There’s a funny story concerning Ben Graham and market timing. Apparently, when Warren Buffett graduated in 1951, Ben (along with Warren’s father) advised him not to go into stocks. Graham pointed out that Dow had traded below 200 at some point in every year save for the present one. Why not postpone going to Wall Street until after the next crash, and meanwhile get a safe job with someone like Proctor & Gamble? This was awful advice – violating Graham’s own tenet of not trying to forecast the markets. The Dow never went back to 200 again! (7)

It has been a known fact that time-in-the-market is a far more critical determinant of long term returns than market timing. In fact data suggests that market timers generally performs worse than buy-hold strategists over long term. This has been proven time and again in different markets over different periods of time. Yet retail investors continue trying to time the market in vein.

Why market timing is so difficult?

Market timing is an investing strategy in which investor tries to identify the best times to be in the market and when to get out. Proponents maintain that successfully forecasting the ebbs and flows of the market can result in higher returns than other strategies. Critics, however, note that changes in a market trend can appear suddenly and almost randomly, making the risk of misjudgement significant. Consider the following examples for instance.

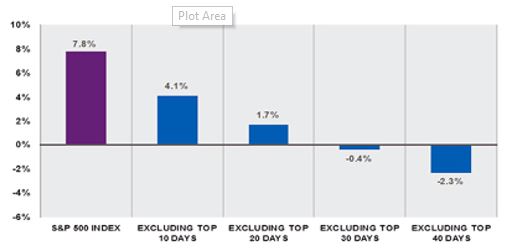

Example 1 S&P 500 returns 1996 -2011

According to research conducted by Charles Schwab Company in 2012, between 1926 and 2011, a 20-year holding period never produced a negative result. However, being out of the market for 30 best performing days reduced the returns from 7.8% compounded to -0.4%! What this data suggests is that timing the market successfully is very difficult because returns are often concentrated in very short time frames. If you aren’t invested in the market on its top days, it can ruin your returns

Fig. 1. S&P500 returns 1996 – 2011, minus X best performing days

Source: Charles Schwab Centre for Financial Research, Investopedia (1)

Example 2. US Market, S&P500 returns for the decade of 1980

The second example examines US market returns for the decade of 1980s. While compounded returns the entire period was 17.5%, being out of the market for a mere 40 best performing days would’ve dramatically reduced returns to 3.9%!

Fig.2 US market returns for the decade of 1980, minus X best performing days

Source: US Trust Corporation, Money Masters of Our Time, by John Train (2)

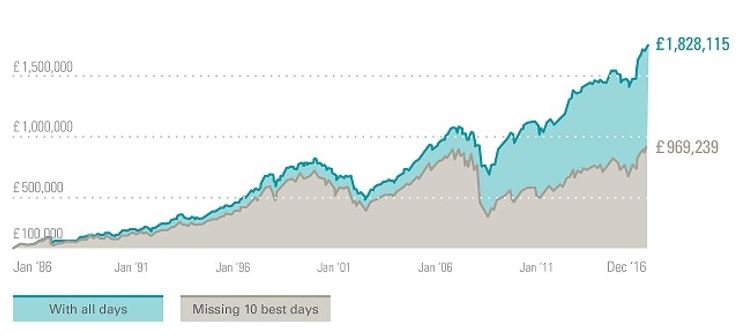

Example 3. FTSE All-Share Index, 1986-2016 & the impact of missing best 10 days

Results in UK market are no different. In the graph below, the blue line shows the return of the FTSE All-Share Index since January 1986. The grey line shows how this return would be eroded if you missed the ten best days over that period. Once again it shows how quickly stock market returns can be generated. Trying to time the market could cost you half your return.

Fig. 3 The impact of missing best 10 days of the FTSE All-Share Index, 1986-2016

Source: Time in the markets, not timing the market, James Norton, Vanguard UK, Apr 2017 (3)

But various experts actively promote this strategy. How do they perform?

To study that lets take a step back and understand how market timing strategies are packaged. You might have come across advisors trying to sell Asset Allocation Funds.

Tactical Asset Allocation (TAA) promises to shift the portfolio mix (normally stocks, bonds and cash) with changing market conditions in a manner that supposedly maximises investor returns. It uses a combination of macro and technical indicators as input and therefore often considered as a form of market timing with a more sophisticated packaging. But does it work?

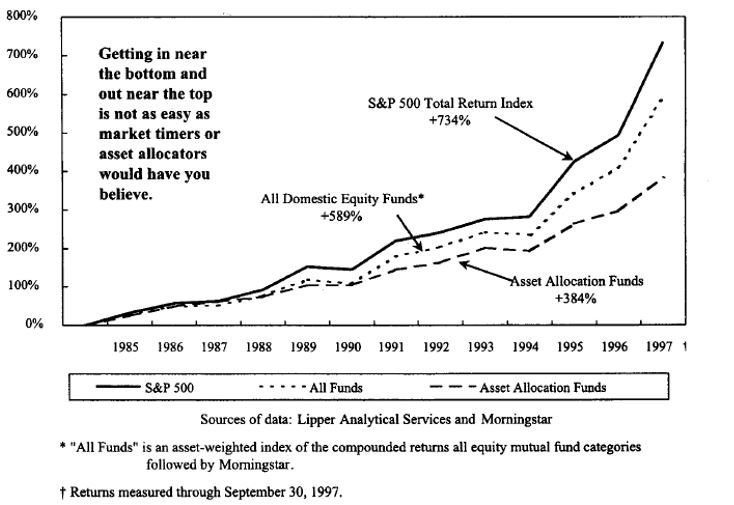

Performance of Tactical Asset Allocation Funds in US Markets

Fig. 4 Returns of Asset Allocation Funds Vs All US Domestic Equity Mutual Funds and S&P500 (4)

Fig. 4 taken from Lipper & Morningstar data, shows returns of 186 asset allocators for the 12 years to September 1997 compared to average of all US domestic equity mutual funds and S&P 500. The period covers good part of the bull market, 1987 crash and sharp downturn of 1990 – making it an ideal time for TAA and market timers to prove their mettle. Theoretically, they should have got out before 1987 and 1990 debacles and back in on time to ride the resurgent bull.

Unfortunately, the chart proves exactly the opposite. While the markets surged 734% for the entire period, the average equity mutual funds moved up 589%, and the asset allocators increased only 384%, about half the gain of the averages.

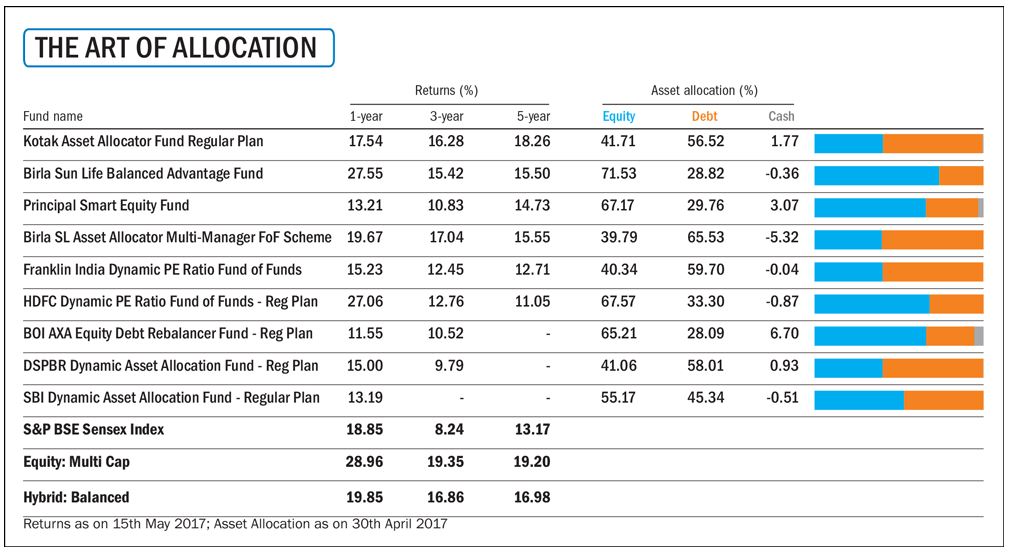

Performance of Asset Allocation Funds in Indian Market

Back home, Asset Allocation Funds in India follow certain models, which are generally based on Nifty 50’s P/E ratio, along with potential other parameters such as interest rates and / or fund manager’s judgement to determine asset allocation strategy. They try to avoid pricey market by raising debt and vice versa in undervalued markets.

The table below summarises the performance of asset-allocation funds, along with their current asset allocations. Not only do their returns vary, they also pale in comparison to those from multi-cap funds and balanced funds over the long term. By just staying invested in equities (as is the case with multi-cap funds) or by sticking to a steady equity-debt allocation (as is the case with balanced funds), one can do pretty well.

Fig. 5 Returns of Asset Allocation Funds in India

Source: www.valueresearchonline.com (5)

Conclusion

Fidelity Investments once analysed the returns of different investors with accounts at the firm, and the results were staggering: Those who forgot they even had an account at Fidelity did best (6).

Legends like Peter Lynch, Warren Buffet, David Dreman, etc. have openly confessed that they do not possess any skills to time the market. If these legends haven’t been able to master this skill, how can you, me and our paid fund manager expect to do that? Every piece of data discussed above suggests that market timing is a suckers’ game, yet retail investors continue to attempt it. Average equity fund investors fail to beat the market as well as average fund returns. Jumping in and out of the market is one of the key contributors. Hope our readers take a note of this, make amends to their investment methods if necessary and succeed in improving their returns going forward.

Reference

- Charles Schwab Centre for Financial Research, Investopedia

- John Train, Money Masters of Our Time

- Time in the markets, not timing the market, James Norton, Vanguard UK, Apr 2017

- How useful are asset allocation funds?

- David Dreman, Contrarian Investment Strategies – The Next Generation, 1998, Simon & Schuster, pp 58

- Is Swing Trading the Best Strategy for You? Andrés Cardenal (TMFacardenal) Sep, 2015

- Roger Lowenstein, Buffett: The making of an American capitalist, 2008, Random House Trade Paperbacks, pp 45