In this article we review 33 tips and quotes from Rakesh Jhunjhunwala, covering Life, Investing & Trading.

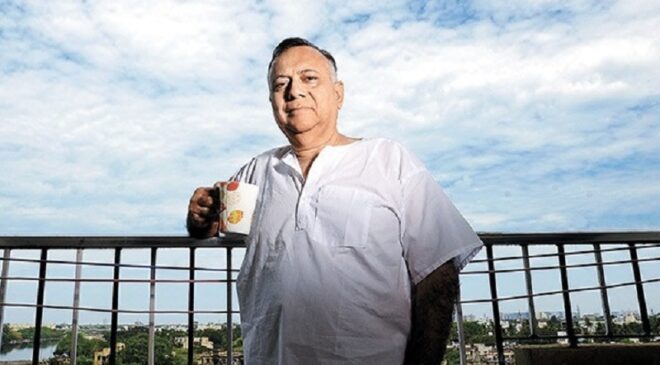

Rakesh Jhunjhunwala, widely referred to as the Indian Warren Buffett, is arguably the greatest investor in India.

Starting with a paltry capital of 5000 rupees in 1985, he went on to make 3B USD (~ 20K) by 2018

You can read more about Rakesh Jhunjhunwala’s biography and latest portfolio here.

Rakesh Jhunjhunwala Tips and Quotes – On Life

- Whatever you can do or dream you can, begin it. Boldness has genius, power and magic in it.

- Be paranoid of success — never take it for granted. Realize success can be temporary and transient.

- You do not succeed without obsession.

- If in doubt, listen to your heart.

- See the world as it is, rather than what you would like it to be.

Rakesh Jhunjhunwala Tips and Quotes – On Investing

- Invest in a business not a company.

- If you see an opportunity, grab it today!

- Never put your hard earned money without proper research. Never invest according to “Stock tips”.

- Invest in companies which have strong management and competitive advantage.

- Invest in the small caps, which will be the large caps. The biggest challenge of investing is that you should recognize whether organization has the ability to scale.

- Never invest at unreasonable valuations. Never run for companies which are in limelight.

- Always go against tide. Buy when others are selling and sell when others are buying.

- Make the investment when the stock is not popular.

- Never in my life have I not made an investment because the stock is not popular. In fact I like to make the investment when the stock is not popular.

- The prettiest part of the stock is that it has to be cheap – the entry point.

- Do not invest in those cheap stock which will give huge returns when your children are grown up. Think about a reasonable time also.

- If a girl is beautiful a suitor will come. If a stock is beautiful, a suitor will come. So I don’t search for suitors when I buy the stock.

- Emotional investment is a sure way to make loss in stock markets.

- Blindly following stock picks by big investors is not a wise thing to do.

- Have some cash in hand so that you can grab the opportunity when it occurs.

- If you believe in the growth prospects of a company, invest in the stock and give it sufficient time.

- Give your investments time to mature. Be Patient for the World to discover your gems.

- Never react and change your investment decisions according to daily business news. Panic selling is a bad habit

- Never get carried away by aberrations, recognize and respect them but do remember that the market corrects its aberration though it takes time.

- Value investing is relevant in all circumstances. But thought processes and principles are dynamic and not static. Be open to change.

- Learn from mistakes. Learn to take a loss.

- Prepare for losses. Losses are part and parcel of stock market investor life

Rakesh Jhunjhunwala Tips and Quotes – On Trading

- Anticipate trend and benefit from it. Traders should go against human nature.

- Vadhere vadhare levanu vadhare vadhare beichavanu”-Buy as the market is rising sell as the market is falling.

- Always know what to stake and when to take a loss.

- As a rule in trading never ever average.

- Trading is against human nature.