ViniyogIndia 🧩 Multifactor Portfolio is based on a Multifactor Regime Switching Strategy where Factor exposure is controlled based on Market Regime forecasts. This portfolio is suitable for Aggressive to Moderately Aggressive investors.

Background:

ViniyogIndia offers model portfolios based on Quantitative Factor Investing. Factors are quantitative attributes used to explain asset returns.

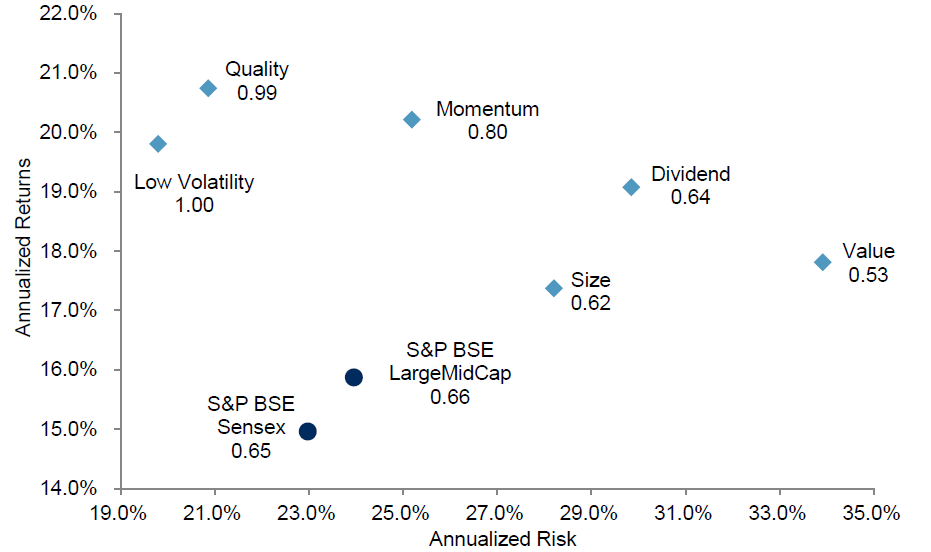

Factor strategies have been extensively researched globally as well as in India. The below chart for example, summarizes the risk-return characteristics of single-factor portfolios in India between October 2005 and June 2017.

Over the period, all major single-factor portfolios outperformed the S&P LargeMidCap. However, only Low Volatility, Quality & Momentum delivered better risk-adjusted returns (returns per unit of risk) than S&P BSE LargeMidCap.

ViniyogIndia’s factor portfolios use a combination of factors that are proven to work well in the Indian markets.

Stocks & Weights

🔐 Protected! Please log in to access this section.

Factor Performance is Cyclical

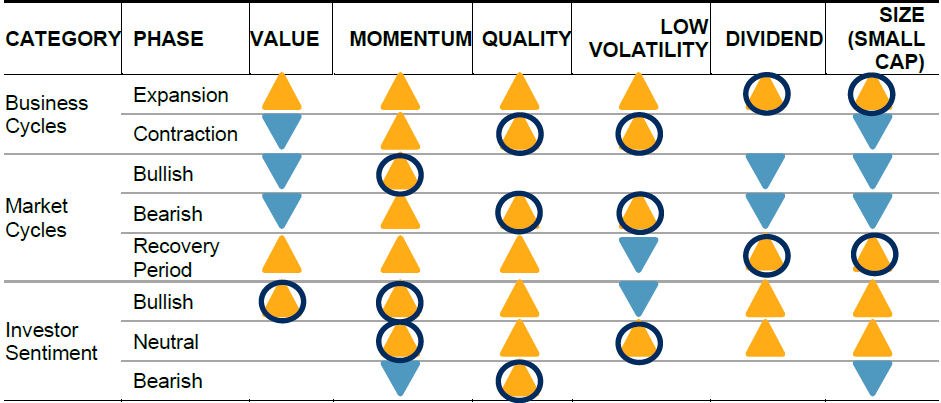

Macroeconomic and market events affected each factor in different ways. Below chart summarizes performance characteristics of factors in different macroeconomic regimes, including market cycles, business cycles, and investor sentiment regimes in India

Source: S&P Dow Jones Indices LLC. Data from October 2005 to June 2017. Index performance based on total return in INR. Past performance is no guarantee of future results. Table is provided for illustrative purposes. Note: Yellow, upward triangles represent favorable performance (positive excess return with outperformance probability not lower than 50%), while blue, downward triangles represent unfavorable performance (negative excess return with outperformance probability not higher than 50%) versus the S&P BSE LargeMidCap. The two factors with the highest information ratio in each of the market cycle phases are circled.

Portfolio Design Rules

ViniyogIndia 🧩 Multifactor Portfolio is based on a Multifactor Regime Switching Strategy where Factor exposure is controlled based on Market Regimes.

Market states/regimes are modelled using a combination of proprietary + macro indicators. This is combined with past performance to dynamically control factor exposures over market regimes.

- Portfolio of 15-20 stocks picked from the NSE universe having the best Factor rank based on Market Regime forecast

- Further refined by using a combination of one or more secondary factors to maximize risk-adjusted returns

- Illiquidity filter to remove low volume| turnover stocks

- Balanced at least once a month to keep the turnover low

Risk Management Rules

Risk exposure to the overall portfolio is reduced by:

- Proprietary asset allocation rule to control equity exposure depending on market conditions

- Limits on exposure to any single stock

- Conservative nature of the factor combination used to reduce downside risks

Asset Allocation Rules

Allocation to Equities is based on a proprietary mathematical function that uses market parameter(s) as the independent variable(s). Excess funds are allocated to Liquid & Gold ETFs.

Suitability

This portfolio is suitable for conservative to moderately aggressive investors

Historical Returns

Understand key terms & disclosures

Live returns: It depicts the actual and verifiable returns generated by the portfolios. Live performance does not include any back-tested data or claim and does not guarantee future returns

Back-tested returns: Back-testing allows a trader to simulate a trading strategy using historical data to generate results and analyze risk and profitability before risking any actual capital. This usually requires expertise of a qualified programmer to develop the idea into a testable form. Back-tested returns does not guarantee future returns

Disclosure: By proceeding, you understand that investments are subjected to market risks and agree that returns shown on the platform were not used as an advertisement or promotion to influence your investment decisions

Back-tested Returns

| Year | N500 | Strategy |

|---|---|---|

| 2010 | 14.25% | -6.23% |

| 2011 | -16.46% | 0.09% |

| 2012 | 33.30% | 18.20% |

| 2013 | 3.89% | 12.60% |

| 2014 | 39.12% | 106.31% |

| 2015 | 0.04% | 7.68% |

| 2016 | 4.68% | -13.67% |

| 2017 | 37.27% | 42.46% |

| 2018 | -1.55% | -1.04% |

| 2019 | 8.64% | 2.74% |

| 2020 | 17.61% | 72.27% |

| 2021 | 31.70% | 146.10% |

| CAGR | 12.1% | 24.83% |

Based on the back-tested results, between 2005 – 2021, the Multifactor strategy generated a compounded rate of return of 24.83% compared to Nifty500 return of 13.1%.

For Live Returns since inception, click on ‘See Performance’ button below.

Performance measurement & attribution analysis

To estimate alpha and interpret the sources of return for our strategy we perform a regression analysis using Carhart 4 Factor Model. The results are shown in the table below:

| α * | MKT | SMB | HML | WML | |

|---|---|---|---|---|---|

| Factor exposure | 0.86 | 0.49 | 0.07 | 0.04 | 0.31 |

| p-value | 0.00 | ~0.0 | 0.22 | 0.41 | ~0.0 |

The monthly alpha or excess return for the strategy is 0.86%. This is generated using a combination of factors and asset allocation rules that tries enhance portfolio returns while reducing risks.

Additionally, returns from standard factors such as market beta and momentum contribute to the overall portfolio returns. Return from size and value factors are not statistically significant.

Subscribe to this portfolio:

Fixed Fee:

Rs. 5499 3999/ 6 months

Asset Based:

1.8% yearly. Offered as smallcases.

Credits

Image by storyset on Freepik