Handling a stock market crash can be a huge challenge to those who haven’t experienced a bear market in their investing career.

Mohnish Pabrai in recent talk at Boston College spoke about the 10 commandments of investment management.

His sixth commandment was:

Thou shall have a rope to climb out of the well.

It basically means having a source of inspiration at times of crisis.

2018 has been a terrible year for investors in mid and small cap space. Investor portfolios have taken a beating after doing very well for the previous 5 years or so.

Keeping Mohnish’s 6th commandment in mind, therefore, this piece attempts to offer a “rope” to fellow investors, hoping to climb out of portfolio losses, notional or otherwise.

Remember you are not alone

The first thing to remember is that you are not alone. Even legends suffer portfolio losses during corrections, just as we, lesser mortals do. Below we present a study on 3 legendary investors and how their portfolios fared during major stock market corrections

Ramdeo Agrawal

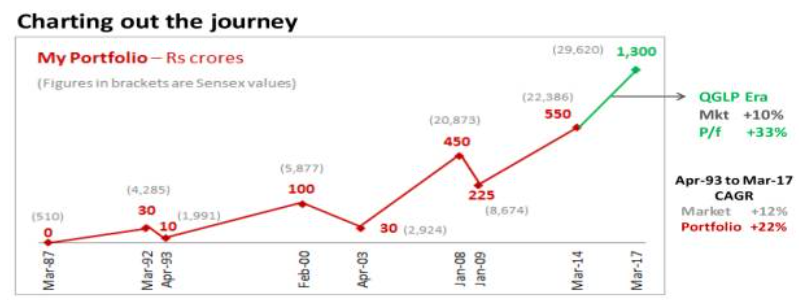

Starting with virtually nothing in 1987, Ramdeo Agrawal went on to make 1300 crs by 2017, compounding at over 22%+ for 30 years.

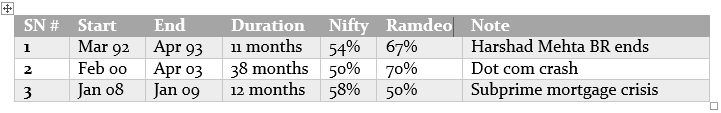

During this 30 years journey, Ramdeo’s portfolio witnessed 3 major declines, each amounting to anywhere between 50 – 70% falls, corresponding to 50% or more decline in the index.

3 major declines of 50% or more over 3 decades

Warren Buffett

It’s no different even with legendary Warren Buffett either.

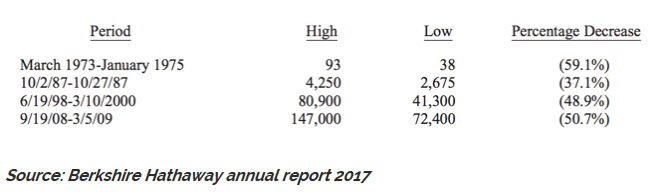

In his 2017 annual letter to shareholders, he himself cited 4 major declines in the share price of Berkshire Hathaway, between 1973 and 2009

Over this 36 years period, share price of Berkshire Hathaway declined by anywhere between 37-59% on 4 different occasions.

Mohnish Pabrai

Mohnish Pabrai of Pabrai funds started with 1M USD in 1994 when he sold part of his software services business, and went on to make 200M+ by 2017. But the journey wasn’t linear.

At the bottom of the financial crisis, his net worth was down to $18 Million (March 2009). It was a huge drop (of 78%) from the peak of $80 Million, in June 2007 (65-70%) 600M – below 200M

Hold on to your portfolio gems

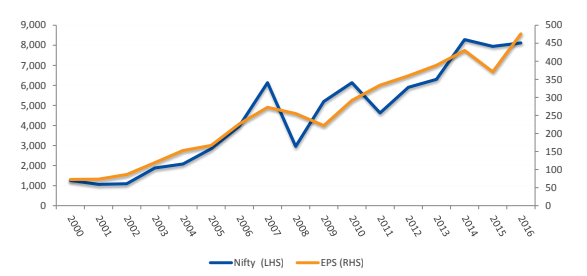

Stock prices are slaves of earnings power. Between 2000 and 2016, Nifty went up by 6.4x against Nifty EPS of 6.6x.

The price line may fall below the earnings line at times, such as 2008, but eventually they move more or less hand in hand.

As long as the underlying businesses are resilient enough to continue to grow over long term, temporary corrections can largely be ignored, if not considered an opportunity to buy more.

Be humble – accept mistakes

Remember that for every 3 stocks we pick, one of them will go wrong.

Legendary Sir John Templeton eloquently described it as follows:

Statistics showed that when I advised a client to buy one stock to replace another, about one-third of the time the client would have done better to ignore my advice…

Consider, for example, just the 30 issues that comprise the Dow Jones Industrials. From 1978 through 1990, one of every three issues changed—because the company was in decline, or was acquired, or went private, or went bankrupt. Look at the 100 largest industrials on Fortune magazine’s list. In just seven years, 1983 through 1990, 30 dropped off the list. They merged with another giant company, or became too small for the top 100, or were acquired by a foreign company, or went private, or went out of business. Remember, no investment is forever.

It is inevitable that we will make mistakes. The good thing about corrections are, quite often they bring down stock prices of both good and bad businesses alike. We should use corrections as an opportunity to correct our mistakes, and replace weaker links with more attractive stocks.

Do not use leverage

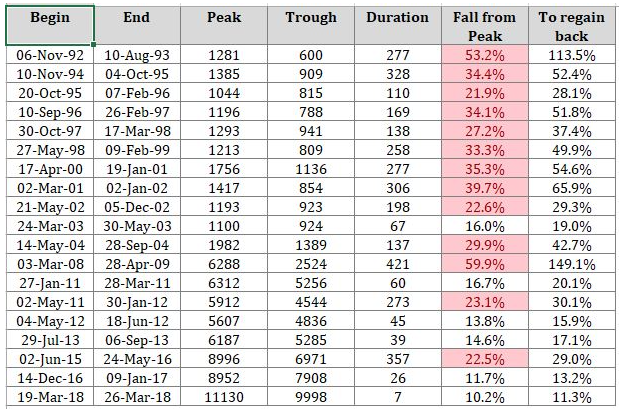

Over the past 28 years, Nifty has been 13 bear markets, with index falling more than 30% in 7 occasion, and more than 50% in 2 occasion.

Having a leveraged portfolio may put your survival at stake. For example, a 50% decline on 50% leveraged portfolio means you are bankrupt.

Only extremely skilled investors and traders can make effective use of leverage. For the rest of us lesser mortals, avoid leverage like plague.

What NOT to do during stock market crash

Couple of things you shouldn’t do when stock markets decline

Don’t rush to sell stocks just because prices have crashed

Retail investors sometimes confuse investing with trading. While in trading having a stop-loss is essential, it is quite meaningless to sell your long term investments purely based on price action.

Investment decisions should combine fundamentals with price action to base our decision – and the outcome could be quite opposite. For a business with strong fundamentals, price decline provides an opportunity to buy more instead of sell, while it might be justified to do the opposite with a shabby business.

Don’t ‘water the weeds’

Another common tendency often observed in small investors is the reluctance to book losses and sell winners instead to ‘lock profits’.

Legendary Peter Lynch beautifully phrased this behaviour as tendency to ‘water the weeds’.

Use market crashes as an opportunity to pluck the weeds and water the flowers instead.

Conclusion

Stock markets and prices of individual stocks do not go up linearly. Over the past 28 years, Nifty has fallen below the 200 DMA convincingly on 18 occasions. Short term decline in stock price has happened in past and will happen again in future.

Predicting the next decline or rise is impossible, hence, it is impractical to time our entry-exits. When it comes to stock market, time in the market is far critical determinant of success than market-timing.

So during the stock market crash, it is important to remind ourselves of our learnings from history, and follow the rules we discussed above.