FD (without adjusting for inflation and taxes)

Knowing that equities are the asset class of choice for long term investment, question is, how can we improve our returns further? After all, our study merely invested the rupee in the BSE Sensex stocks, which in essence is a ‘passive’ investment strategy, as it requires no research other than knowing the composition of the BSE Sensex.

In reality, there are multiple ways to beat the index consistently over long-term. In this article we will explore just one. But before we do that, let’s take one step back and understand what investing in the index really means.

Index (& Index Funds) as a Momentum Strategy

If we consider market index as an investment strategy, then equity indices around the world in most cases resemble long term momentum strategies of some sort. The BSE Sensex for example, is constituted by picking large cap companies with high liquidity (along with certain other criteria). Constituents are weighted by market cap, which in essence means, larger stocks will have a greater impact on the movement of the index. As an investment strategy this isn’t ideal, as common sense tells, it is easier to double revenue of a 50 million company than a 50 billion company.

Of course market indexes are not constituted to provide high return investment strategies, rather they provide indication of overall market performance, for which purpose market cap weighted strategy makes perfect sense.

Problem is, investment advisers, and often legendary investors promote investing in the index, for entirely different reasons, when in reality, for the small investors it’s a poor investment strategy that is fairly easy to outperform. Consider the following simple tweak for example.

Equally Weighted Index

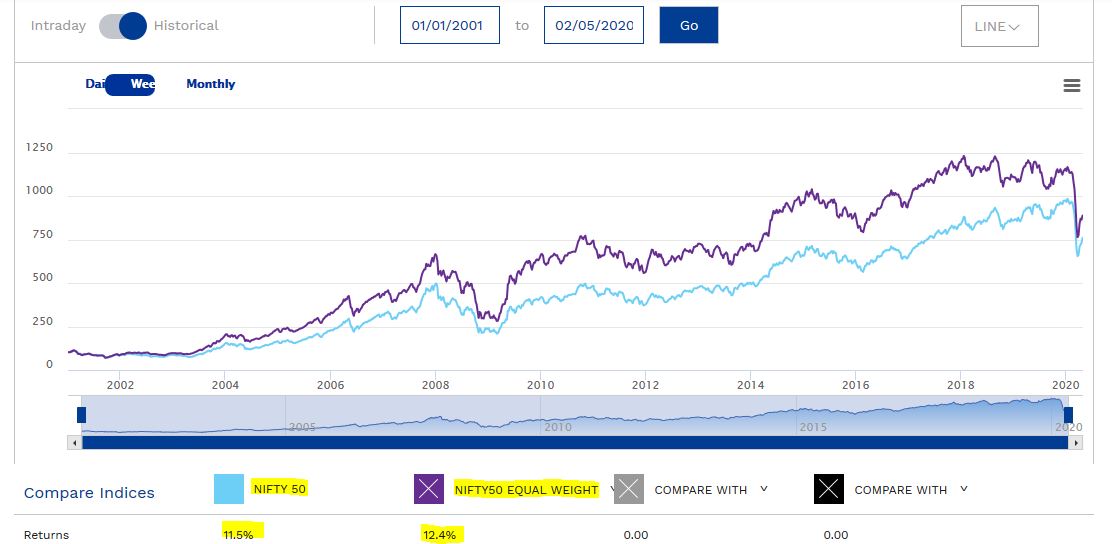

We make a simple adjustment to the index constitution. Instead of weighing the constituents by market cap, we weigh them equally, i.e. instead of buying more of what is going up and selling declining stocks, we hold equal quantities of each stock by value. Using NIFTY-50 as the base index, starting 01-Jan-2001 till date, for past 19 years Nifty50 Equally Weighted Index returned 12.4% against Nifty returns of 11.5%, beating Nifty by almost 1% annually.

Fig-1, Source: NSE

Benchmarking Randomness

Andreas Clenow in his interesting book ‘Stocks on the move: beating the market with hedge fund momentum strategies’ performed a rather unique study. He let computer pick stocks from S&P 500 at random. At the beginning of each month, the entire portfolio is liquidated and 50 random stocks are bought in equal proportions. Simulation was repeated a few hundred times and the results were fairly consistent. Apparently, not a single simulation failed to beat the index.

Fig-2, Source: ‘Stocks on the move: beating the market with hedge fund momentum strategies’ by Andreas Clenow, pp 265

The above results removes any remaining shade of doubt that market cap weighted indices or index funds may not be the best strategy for producing high returns. In the US, S&P 500 Equally Weighted Index was introduced in 2003. Back home, NSE introduced NIFY-50 Equally Weighted Index as recently as April 2017. BSE is yet to include this strategy in its basket of indices.

Smart Money & Other Myths

Now for the best part. Given all this, it might appear that beating the index is ridiculously simple, and the highly paid Fund Managers working for AMCs managing Mutual Funds & Hedge Funds must be beating the pants out of the indices by a wide margin day in and day out. Well… at least if we look at objective data available for the US market, in any given year Mutual Funds that fail to beat the index over a 5 year period range anywhere between 60-80% or more! So much for the smart money!!

Mutual Fund (& Index Fund) Returns in India

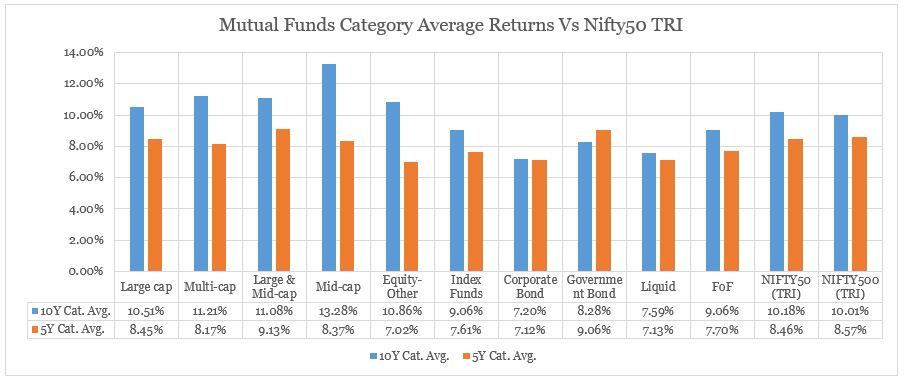

Back home in India, Mutual Funds in general have performed rather poorly of late!

Fig.3. Mutual Fund category average returns in India, for past 5 & 10 years, as of November, 2019. source: Morningstar, NSE

Over the past 5 years in India, mutual funds irrespective of categories, have given single digit returns on average. Index Funds returned 7.61% on average against 8.46% for Nifty50 TRI, trailing the index by almost one percentage point due to management, distribution and other fees. With Long Term Capital Gains taxed at 10%, the case for investing in Index Funds becomes even more feeble.

Conclusion

Small investors shouldn’t blindly follow legendary investors such as Buffet or Bogle without understanding the context. In US, Actively Managed Funds generally fail to beat the benchmark indices, partly due to various fees such as management, marketing & distribution, etc. which AMCs charge, and partly because the equity markets in US are more efficient than in India. So Index investing makes sense in the US. However, in India where markets are less efficient, the opportunity to beat the market is greater.

So, if you were thinking of investing in Index Funds, think again!

I have been looking for this Investment Strategies article since long time. Thanks author.