ViniyogIndia ⚖ Multiplier portfolio invests in high quality businesses at a reasonable price. This portfolio is suitable for moderately aggressive investors.

Note. The ViniyogIndia ⚖ Multiplier was originally referred to as the ViniyogIndia ⚖ Balanced portfolio. Both the portfolios are identical.

Background:

ViniyogIndia offers model portfolios based on Quantitative Factor Investing. Factors are quantitative attributes used to explain asset returns.

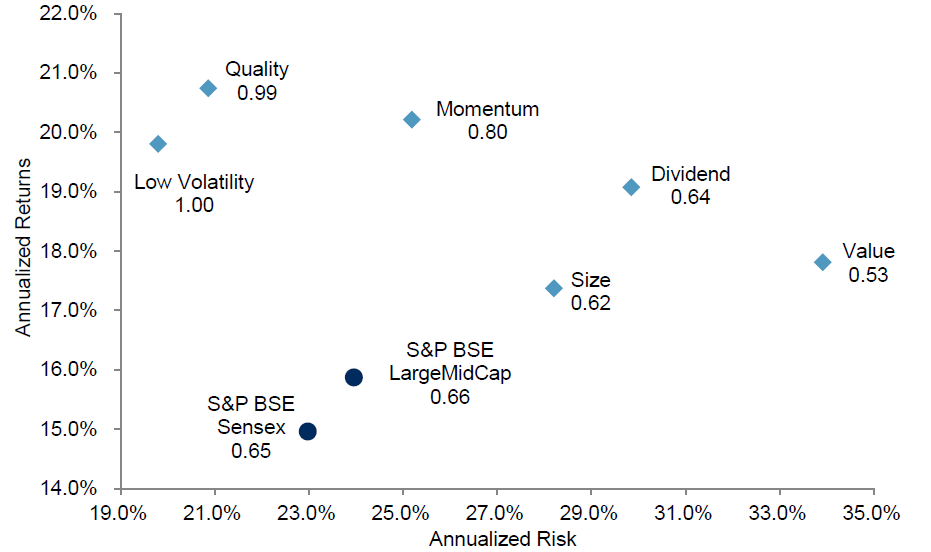

Factor strategies have been extensively researched globally as well as in India. The below chart for example, summarizes the risk-return characteristics of single-factor portfolios in India between October 2005 and June 2017.

Over the period, all major single-factor portfolios outperformed the S&P LargeMidCap. However, only Low Volatility, Quality & Momentum delivered better risk-adjusted returns (returns per unit of risk) than S&P BSE LargeMidCap.

ViniyogIndia’s factor portfolios use a combination of factors that are proven to work well in the Indian markets.

Portfolio Design Rules

ViniyogIndia ⚖ Multiplier Portfolio is based on a Multifactor Strategy that uses Quality as one of the Primary Factors

- Portfolio of 15-20 stocks picked from the NSE universe having the highest Quality rank

- Quality is usually measured as RoE over the past year or using an alternative proprietary measure

- Further refined by using a combination of one or more secondary factors to maximize risk-adjusted returns

- Illiquidity filter to remove low volume| turnover stocks

- Balanced at least once a month to keep the turnover low

Risk Management Rules

Risk exposure to the overall portfolio is reduced by:

- Proprietary asset allocation rule to control equity exposure depending on market conditions

- Limits on exposure to any single stock

Asset Allocation Rules

Allocation to Equities is based on a proprietary mathematical function that uses market parameter(s) as the independent variable(s). Excess funds are allocated to Liquid & Gold ETFs.

Suitability

This portfolio is suitable for moderately aggressive investors

Performance measurement & attribution analysis

To estimate alpha and interpret the sources of return for our strategy we perform a regression analysis using Carhart 4 Factor Model. The results are shown in the table below:

| α * | MKT | SMB | HML | WML | |

|---|---|---|---|---|---|

| Factor exposure | 0.69 | 0.35 | 0.20 | 0.11 | 0.21 |

| p-value | 0.01 | ~0.0 | 0.01 | 0.07 | ~0.0 |

The monthly alpha or excess return for the strategy is 0.69%. This is generated using a combination of factors and asset allocation rules that tries enhance portfolio returns while reducing risks.

Additionally, returns from standard factors such as market beta, size and momentum contribute to the overall portfolio returns. Return from the value factor is not statistically significant.

Subscribe to this portfolio:

Fixed Fee:

Rs. 5499 3999/ 6 months

Asset Based:

1.8% yearly. Offered as smallcases