In this post we discuss the investment journeys of 3 top investors in India and how they made it big. We also reveal their latest portfolios as on Q2 FY18.

Rakesh Jhunjhunwala

He is known by various names – the Warren Buffett of India, the Big Bull and the Pied Piper of Indian Bourses. With an estimated wealth of around 3B USD, Rakesh Jhunjhunwala is arguably the most successful investor in India.

Early Life

Born in a middle class family, Rakesh Jhunjhunwala was curious about stock markets as a child. His father was an Income Tax officer and a stock market enthusiast. As a child he would see his father discuss about stocks with friends in the evening over a drink. Rakesh would listen to them and one day he asked why the prices fluctuate. His father told him to check if there is a news item on Gwalior Rayon in the newspaper, and if there ware, Gwalior Rayon’s price would fluctuate the next day.

Rakesh found this very interesting and he got fascinated by stocks.

Rakesh started dabbling in stocks while in Sydenham College. In January 1985 after completing CA Rakesh decided to join the stock market. The BSE was then trading at around 150.

The Plunge

His first success came in the following year when he bought 5000 shares of Tata Tea at the price of Rs 43. After 3 months he sold them for Rs 143 pocketing around 5L

Between 1986 and 1989 Rakesh earned Rs 20-25 lakhs. After 1986, the market went into a big depression for two three years but Rakesh put that money in Tata Power and the stock became about 1100-1200. He was now worth around Rs 50-55 lakhs.

His first big win came through Iron or mining company Sesa Goa. Stock had a big fall because there was a depression in the iron ore industry and then prices for the next year had been considerably raised about 20-25%. The stock was available abysmally cheap around Rs. 25-26. There was a projection of a very good growth in profitability in the next year but nobody seemed to believe it.

Rakesh bought 4 lakh shares of Sesa Goa in forward trading, worth Rs 1 crore. He sold about 2-2.5 lakh shares at Rs 60-65 and another 1 lakh at Rs 150-175. The prices then went up to Rs 2200 and he sold some shares, and did some other trading too. Rakesh now had net worth of about Rs 2 – 2.5 crore.

Inflexion point came with the Madhu Dandavate’s (1989-1990) budget, which rationalised excise duty. Everybody was expecting socialist budget, but Rakesh thought otherwise. He was proven right and his net worth quintupled.

Investment Philosophy

Although he claims to put only a minuscule of his net-worth on the table for trading activity, he has often leveraged his own capital and managed to make a fortune from his calls, more often than not. His stock picking strategy is influenced by the lessons from Mr George Soros’s trading strategies and Dr Marc Faber’s analysis of economic history. He endorses the thumb rule of ‘trend is my best friend’.

The poster boy of the Indian bull-run admits to have been a bear in the Harshad Mehta days. Under the guidance of Mr Radhakrishna Damani, he made a lot of money shorting stocks at the time of Harshad Mehta scam post 1992.

Much like Mr Warren Buffet, he buys into the business model of a company and for judging the longevity and growth potential, he gives top priority to ‘competitive ability’, ‘scalability’ and ‘management quality’ of the enterprise.

The ‘entrepreneur’, according to Mr Jhunjhunwala is what makes an invaluable difference to his expected investment returns. According to Mr Jhunjhunwala, believing in the vision and the beliefs of the entrepreneur and validating the risks that may not be perceived by the entrepreneur are the key success factors for an investor.

Multi-baggers

Mr Jhunjhunwala has managed to identify numerous multi-baggers in the past decade, notable being Karur Vysya Bank, Praj Industries, Crisil, Titan, Nagarjuna, HOEL and PSUs like BEML and Bharat Electronics, among others.

His biggest holding is an 8% stake in watch and jewellery maker Titan, worth more than $900 million.

The typical traits to look for while identifying potential multi-baggers, according to Mr Jhunjhunwala are – low institutional holding, under-researched and general pessimism about the stock.

Today Rakesh runs his privately owned stock trading firm Rare Enterprises, which derives its name from the first two initials of his name and wife Rekha’s name.

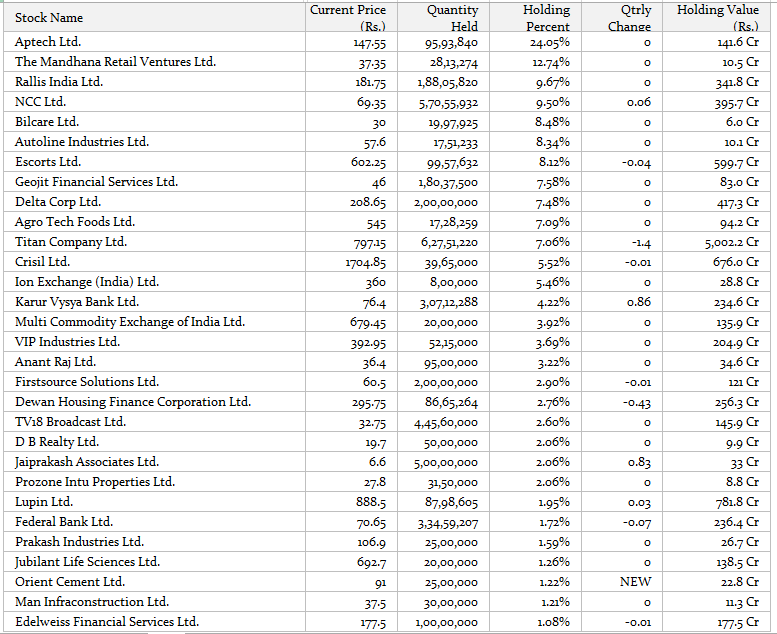

Rakesh Jhunjhunwala portfolio

Dolly Khanna

She is one of the most celebrated and the most mysterious stock-pickers of Dalal Street with knack of hunting multi-baggers. But here is the funny thing – she is a homemaker and knows nothing about stocks.

Her husband Rajeev Khanna manages her portfolio and appears to be the brain behind her phenomenal stock market success. But he prefers to live behind shadows – and despite his eye-popping success has never given a TV interview till date despite the media frenzy.

Early Life

Mr Khanna was born and brought up in middle class family in Chennai. Rajiv was an excellent student and successfully qualified as a chemical engineer from IIT Madras. After completing engineering, Khanna worked for ICI Ltd, a pharmaceutical company as a research person in the field of industrial explosives and blasting physics. In 1986 Rajiv ventured into his own milk food business, and started his company “Kwality Milk Foods”.

The venture became a success, so much so, that in 1995 Rajeev sold their ice-cream business to Hindustan Unilever.

The Plunge

With the money received from selling the ice cream business, Rajiv started investing in the market in 1996-97 for the first time. He was 67. Almost for a decade he struggled in the market without much success before the tides turned in favour.

Multi-baggers

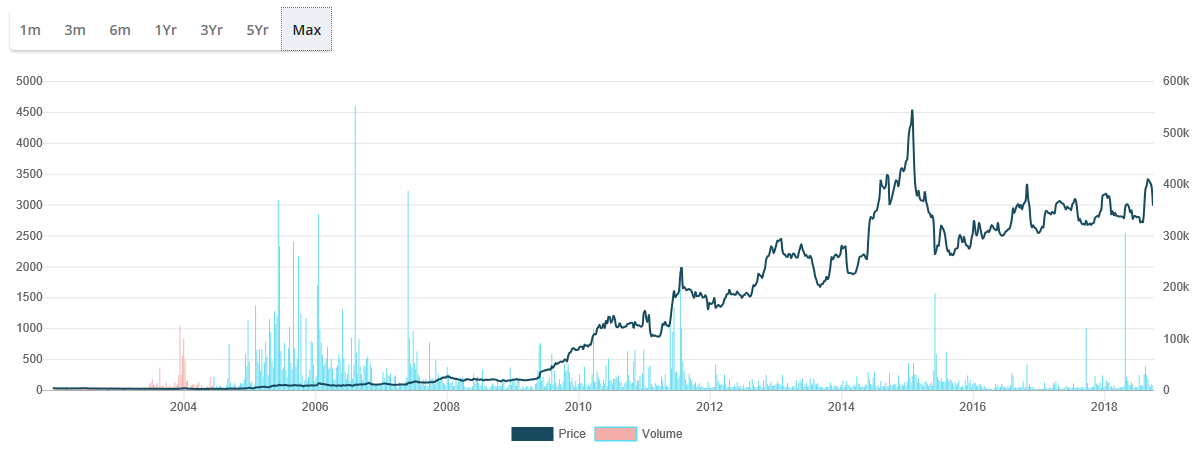

Hawkins Cookers was his first multi-bagger. Khanna started accumulating the stock in 2007 and went on accumulating it till June 2009. The stock went upto 4500+ by 2015.

Then, there was nothing stopping Khanna. He went on to identify small-cap winners such as Wimplast (more than 7 times in two years), Cera Sanitaryware (more than 7 times in two years ), RS Software (4 times in less than two years), and Avanti Feeds (more than 4 times in less than 6 months).

Khanna has held most of the stocks in his portfolio for a long time now but he has also played the momentum game. For instance, he had purchased 1% stake in Amara Raja Batteries worth Rs 13 crore in the June quarter of 2012 and sold the entire stake in less than six months for Rs 39 crore, making three times the profit. “I am just somebody who got lucky. People just see the profits we make, nobody knows the kind of hits we have taken.”

Dolly Khanna’s portfolio (companies in which she holds more than 1%) grew from Rs 1 crore in 2007 to Rs 175 crore by end of 2014.

Investment Philosophy

Unlike any other big ticket investors who talks to various management explicitly before parking their money, Rajiv Khanna looks for information available in public domain like a retail investor. He claims he does not talk to company managements before buying a stock. “We purely rely on the public information and act on it.”

When asked about the investment strategy, Khanna said, “It all depends on the underlying market condition. Like in tennis you play different games on different courts — hard court, clay court and lawn, we also study the market situation and pick our stocks accordingly. It can be either a value stock, growth stock, momentum stock or buying based on technical.” He feels market is the most complex puzzle, “It’s not the money, it’s the challenge what is exciting. Money is just the outcome. And once you start to understand the game, making money is not difficult,” he said.

If you understand and absorb completely above investing philosophy, you don’t need any other learning about stock investing from anyone else ever.

Credits ET

For Chennai-based Khanna, stock investing is more of a hobby than a profession. “It started as a hobby and remains a hobby. My core business is of milk products,” the low-profile investor had sais to ET over a telephonic talk which took weeks of persuasion.

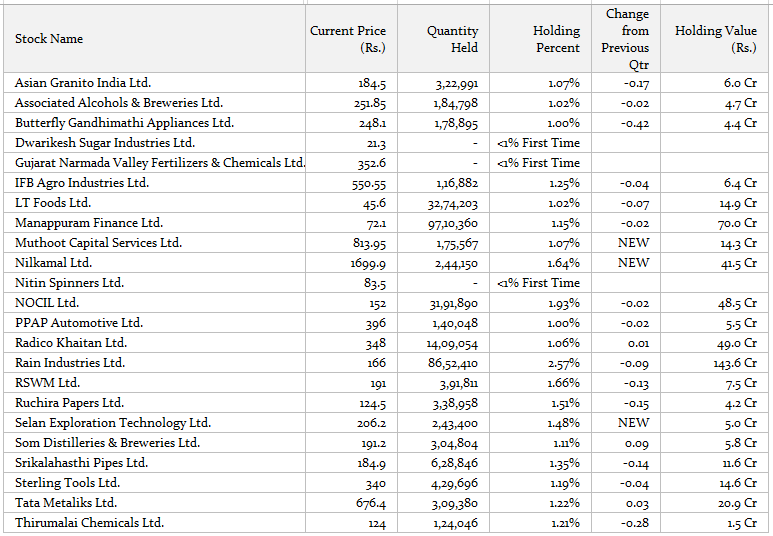

Dolly Khanna portfolio

Porinju Veliyath

He is law graduate who found his love in equities back in the year 1990. The latest book he read in full was Civil Procedure Code & Law of Limitation, 27 years ago. His investment style is anything but conventional. And Yet Kochi based investor Porinju Veliyath is stinkingly successful at what he does, so much so that he has been called a small-cap czar by The Economic Times.

Early Life

At the age of 16, it dawned on Veliyath that his family did not have enough money to fund his higher education. The home they were staying in till then had to be sold to repay the debts. Soon, Veliyath shifted to Ernakulam, Kerala’s biggest city, to hunt for a job to support his family and also fund his education.

He started as an accountant in a private firm at Rs 1,000 per month and then at Ernakulam Telephone Exchange as a phone operator drawing Rs 2,500. He was homeless when he started working

To save on rentals, Veliyath enrolled for the law programme at Ernakulam Law College, which offered cheap accommodation and canteen to its students. The next five years were spent studying law and routing trunk calls for the Kochi elite. After graduating in 1990, and not immediately finding any gainful employment back home, he boarded the steam engine-drawn Jayanthi Janata, a popular train for Keralites till mid-90s, for Mumbai with dreams of getting rich. Upon reaching the city, an acquaintance of Veliyath found him a job with Kotak Securities, initially as an office clerk and later as a floor trader.

Preparation

With no significant capital to start investing at beginning of his equity career, it was not a ‘purchase’ but a ‘sell’ that turned out to be a gold mine for him.

At the peak of 1992, he short-sold SBI Magnum at Rs 165 while its NAV was 32.

The stock peaked out at 180, following day (23 April 1992) and fell sharply. He covered at near zero levels adjusted to the ‘badla’ gains in few months. In a bi-weekly settlement system, you could short-sell any stock and carry forward with the corresponding buyer with ‘white kapli’. This trade helped him own a 475 sq ft apartment in Mumbai suburb.

In 1994 Prinju joined Parag Parikh Securities where he worked as research analyst and fund manager until 1999.

Veliyath stayed in Mumbai only for nine years. But, by then, he had learnt the ropes of the trade — mainly badla — from the best in market those days. The biggest lesson that Veliyath had learnt in his stint in Mumbai was that one only needs “common sense” to make money in stocks

Plunge

In 1999, Veliyath moved back to Kerala because he was unhappy with the quality of life in Mumbai. Soon after shifting base to Kochi, he made his first investment, mopping up as much as 8% stake in Geojit Financial Services. Geojit was trading in single-digits those days and the whole firm was valued at around Rs 2.5 crore then.

The stock touched a high of Rs 280.65 in September 2006, helping him make big money in the investment. BNP Paribas acquired 34.5% stake in Geojit in 2007.

Armed with the newly acquired wealth, Veliyath bought back the land his family sold decades ago to repay debt and built a luxurious farmhouse on it. Veliyath claimed to ET that his investment portfolio has generated 33% compounded gains every year since 2003.

Investment philosophy

In 2002 he founded Equity Intelligence, a fund management firm focused on Value Investing in Indian Equites. Veliyath’s investment philosophy is far from conventional. He does not base his strategy on financial ratios or business cycles; on the contrary, it defies various established investment parameters. Many stocks in his portfolio are illiquid, while some of them do not make sense to orthodox stock pickers. He also doesn’t mind corporate governance issues as long as future prospects of the company is good. In his words: “I don’t buy a lot of great companies with clean balance sheet, honest management and clear business visibility. If you invest in such companies, even bank FDs would beat your portfolio returns.”

Multi-baggers

Few stocks which gave multi-bagger returns include names like Wockhardt (120), Orient Paper (6) Piramal Enterprises (340), Shreyas Shipping (20), Balaji Amines (100), Force Motors (400), Biocon (150) and Jubilant Life (300) are few past wealth creators under his PMS.

He manages his own portfolio and the portfolios of investors in his fund management firm Equity Intelligence India Private Limited. He has been called a small-cap czar by The Economic Times.

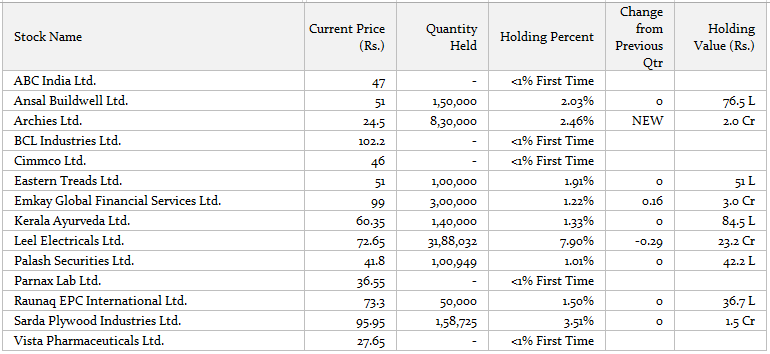

Porinju Veliyath portfolio

Conclusion

In this post we discussed the investment journeys of 3 top investors in India. We reviewed their investment philosophies and revealed their latest portfolios.

If you wish stay updated with the latest portfolio holdings of the top investors in India, enter your email-id below.

[wysija_form id=”6″]

If you enjoyed reading the article share it with a friend or colleague.

Credits

- Economic Times

- Moneycontrol

- Wikipeadia

- Trendlyne

good article.continue your service