Incorporated in 1985 in Kota (Rajasthan), Chambal Fertilisers Ltd. has the largest installed urea capacity of 3.07 mn ton (1.34 mn ton of urea unit at Gadepan-III recently commissioned in January 2019) in the private sector in India. Company is also into trading of complex fertilisers and pesticides. The company had significant investments in the shipping and software businesses. In fiscal 2016, Chambal had transferred its textile division to Sutlej Textiles and Industries Ltd on slump sale basis. During September 2017, Chambal sold off its all four remaining ships, thus exiting the shipping business also.

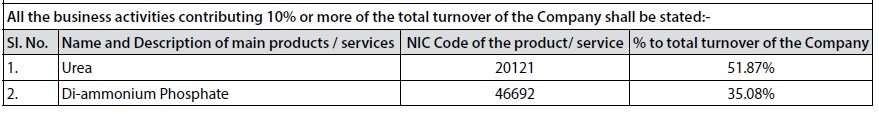

Principal Business

- Manufacture of Urea, 20121

- Manufacture of Single Super Phosphate (SSP), 20122

- Marketing of Fertilizers & Agrochemical Products, 46692

The Company has three Urea manufacturing plants at Gadepan, District Kota, Rajasthan.

The Company also supplies other agri-inputs like Di-ammonium Phosphate (DAP), Muriate of Potash (MOP), Single Super Phosphate (SSP), NPK Fertilisers, Agrochemicals, seeds, sulphur, micro-nutrients, complex fertilisers and city compost. The Company sources the products from reputed domestic and international suppliers.

SSP supplies comprised of own production and procurement from domestic suppliers.

Company commissioned the third Urea manufacturing unit at Gadepan, Distt. Kota, Rajasthan, PIN-325208 at an approximate cost of USD 900 million on January 2019. The new Urea plant will increase the present Urea production capacity of the Company by about 1.34 million MT per annum.

Gadepan III plant has had steady operations since commissioning, operating at average healthy utilisation of above 90%. Government has already allowed supply of urea from this unit.

Post expansion, total Urea manufacturing capacity stands at 3.07 million tons per annum.

No new urea production capacity came on stream in the country during last 18 years except revamp of few existing plants. This is the first major capex in Urea in 18 years.

Products

Fertilisers

- Uttam Veer Urea (Urea)

- Uttam Neem (Neem Coated Urea)

- Uttam DAP (Di Ammonium Phosphate)

- Uttam MOP (Murate of Potesh)

- Uttam SSP (Single Super Phosphate)

Seeds

- Hy Paddy – Khushi & Barkha

- Paddy – Uttam Kranti

- Bt Cotton Dhruv

- Barley – Uttam

- Mustard – Uttam Kranti

- Soybean – Uttam Kranti & Chamtkar

- Hy Bajra – Albela & Uttam Kranti-2095

- Hy Maize – Nandini & Muskan

- SSG – Manik & Moti

- Kranti

- Wheat – Uttam Kranti

Insecticides

- Aceveer

- Endoveer

- Alphaveer

- Acto

- Lambda veer

- Chlorveer

- Monoveer

- Imidaveer

- Lambda Double

Industry Overview

All India Demand Forecast of fertilizer products

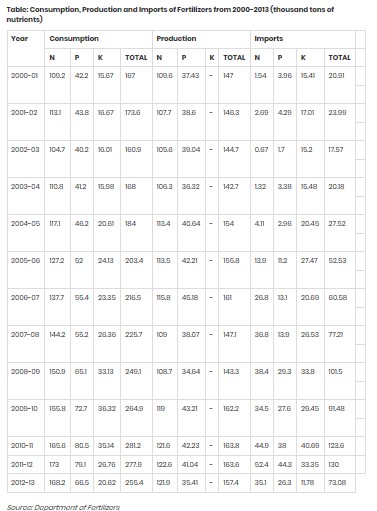

India is the second biggest consumer of fertilizer in the world next only to China. According working group report on fertilizer industry for twelfth five-year plan all India demand forecast of fertilizer 2012-13 to 2016-17 are given table.

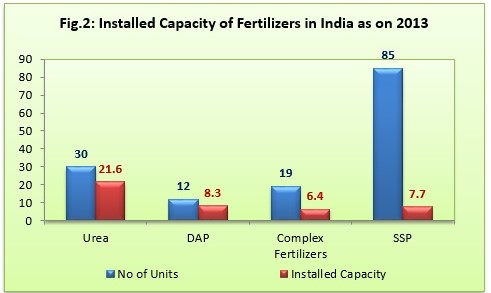

Fertilizer Production, Consumption and Import Status

Urea production in the country during the Financial Year 2017-18 was 24.02 million MT against 24.20 million MT during the previous year. India imported 5.97 million MT of Urea during the Financial Year 2017-18 as against 5.48 million MT of Urea imported during the previous year.

Historical price of Urea, January 1999 to May 2018, Source: indexmundi.com

The Urea sales in the country during the Financial Year 2017-18 were 30.31 million MT against the Urea sales of 29.61 million MT during the previous year – an annual growth of 2.4%. The imported Urea was 19.70% of the total Urea sales in the country and its prices ranged between USD 203 to USD 292 per MT during the financial year 2017-18.

The total sales of DAP in the country during the Financial Year 2017-18 were 8.98 million MT as against 8.82 million MT during the previous year registering a growth of around 1.81%. The total production of DAP during the year was around 4.65 million whereas 4.22 million MT of DAP was imported in the country.

The demand of DAP in the country is met through imports and domestic production whereas the country is fully dependent upon imports for MOP

MOP imports in the country during the Financial Year 2017-18 were 4.74 million MT as against 3.74 million MT during the previous year.

India is meeting 80 per cent of its urea requirement through indigenous production but is largely import dependent for its requirements of phosphatic and potassic (P & K) fertilizers either as finished fertilizers or raw materials. Its entire potash requirement, about 90 per cent of phosphatic requirement, and 20 per cent urea requirement is met through imports.

Consumption, production & import of fertilisers, source: Department of Fertilisers

Top leading fertilizer Companies

Some of the public sector companies in India fertilizer industry:

1. National Fertilizers Limited

2. Fertilizers & Chemicals Travancore Limited (FACT)

3. Rashtriya Chemicals & Fertilizers Limited (RCF)

4. Madras Fertilizers Limited

5. Steel Authority Of India Limited

6. Neyveli Lignite Corporation Limited

7. Paradeep Phosphates Limited

8. Pyrites, Phosphates & Chemicals Limited

9. Hindustan Fertilizer Corporation Limited

Some of the private sector companies in Indian fertilizer industry:

1. Chambal Fertilizers & Chemicals Limited

2. Ajay Farm-Chem Private Limited

3. Balaji Fertilizers Private Limited

4. Deepak Fertilizer and Petrochemicals Corporation Limited

5. Bharat Fertilizer Industries Limited

6. Coromandal Fertilizers Limited

7. Gujarat Narmada Valley Fertilizer Co. Limited (GNFC)

8. Meerut Agro Chemicals Private Limited

9. Duncans Industries Limited

10. Karnataka Agro Chemicals

11. Godavari Fertilizers & Chemical Limited

12. Shri Amba Fertilizers (I) Private Limited

13. Tuticorin Alkali Chemi & Fertilizer Limited

14. Gujarat State Fertilizers & Chemicals Limited (GSFC)

15. Indo-Gulf Fertilizers & Chemicals Corporation Limited

16. Southern PetroChemical Industries Corporation Limited (SPIC)

17. Maharashtra Agro Industrial Development Corporation

18. Zuari Industries Limited- Fertilizer Limited

19. Mangalore Chemicals & Fertilizers Limited

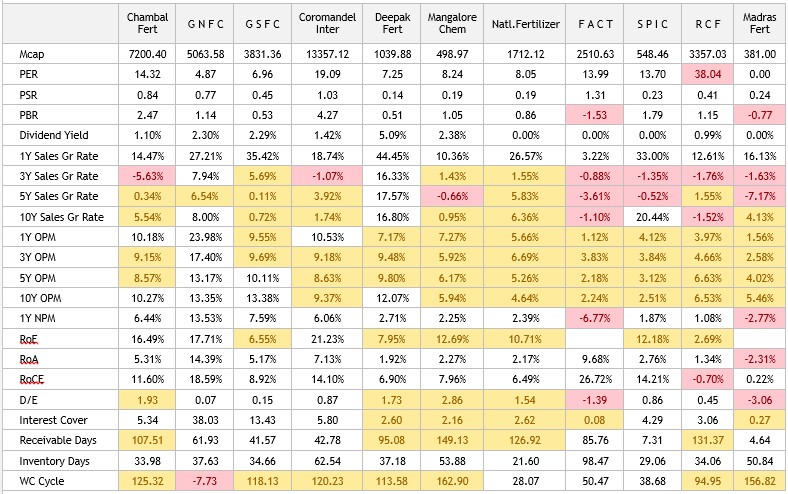

Comparative Analysis

Most of the fertilizer companies in general are characterised by slow growth due to stagnant demand.

Working capital cycle is often high, potentially due to delays in subsidy payments

Majority of the companies have low margins, with OPM < 10%

Capital intensive business, with low RoA

Low margins, with OPM < 10% in many cases

Apart from Chambal Fertilizers, GNFC, Coromandel & Deepak Fertilizers look interesting.

Risk Analysis

Regulated nature of the industry

The Fertiliser Industry is highly regulated and dependent on the Government policies. The changes in such policies may sometimes adversely affect the Company. The low prices of Urea in the International market coupled with increase in gas prices due to increase in prices of crude oil in international market may affect the Urea production beyond re-assessed capacity of Urea manufacturers in the country.

Working Capital stress due to delays in payment of subsidies

Subsidy is a major component of revenue of the Company. The delay in payment of subsidy by the Government of India creates stress on the working capital and increases the finance cost of the Company. The implementation of DBT for fertiliser subsidy envisages linking of subsidy payment to the actual sales through POS. This has made the subsidy payment process cumbersome and it requires more resources and efforts on the part of fertiliser manufacturers / suppliers. However, it is expected that the DBT process will stabilise after teething troubles and it is not likely to have a material financial impact on the Company.

Leveraged capital structure and moderate debt protection metrics

Chambal has a leveraged capital structure and moderate debt protection metrics. The company’s capital structure, is constrained by large working capital borrowings following delay in subsidy disbursement by the government. Gearing is expected to remain high in the near term, with Debt/EBITDA estimated at 7-8 times for fiscal 2019, due to commissioning of Gadepan III plant in the last quarter. Nonetheless, higher cash accruals from Gadepan-III unit from fiscal 2020 (being first full year of commissioning), capital structure is expected to improve gradually over the medium term.

Variation in Monsoon, Forex, International prices of fertilizers

The variations in demand of DAP and MOP due to change in monsoon patterns, volatility in foreign exchange rates and prices of the products in international markets and interest burden due to delay in payment of subsidy may impact the profitability of the Company.

Management Analysis

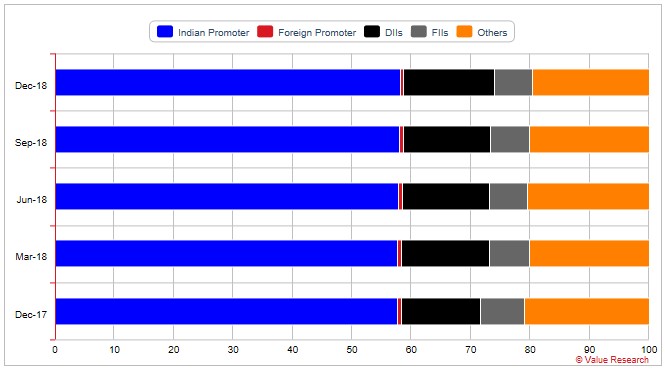

Promoter holding

Domestic promoters have been upping the stake continuously, from 57.72% in Dec CY17 to 58.08% in Dec CY18. Foreign promoters hold additional 0.64%.

Promoter holding, graphics valueresearchonline.com

Recent actions

Promoters made additional purchases in Q4FY19 through open market transactions:

Feb: 1.95cr/35.6 L Net 1.6cr

Jan: 34.3L/ 12.6L Net 21.7L

Net, in Q4FY19 insiders have purchased around 1.82 crores worth of shares (or ~0.03%)

Related parties

Details of subsidiaries & JVs – net assets & profit share, source: Annual Report

Subsidiaries

• CFCL Ventures Limited, Cayman Islands

• Chambal Infrastructure Ventures Limited, India

• India Steamship Pte. Limited, Singapore

• India Steamship International FZE, UAE

• India Steamship Limited, India

• Subsidiaries of CFCL Ventures Limited, Cayman Islands

• ISGN Corporation, USA

• ISG Novasoft Technologies Limited, India

• Inuva Info Management Private Limited, India

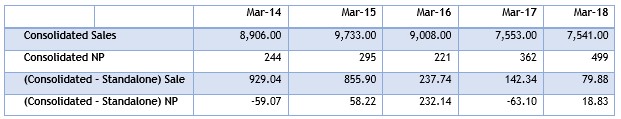

Contribution of subsidiaries are negligible after sales of shipping & IT business. Only JV contribute to around 8% of turnover & PNL.

Joint venture

• Indo Maroc Phosphore S.A. Morocco

IMACID is a joint venture of your Company with Tata Chemicals Limited and OCP, Morocco and each partner is having equal stake in the joint venture. IMACID is engaged in the manufacture of phosphoric acid in Morocco.

During the calendar year 2017, IMACID produced 409,160 MT of phosphoric acid against 336,984 MT produced during the calendar year 2016. Sales of phosphoric acid during the calendar year 2017 were 408,013 MT against the previous year sales of 336,341 MT.

During the calendar year 2017, IMACID achieved revenue of Moroccan Dirham (MAD) 2279.87 million (Rs. 150851.90 Lakhs) against revenue of MAD 2068.30 million (Rs.140419.38 Lakhs) achieved during the calendar year 2016. The profit after tax of IMACID was MAD 177.98 million (Rs. 11776.21 Lakhs) during the year 2017 as against MAD 12 million (Rs. 814.78 Lakhs) in the calendar year 2016.

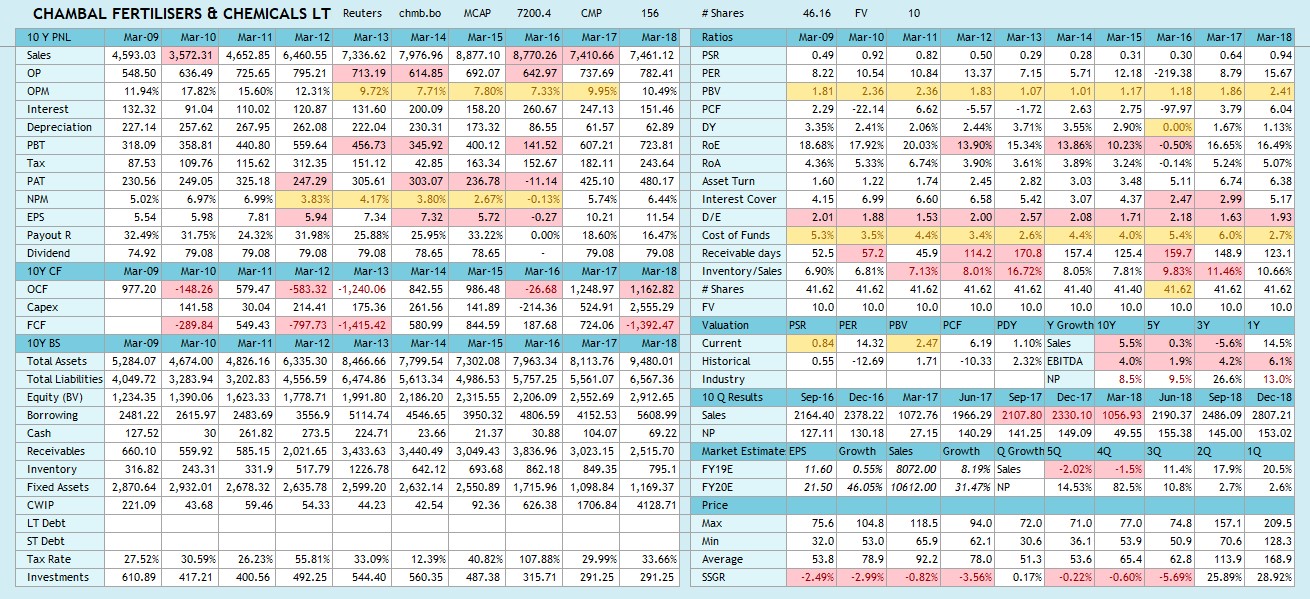

Financials

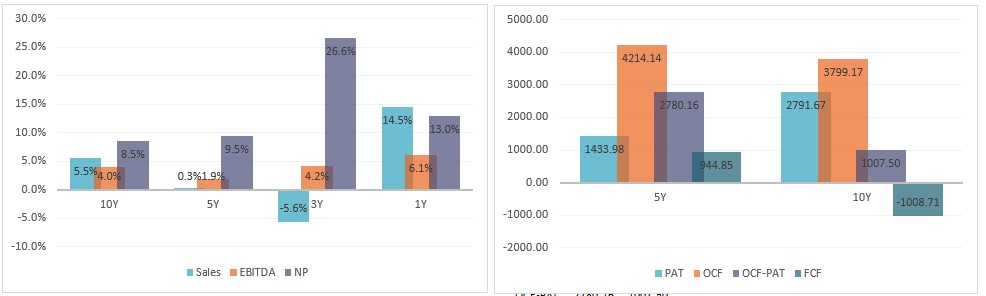

- Capital intensive business, with RoA of 5%, RoE is 16.5%

- FY18 OPM is 10.49%, less than 10Y average of 11.07%, but higher than 5Y average of 8.66% (generally, urea business is sometimes considered to be one of declining profitability, as input costs go up, but realisations don’t)

- No equity dilution in past 10Y

- Leverage has generally been high, with 10Y D/E average at 1.87. Currently DE is even higher at 1.93 due to project borrowings, which is gradually expected to come down with cash stream from the new urea unit hitting the books from Q4FY19

- Receivables are high at 123+ days due to delays with subsidy payments

- 10Y cumulative FCF is negative, although same is positive for 5 years cumulative.

1 Y historical price chart

Conclusions

Chambal Fertilisers is the largest private sector Urea producer in the country. Company has recently conducted first major Urea capex in the country after a gap of 18 long years.

Since commissioning, the new unit is already operating at optimum capacity. India being a net importer of Urea, off-take wouldn’t be an issue, consequently, company’s top-line and bottom-line are expected to grow by 31% and 46% in FY20 according to consensus estimates by Reuters. This is expected to result in upward movement of the stock price in the near to medium term.

However, Urea manufacturing as a business is plagued with problems which has held back investments for years. It’s a capital intensive business, which is subsidised and heavily regulated by the government. Subsidies are often delayed which results in stretched working capital cycles. Further, margins have shrunk as input costs have risen over the years, but same is not reflected in the realisations. All these limits prospects of the stock as an attractive candidate for long term holding in core portfolio, although medium term prospects look positive.