You have surplus cash and want to know where to invest money in India for best returns.

Assume you and your spouse are both 30 years old, desiring to retire at 65, both investing 50k each month towards retirement. You being a conservative investor, put entire savings on FDs at 7.5% effective return after tax, while your spouse invests entirely in equities, which lets say gives 15% on average after tax.

What difference do you think it makes to your wealth?

When you retire at 65, at today’s value of money you will end up with a corpus of around 1.8 crores, while your spouse will have around 13 crores , 7.3x more*.

That would mean, after retirement you will be restricted to spend upto 66K pm max at today’s value, while your spouse will have the luxury to spend upto 4.8L pm, assuming 85 years life expectancy

Despite the fact that both earned exactly same amount of money, your spouse will have a very comfortable retirement due to judicious investing, while you will be left sucking your thumb.

And yet, More 95% of Indian households prefer to park money in bank deposits against less than 10% opting for stocks & Mutual Funds, a recent SEBI survey has revealed

Investors in India have been playing a suckers game for way too long.

(*nominal values ate 10 crs and 73 crs respectively)

But above example was a hypothetical situation

True, it was. Let’s look at some objective data then.

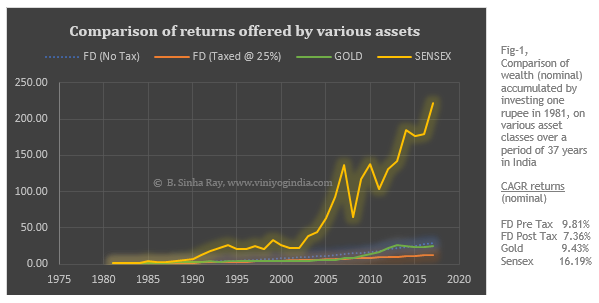

Below we present historical returns offered by various asset classes in India, over a 37 year period, starting 1981 through 2017.

Historical return of Stocks, FD & Gold in India

Fig-1, represents wealth accumulated by a hypothetical investor residing in India who put one Rupee each on FD, Gold and Stocks in 1981. As on 2017, nominal value of that one rupee investment before adjusting for inflation would be as follows:

FD post-tax 12.89 (Pre Tax Rs 29.06), Gold Rs 25.6 and Stocks Rs 221.72

Fig-1, Comparison of wealth (nominal) accumulated by investing one rupee in 1981, on various asset classes over a period of 37 years in India

CAGR returns (nominal)

• FD Pre Tax 9.81%

• FD Post Tax 7.36%

• Gold 9.43%

• Sensex 16.19%

Our hypothetical example wasn’t too off the mark after all in its assumptions. If anything, investing in equities would have been more rewarding than we had assumed had we gone with this data.

But I know so many who failed in stocks

Actually you are absolutely right.

Long term wealth creation in equities has never been easy. You will be surprised to note the following statistics for the US markets:

- Number of Equity Mutual Funds that failed to beat the market over 10 year period is 74% or more(1)

- Average Equity Fund investors performed worse, returning of 3% annual gains against 13% for the markets over 20 years’ period ending 2004(2)

- 80% of the stock market newsletter publishers fail to beat the market returns over long periods of time(3)

- More than 80% of day traders lose money in a typical 6 month period, with only 1% succeeding in making predictable profits net of fees(4)

- In 2007, Buffett famously placed a million dollar bet, challenging Hedge Fund industry to put together a portfolio that would outperform S&P500 index fund over 10 years. He won by a wide margin. By the end of the bet, $1 million invested in the funds chosen by Seides, who accepted the bet, would have gained $220,000 against $854,000 for the low cost S&P500 index fund.(5)

Most investors fail to create wealth through equities and even significantly underperform index returns. Common causes are impatience, inability to stomach volatility, moving in and out of the market at precisely the wrong moments, relying on poor tips, etc.

Where to invest money in India then?

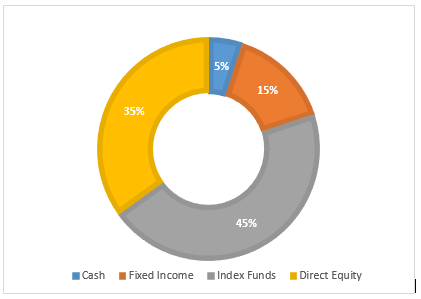

Well, first of all – have an asset allocation plan. This is different for every investor and it depends on factors such as investment time horizon and risk appetite.

Usually your risk profile is assessed by taking you through a short behavioural quiz. Based on your response to the questions asked, your financial advisor can advise you on the asset allocation plan.

For example, below is a representative asset allocation plan for a moderately aggressive investor.

Once you have the asset allocation plan in place, the next step is deciding how to invest in each of these assets.

How to invest in stocks?

The simplest way is to invest passively in ETFs. It is low cost and guarantees index returns.

This is particularly true if you have a very big corpus running into tens of thousands of crores. For most small investors though, beating the index can be easy using simple tweaks. Take the following strategy for example.

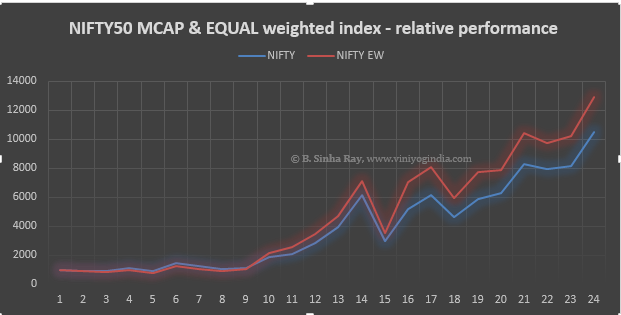

Equally Weighted Index (EWI)

We make a simple adjustment to the index constitution. Instead of weighing the constituents by market cap, we weigh them equally, i.e. instead of buying more of what is going up and selling declining stocks, we hold equal quantities of each stock by value. Using NIFTY-50 as the base index, starting 03-Nov-1995 till date, for past 24 years the results are as follows.

After initial few years of neck-to-neck performance, the market cap weighted index never really manages catch-up with the equal weighted index.

Value Investing

The essence of value investing is quite simple and intuitive – buy stock at a price significantly less than its actual worth, wait for it to rise to its intrinsic value when you sell for a profit.

Measuring absolute value of a business though can be a challenge which is why contemporary fund managers tend to rely on relative valuation approach.

Study performed by David Dreman and Eric Lufkin on 1500 stocks over a period of 27 years show, relatively undervalued stocks beats the market comfortably, with lower draw-downs.

According to the study, 10K dollars invested in the bottom 20% stocks generated 708K for low P/E stocks, 572k for low P/CF, 685K for low P/V and 415K for high Dividend Yield stocks. This is compared to 289K generated by the market.

Actively managing a reasonable size portfolio of stocks is a full-time profession. If you are into a full-time job, you should seek help from a professional Stock Advisory or PMS Service.

Reasonable advisor or PMS should be able to beat market over long term by a comfortable margin.

Other Active Management Strategies

Many other active management strategies are popular, such as growth, momentum, special situations, etc. In most cases, you Fund Manager will use a combination of multiple strategies to maximise returns and reduce draw-downs.

Attempting to do all these on your own while on a full-time job can be overwhelming. If you are a market enthusiast, and can’t keep your hands-off, then try to understand your advisors strategies are ensure they are making sense, but leave the stock-picking and the rest to him.

Conclusion

Equities have proven to be by far the most attractive asset class in India over past 37 years. Yet, only 10% of people invest in equities, against 90% investing in bank deposits.

If you wish to create wealth and enjoy a comfortable retirement, then you must allocate a portion of your funds in equities.

How much you should invest in equities should be decided by the Asset Allocation Plan derived from your risk profile.

You must take a disciplined approach towards equity investing. Most investors fail in stock markets due to its absence.

Passive investing through index funds make particular sense if you have huge portfolio. For smaller investors though, it might be easy to beat the market using simple strategies.

If you wish to go with actively-managed portfolio but have a full-time job, take help of an advisor or PMS.

Wish you success!