ViniyogIndia 🦔 Armadillo Portfolio (erstwhile ViniyogIndia☔ All Weather) invests in a basket of Low Risk Stocks & ETFs. This portfolio is suitable for Conservative investors

Background:

ViniyogIndia offers model portfolios based on Quantitative Factor Investing strategy. Factors are quantitative attributes that can be used to explain asset returns.

Mathematically, if we try to model Asset Pricing behavior as a liner multivariate function, then factors represent the independent or explanatory variables of the function.

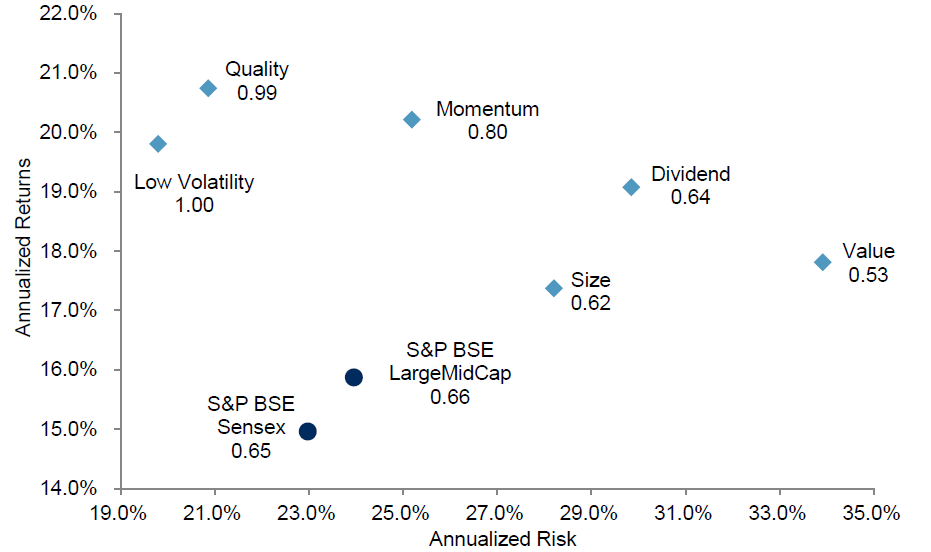

Factor strategies have been extensively researched globally as well as in India. The below chart for example, summarizes the risk-return characteristics of single-factor portfolios in India between October 2005 and June 2017. Over the period, all major single-factor portfolios outperformed the S&P LargeMidCap.

ViniyogIndia’s factor portfolios use a combination of factors that are proven to work well in the Indian markets.

Portfolio Design Rules

ViniyogIndia ☔ All Weather Portfolio is based on a Multifactor Strategy that invests in Low Risk stocks

- Portfolio of 15-20 stocks picked from the NSE universe having lowest risk

- Further refined by using a combination of one or more secondary factors to maximize risk-adjusted returns

- Illiquidity filter to remove low volume| turnover stocks

- Balanced at least once a month to keep the turnover low

Risk Management Rules

- Proprietary asset allocation rule to control equity exposure depending on market conditions

- Limits on exposure to any single stock

- Conservative nature of the factor combination used to reduce downside risks

Asset Allocation Rules

Allocation to Equities is based on a proprietary mathematical function that uses market parameter(s) as the independent variable(s). Excess funds are allocated to Liquid & Gold ETFs.

Suitability

This portfolio is suitable for conservative investors

Performance measurement & attribution analysis

To interpret the sources of return for our strategy we perform a regression analysis using Carhart 4 Factor Model. The results are shown in the table below:

| α * | MKT | SMB | HML | WML | |

|---|---|---|---|---|---|

| Factor exposure | 0.86 | 0.49 | 0.07 | 0.04 | 0.31 |

| p-value | 0.00 | ~0.0 | 0.22 | 0.41 | ~0.0 |

The monthly alpha or excess return for the strategy is 0.86%. This is generated using a combination of factors and asset allocation rules that tries enhance portfolio returns while reducing risks.

Additionally, returns from standard factors such as market beta and momentum contribute to the overall portfolio returns. Return from size and value factors are not statistically significant

Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Subscribe to this portfolio:

Fixed Fee:

Rs. 5499 3599/ 6 months

smallcase:

Rs. 1999/ 3 months. Offered as smallcases.