In this post we discuss what multibagger stocks are and how you can identify them to create wealth.

What are multibagger stocks?

Wikipedia describes a multibagger stock as an equity stock which gives a return of more than 100%.

This term was coined by legendary American fund manager Peter Lynch in his 1988 book One Up on Wall Street.

Lynch was a baseball fan and he borrowed the idea of a multibagger from baseball where ‘bags’ or ‘bases’ that a runner reaches are the measure of the success of a play.

For example, a ten bagger is a stock which gives returns equal to 10 times the investment, while a twenty bagger stock gives a return of 20 times. MRF for example, gave 1651% returns between June 2001 and April 2018 – it can be referred as a 17-bagger stock.

This term was coined by legendary American fund manager Peter Lynch in his 1988 book One Up on Wall Street.

Lynch was a baseball fan and he borrowed the idea of a multibagger from baseball where ‘bags’ or ‘bases’ that a runner reaches are the measure of the success of a play.

For example, a ten bagger is a stock which gives returns equal to 10 times the investment, while a twenty bagger stock gives a return of 20 times. MRF for example, gave 1651% returns between June 2001 and April 2018 – it can be referred as a 17-bagger stock.

Table of Contents

- What are multibagger stocks?

- Top multibagger stocks for 2022

- Top multibagger stocks for the past decade

- And finally, The 100-baggers

- Characteristics of top multibagger shares

- The Bajaj Finance story

- The Astral story & our experience

- How to spot potential multibagger stocks

- Future multibagger stocks for next 10 years

- List of smallcap multibagger stocks for 2023

- List of multibagger penny stocks for 2022

- Conclusion

Top multibagger stocks for 2022

Year 2022 produced many multibaggers. Below is the list of top 20 stocks that gave highest returns in the past 12 months.

| Name | 1Yr returns % | CMP Rs. |

|---|---|---|

| M K Proteins | 1618.34 | 775 |

| Bombay Super Hyb | 1613.05 | 602.3 |

| Ambar Protein | 1376.65 | 360.55 |

| SG Finserve | 1291.61 | 481.7 |

| NINtec Systems | 1081.59 | 237.5 |

| Bombay Metrics | 1034.58 | 408.45 |

| S & T Corporatio | 1030.77 | 59.8 |

| NIBE | 1004.75 | 426 |

| Ovobel Foods | 976.05 | 266 |

| Captain Pipes | 968.4 | 624 |

| EFC (I) | 791.19 | 889 |

| Sera Investments | 678.14 | 349.5 |

| Vinny Overseas | 657.29 | 259.05 |

| Knowledge Marine | 633.32 | 1100 |

| Ascom Leasing & | 616.81 | 324 |

| M B Agro Prod. | 549.75 | 625.25 |

| Bodhi Tree | 532.65 | 166.45 |

| Axita Cotton | 527.46 | 60 |

| IFL Enterprises | 523.84 | 153 |

| Supreme Holdings | 511.9 | 106.9 |

Top multibagger stocks for the past decade

If we look at the past decade (2010-20), then the 20 best multibagger stocks based on 10 year absolute returns will be the following:

| Symbol | Stock | Gain | Sector |

|---|---|---|---|

| AJANTPHARM | Ajanta Pharma | 5061% | Pharmaceuticals |

| ASTRAL | Astral Poly | 4614% | Plastic |

| ATUL | Atul | 4120% | Chemicals |

| LAOPALA | LaOpala | 3319% | Glass Products |

| AARTIIND | Aarti Industries | 3127% | Chemicals |

| VGUARD | V-Guard | 2357% | Electrical Equipment |

| BERGEPAINT | Berger Paints | 2268% | Paints & Varnish |

| VINATIORGA | Vinati Organics | 2034% | Chemicals |

| EICHERMOT | Eicher Motors | 2017% | Auto |

| PAGEIND | Page Industries | 1963% | Textile |

| NATCOPHARM | Natco Pharma | 1911% | Pharmaceuticals |

| NAVINFLUOR | Navin Fluorine | 1770% | Chemicals |

| CERA | Cera Sanitaryware | 1675% | Ceramics |

| CANFINHOME | Can Fin Homes | 1643% | Finance |

| ABBOTINDIA | Abbott India | 1593% | Pharmaceuticals |

| SRF | SRF | 1448% | Technical Textile |

| GRANULES | Granules India | 1382% | Pharmaceuticals |

| BRITANNIA | Britannia Industries | 1363% | FMCG |

| BAJAJFINSV | Bajaj Finserv | 1244% | Finance |

Multibagger stock Ajanta Pharma & our experience

Ajanta Pharma has been one of the most successful multibaggers of the past decade generating nearly 50x returns.

In 2012 when I first stumbled across Ajanta Pharma, I was drawn to it purely by its numbers. It had excellent financials, but I had no clue on what it did. Looking up in the Internet revealed it’s a pharmaceutical company (yes, you can tell that by the name) that produces a herbal preparation for kids named “Pinkoo Gripe Water” and sells anti-malarial drugs in Africa. Didn’t ring any bells, but after hesitating for few days I bought some shares of the company in September 2012. Subsequently, I added some more over the next two months (probably after bit more reading).

Between September 2012 – when I bought my first share of Ajanta Pharma, and May 2017 – when I sold my last bit– the stock had went up by an astonishing 1361%.

In 2012 when I first stumbled across Ajanta Pharma, I was drawn to it purely by its numbers. It had excellent financials, but I had no clue on what it did. Looking up in the Internet revealed it’s a pharmaceutical company (yes, you can tell that by the name) that produces a herbal preparation for kids named “Pinkoo Gripe Water” and sells anti-malarial drugs in Africa. Didn’t ring any bells, but after hesitating for few days I bought some shares of the company in September 2012. Subsequently, I added some more over the next two months (probably after bit more reading).

Between September 2012 – when I bought my first share of Ajanta Pharma, and May 2017 – when I sold my last bit– the stock had went up by an astonishing 1361%.

And finally, The 100-baggers

You might be surprised to learn that over the past 10 years alone, multiple stocks have generated more than 100 times returns. Top five names among them in terms of 10Y returns are:

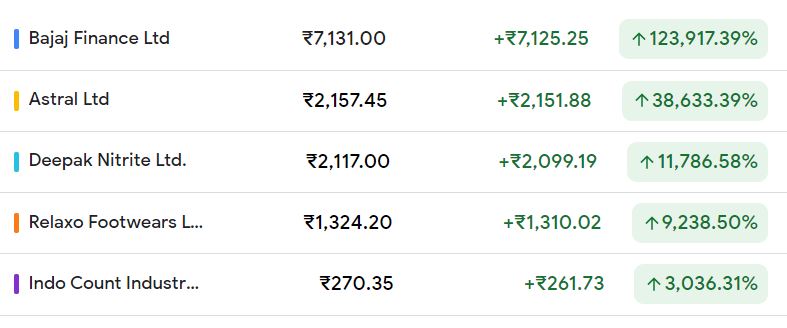

And, if you consider their Inception Till Date (ITD) returns, the numbers are even more astounding:

ITD returns of best multibagger stocks based on 10Y performance:

Characteristics of top multibagger shares

Multibagger shares usually have the following traits:

The Bajaj Finance story

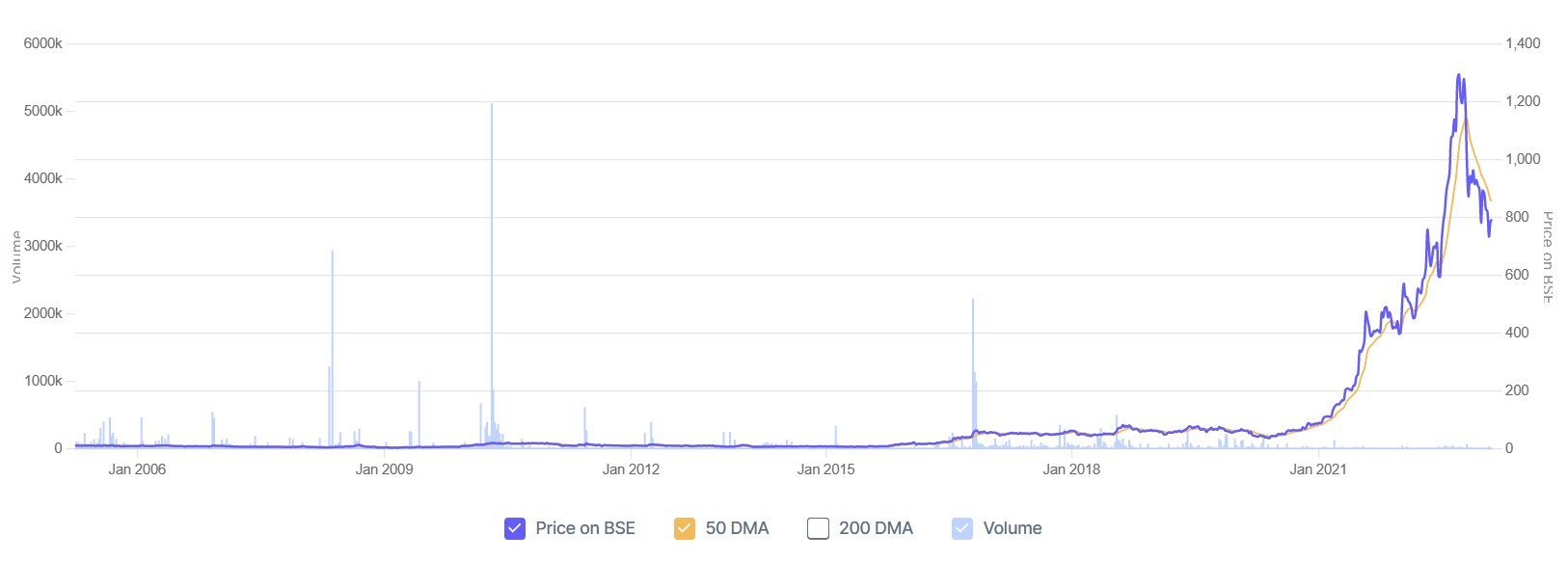

Bajaj Finance started as Bajaj Auto Finance in 1988, primarily as a financing arm of the group’s auto business.

Today it stands out as one of the largest and fastest growing deposit taking NBFC in India with a diversified portfolio of financing businesses covering Retail, SME Rural & Commercial.

Since its IPO listing in FY95, the stock has multiplied by an astounding 124,450%. A casual 1 lakh rupees invested in the IPO is now worth around 1200 crores! (Feel free to double check the number of zeros when you have time 😊)

Today it stands out as one of the largest and fastest growing deposit taking NBFC in India with a diversified portfolio of financing businesses covering Retail, SME Rural & Commercial.

Since its IPO listing in FY95, the stock has multiplied by an astounding 124,450%. A casual 1 lakh rupees invested in the IPO is now worth around 1200 crores! (Feel free to double check the number of zeros when you have time 😊)

The Astral story & our experience

We had been invested in 4 of these 5 100-baggers mentioned before, at one point or another. Yet, like many investors, whenever we look at these stocks today, we feel the pain of missing out.

Astral Limited is a prime example. The company is primarily engaged in manufacturing of plumbing & drainage systems, fittings and adhesive solutions. Roughly 77% of its business comes from Pipes & Fittings, while Adhesives accounts for the rest.

We had identified Atral almost a decade back. It used to be known as Astral Poly Technik then. Within one year the stock went up by approximately 5 times!

Schooled in the principles of traditional value investing, we exited the stock considering it to be over-valued, waiting for a suitable opportunity to re-enter after correction! As you can imagine, it has been a rather long and frustrating wait 😊

Astral Limited is a prime example. The company is primarily engaged in manufacturing of plumbing & drainage systems, fittings and adhesive solutions. Roughly 77% of its business comes from Pipes & Fittings, while Adhesives accounts for the rest.

We had identified Atral almost a decade back. It used to be known as Astral Poly Technik then. Within one year the stock went up by approximately 5 times!

Schooled in the principles of traditional value investing, we exited the stock considering it to be over-valued, waiting for a suitable opportunity to re-enter after correction! As you can imagine, it has been a rather long and frustrating wait 😊

How to spot potential multibagger stocks

So how do you spot a multibagger share?

The usual starting point is to screen the traded stock universe by applying filters in-line with the criteria mentioned before. This will give us an initial list, which can be digged in further.

We look for a highly profitable business with strong cash-flows and low debt that is maintaining a consistent but high growth rate.

The usual starting point is to screen the traded stock universe by applying filters in-line with the criteria mentioned before. This will give us an initial list, which can be digged in further.

We look for a highly profitable business with strong cash-flows and low debt that is maintaining a consistent but high growth rate.

Future multibagger stocks for next 10 years

Running the above screen, we get a list of 19 potential multibagger stocks. These stocks could potentially generate strong returns in future:

| Name | CMP Rs. | MCAP Rs.Cr. | FCF 5Yrs Rs.Cr. |

|---|---|---|---|

| Sr.Rayala.Hypo | 472.35 | 810.78 | 179.07 |

| DHP India | 993 | 297.9 | 33.01 |

| Sarthak Metals | 156.45 | 214.18 | 27 |

| Jindal Stain. | 263.3 | 13836.26 | 4945.73 |

| Monarch Networth | 212 | 658.23 | 103.66 |

| Tiger Logistics | 414.75 | 438.47 | 49.39 |

| Guj. Themis Bio. | 634 | 921.08 | 30.45 |

| Vinyl Chemicals | 390.7 | 716.42 | 54.74 |

| Saksoft | 144.2 | 1524.03 | 206.58 |

| RPG LifeScience. | 818.8 | 1354.22 | 155.51 |

| Avantel | 389.4 | 631.55 | 17.63 |

| Roto Pumps | 580.05 | 910.91 | 54.23 |

| Rajratan Global | 792.35 | 4022.82 | 44.79 |

| Shivalik Bimetal | 386.25 | 2224.94 | 9.45 |

| Praveg | 385.8 | 807.16 | 14.46 |

| RHI Magnesita | 763.1 | 14346 | 210.48 |

| Raghav Product. | 1025 | 1114.82 | 25.3 |

| Abbott India | 20898.05 | 44408.36 | 2901.56 |

| Varun Beverages | 1227 | 79277.57 | 2073.85 |

| Timken India | 2999.8 | 22564.12 | 396.54 |

List of smallcap multibagger stocks for 2023

In order to get get a list of smallcap multibagger stocks (potential), we filter the above list further by market capitalization, setting the maximum market cap at 8500 crores for smallcap stocks. We selectively present 3 stocks from the resulting list:

Shivalik Bimetal Controls Ltd

Shivalik Bimetal Controls Ltd is a company specialized in the joining of material through various methods such as Diffusion Bonding / Cladding, Electron Beam Welding, Solder Reflow and Resistance Welding.

The company’s main products are Thermostatic Bimetal /Trimetal strips and SMD/ Shunt Resistors.

Company also manufactures Reflow Solder/Pre-soldered Strips, Precision Stainless Steel, Thermostatic Bimetal Coils & Spring, Snap Action Disc, etc.

The shunt resistors division of the company is completely new and was started 4-5 years back by the company.

The company’s main products are Thermostatic Bimetal /Trimetal strips and SMD/ Shunt Resistors.

Company also manufactures Reflow Solder/Pre-soldered Strips, Precision Stainless Steel, Thermostatic Bimetal Coils & Spring, Snap Action Disc, etc.

The shunt resistors division of the company is completely new and was started 4-5 years back by the company.

DHP India Ltd

DHP India Limited was incorporated on 26th April, 1991. The Company is engaged in manufacturing of LPG Regulators & accessories and related brass items from its ISO 9001 : 2015 certified factory in Howrah, West Bengal, India.

The Company’s main products are regulators, hose assemblies and brass fittings. As of FY22, appox. 87% of its sales came from exports while 13% came from domestic market.

The Company’s main products are regulators, hose assemblies and brass fittings. As of FY22, appox. 87% of its sales came from exports while 13% came from domestic market.

Avantel Ltd

Avantel offers innovative, customized network centric solutions through products that comply with MIL standards for defence platforms including Ships / Submarines / Aircraft / Helicopters.

Company caters to customers majorly from aerospace, defence and healthcare sectors.

Company caters to customers majorly from aerospace, defence and healthcare sectors.

Rajratan Global Wire Ltd

Rajratan Global Wire Ltd is primarily into manufactures of Tyre Bead Wire (TBW) and High-Carbon steel wire aka Black Wire. It is the largest manufacturer of TBW in India with a market share of ~50% and among the largest in Asia (ex-China).

Its products are used primarily in automobile, aircrafts, construction and engineering industries.

Its products are used primarily in automobile, aircrafts, construction and engineering industries.

List of multibagger penny stocks for 2022

In US, stocks below one dollar (roughly 75 Indian rupees in todays date) are referred to as penny stocks. In the context of Indian markets, considering 100 rupees as the cut-off for penny stocks, the following stocks can be considered as potential multibagger penny stocks:

KMC Speciality Hospitals Ltd

KMC Speciality Hospitals (India) is a healthcare services and pharmacy company. It is a part of the KMC group of hospitals based at Tiruchirappalli.

The company is in the business of running a super specialty hospital having 175 beds with team of dedicated specialists and state-of-the-art equipment. They cater to key specialty areas such as Neurosurgery, Cardiovascular & thoracic surgery, Orthopedics, Plastic and Reconstructive Surgery, Gynecology, Neonatology and Nephrology (including renal transplants).

The company is in the business of running a super specialty hospital having 175 beds with team of dedicated specialists and state-of-the-art equipment. They cater to key specialty areas such as Neurosurgery, Cardiovascular & thoracic surgery, Orthopedics, Plastic and Reconstructive Surgery, Gynecology, Neonatology and Nephrology (including renal transplants).

M K Exim (India) Ltd.

M K Exim (India) Ltd is engaged in the business of manufacturing textiles and fabric. It has also ventured into distribution of cosmetic products.

As of FY21, finished fabrics constituted 42% of its sales, while cosmetic distribution contributed to 58%. 64% of total revenues came from domestic market while 36% was exports (FY21).

As of FY21, finished fabrics constituted 42% of its sales, while cosmetic distribution contributed to 58%. 64% of total revenues came from domestic market while 36% was exports (FY21).

Conclusion

If you had invested 1 lakh in Bajaj Finance in the 1995, you would probably be settled in the Caribbean today with a cool 1000 crore plus cash, sipping rum and enjoying retirement.

As Lynch says, you only need a few big winners !

As Lynch says, you only need a few big winners !

All you need for a lifetime of successful investing is a few big winners, and the pluses from those will overwhelm the minuses from the stocks that don’t work out.

Peter Lynch

Legendary American Investor and Fund Manager

But if you missed the previous one and don’t have the time to go hunting for the next big one, we are here to help.

Feel free to review our advisory offerings and select a plan that suits you. However, please remember that equity investments carry risks, and you must read our full disclaimer before investing.

Otherwise, just keep learning and happy hunting!

Feel free to review our advisory offerings and select a plan that suits you. However, please remember that equity investments carry risks, and you must read our full disclaimer before investing.

Otherwise, just keep learning and happy hunting!

Credits

Graphic credits – screener.in

Company overview credits – Reuters

sir

i want tosubscribe for multibaggers scheme plz send details ,but i saw somewhare multibaggers ,shortterm ,and long term plans ,soplz send details to my e-mail given below or whatsapp my number – 7995144334 .waiting for reply sir

You can subscribe to the long-term (potential multi-baggers) plan directly from the following link Long Term (Potential Multi-baggers) Plan

Alternatively, you can go to https://viniyogindia.com/plans, and click on the Fixed Fee plans tab.

This will give you access to all the Fixed Fee plans, and you can subscribe from there.

Sir, would like to know your views on Prince Pipe stock. Do you think it’s good ?