Anil Goel portfolio has generally been a contrast to popular themes – same can be said about his life. In late 1960s, when his friends were in college, swaying to the tunes of Beatles and wearing scarves like Dev Anand, Goel was toiling hard in humid Chennai (then Madras), helping his grandfather run the family’s flourishing steel trading business.

Early Life

Originally from Amritsar, Goel shifted to Chennai in the mid-60s at the behest of his grandfather, who wanted a family member to take care of his business. His father was opposed to this idea, and wanted him to study further, but ultimately gave-in.

At 13, Goel stuck his first deal when he sold “slow moving” steel angles to grape farmers from Hyderabad at a decent profit. In 1974-75 steel prices fell from Rs 6000 to 1200 a tonne in a matter of six months. Anil bought more stocks at lower prices and averaged out.

However, Goel was oblivious to the happenings in the stock market. The great Silver crash of 1980s, the Hong Kong market crash of 1987 and the Rio exchange crash of 1989 made no impact on his life.

The beginning of 1990s witnessed euphoria in stock markets driven by the Harshad Mehta bull-run. Being a steel trader, Goel was sceptical about the steep and continuous rise in stock prices.

His premise was proven right when in May 1992, dropping from 4400 levels in March 1992 to 1800 levels in April 1993.

The Plunge

In May 1993, when the index was still at 1850, Goel invested 5 crores – his first big stake in stocks. A rally started in mid-1993, driven by FIIs who started investing in Indian companies. By January 1994 Goel Goel’s investment was quadrupled to 20 crores.

But the FII enthusiasm was short-lived. The FII interest lead my companies to issue DRs at elevated prices resulting in a cash glut. In absence of specific capex plans, comapnies made bad treasury investments. When FIIs understood this, they dumped the shares mercilessly.

Goel decided to buy on the decline, which turned out to be a mistake. For example, Arvind Mills issued GDRs at 360 and Goel bought after 50% decline at 180. In a few months, Arvind was trading at Rs 7. Goel lost all the money made till then. But instead of quitting stocks, Goel left the steel business, sold 6 acres land to get out of the mess and devoted fulltime in equities.

Goel re-entered the market in 1998 with a portfolio that included EID Parry, Carborundum Universal, SAIL, Tata Steel and Tube Investments. Prices trebled and quadrupled by 2000. He stayed out of IT as he did not understand the business. That saved from the dot com crash.

According to Goel the period between 2001 and 2007 offered the best window for investors to make money in stocks. He believes in an 8 year cycle, when market throws an euphoric bull phase.

Goel believes in doing his own analysis and does not believe everything that management claims. He remains invested in stocks till it delivers returns of atleast 3-4 times. He also likes to invest in dividend paying companies.

Based on: Super Star Investors, by Turtle Wealth Management

www.turtlewealth.in

Anil Goel Portfolio

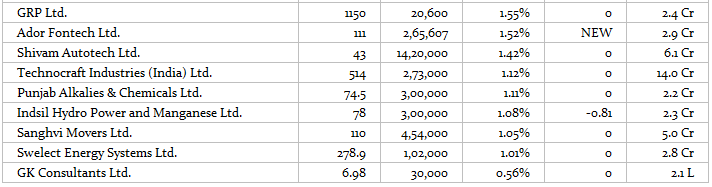

Anil Kumar Goel’s portfolio as on 30th June 2018 is supposed to be as follows:

Source: trendlyne.com