Reader query: Answered on 11th July, 2018

Jamna auto and Motherson Sumi are both auto ancillary players, but the similarity probably ends there 🙂

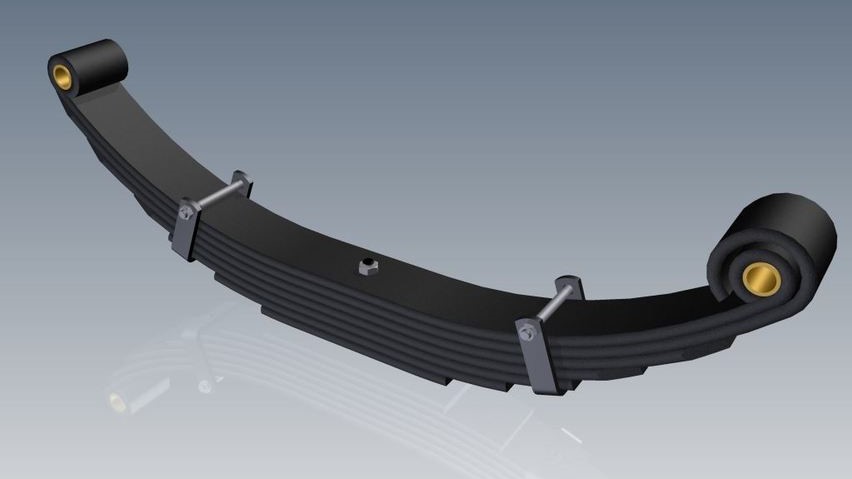

Jamna Auto manufactures Leaf springs for CVs primarily, where it has 72% domestic market share in OEM segment, and is the 2nd largest player worldwide. Company is also diversified into parabolic springs (90% domestic share) & suspensions.

Challenge with such dominant market share is that, its increasingly going to be difficult to beat the industry growth rates. Since the primary market has limited headroom, company has to find newer markets. One such space is after market segment, where company has around 15% share and there is room to grow, but this space has lots of players and competition is fierce.

So, if industry grows at 15%, company might grow at 20% top-line & 25% bottom-line. These are very good growth numbers which the company is quite likely to achieve… Problem is, stock is trading at around 28x TTM earnings which is greater than optimistic PEG> 1 and hence not cheap. On the downside, surge in commodity prices, failure with monsoon can act as potential spoilers.

While Jamna auto is a relatively small & focussed player, Motherson Sumi is significantly bigger (around 50x in terms of revenue), diversified and multinational. MSL has around 230 plants in about 30+ countries. India revenue contribute to only around 15% of its consolidated top-line, BUT 50% of bottom-line. Company has ambitious plans of increasing top-line from around 8Billion USD currently to 20 B USD by 2020 and ROCE from around 26 to 40. This is expected to happen mostly through inorganic growth and company seems to be in advanced stage of finalizing potential acquisition targets. My personal view though is, even if the 20B USD top-line target is achieved, company is unlikely to achieve is 2nd target of 40x ROCE. Historically MSL failed to meet its ROCE targets in 2010 and 2015.

Source: Axis Capital, MSL

In terms of valuations, MSL is also quoting at around 28x PER, similar to Jamna Auto, even after the significant correction, which appears to be > 1 PEG, based on optimistic growth estimates

If I have to limit my pick between these 2, I would probably be more tilted towards Jamna Auto, as the business is more focussed and predictable, than Motherson Sumi, which despite being a very good company, has a more complex business. MSL’s global nature, inorganic growth model, combined with significantly larger size makes it even more challenging to achieve high growth rates that the market expects, despite company’s excellent track record.

Both these companies are currently being recommended by multiple brokerage houses. The auto ancillary space has shown lot of resilience during the recent mid-small cap carnage and hence in the radar of analysts. At ViniyogIndia.com no fresh buys have been initiated in the auto ancillary space recently, as I believe that the recent carnage has created value in other areas of the market where combination of strong growth and attractive valuation are available.

Hope this answers.

Disclosure: Views expressed are personal and can be wrong. I may have vested interests, please do your own research. Also, above perspective does not constitute financial advice.