Incorporated in 1993, Som Distilleries Ltd (SDBL) is involved in brewing, fermentation, bottling, canning and blending of beer and IMFL. It is the flagship company of the Som Group, based in Bhopal, Madhya Pradesh. The company’s shares are listed on BSE and NSE.

SDBL has manufacturing facilities located in Bhopal, MP; Hassan, Karnataka & Odisha. On a consolidated basis, the Som Group (SDBL, WDBL and SDOPL) has the capacity to manufacture 15.1 million cases of beer and 3.5 million cases of IMFL per annum.

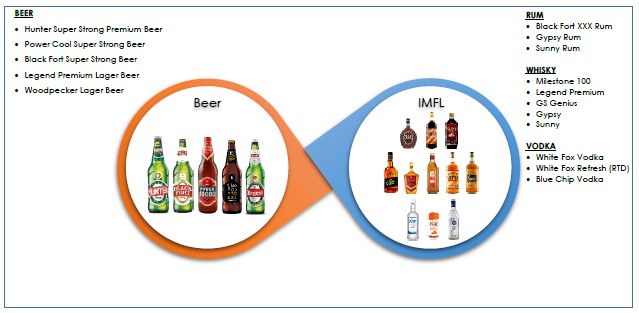

Business Overview

SDBL primary business is manufacturing beer from malt. It also produces Indian Made Foreign Liquor (IMFL). Complete product portfolio is listed below.

Products

Existing Capacity & Expansion Plans

SDBL has 3 plants located in Bhopal, Karnataka and Odisha, with a total capacity of 15.2m cases of beer + 3.3m cases of IMFL.

The Bhopal facility has a manufacturing capacity of 7.6 million cases of beer and 0.6 million cases of IMFL per year as of March 2018.

In FY2018, the Company completed the Greenfield expansion to set-up a fully owned subsidiary, Woodpecker Distilleries and Breweries private limited at Hassan, Karnataka. This facility was commissioned in April 2018 and has a manufacturing capacity of 3.4 million cases of beer and 2.7 million cases of IMFL.

The commercial production from the Hassan unit commenced in June 2018. The total project cost of Rs. 122 crore was funded by internal accruals of Rs 78 crore, term loans of Rs. 25 crore and interest-free unsecured loans from promoters amounting to Rs. 19 crore.

In July 2018, the SOM acquired a beer manufacturing unit in Odisha to cater to the markets of Odisha and West Bengal for a purchase consideration of Rs. 46 crore. The acquired company, now known as Som Distilleries Odisha Private Limited (SDOPL), has a manufacturing capacity of 4.2 million cases per annum of beer and is likely to commence commercial production in Q4 FY2019.

SDBL plans to invest additional Rs. 25-30 crores in the Odisha plant for its modernisation and upgradation. The plant would be operational by Q4 FY2019 and contribute meaningfully from FY2020.

Company has raised Rs. 100-crore fresh equity (preferential allotment) capital through private placement under the FDI route from Hong Kong-based investors, Karst Peak Asia Master Fund and Vermillion Peak Master Fund, which is being used primarily for the acquisition and upgrade of the Odisha unit.

The Company has signed an MOU with White Owl Brewery, India’s foremost craft beer company for the manufacture of all their speciality beers.

In October 2017, SOM’s beer brands were approved by FDA for supply to the United States of America. The first trial order has already been dispatched.

Summary of installed capacites

1. Bhopal, MP – 7.6m beer + 0.6m IMFL

2. Hassan, Karnataka – 3.4m beer + 2.7m IMFL

3. Odisha – 4.2m beer

Total capacity – 15.2m beer + 3.3m IMFL. Numbers represent cases of alochobev.

Sales & distribution

The Company has a strong sales and distribution network of distributors across India in states such as Andhra Pradesh, Chhattisgarh, Jharkhand, Madhya Pradesh, Maharashtra, Orissa, Karnataka, Kerala and West Bengal. The Company’s distribution network is also strong in union territories such as Chandigarh, Delhi and Pondicherry

Industry Overview

In terms of volume, India is the 3rd largest consumer of alcoholic beverages (alcobev) with states such as Andhra Pradesh, Tamil Nadu, Karnataka and Kerala accounting for over 50% of the total IMFL and beer consumption. The Indian alcoholic beverages market is broadly segmented as Spirits (IMFL and country liquor), beer and wine. IMFL market has been further bifurcated into whisky, rum, brandy, vodka and gin. The beer market is broadly classified based on the alcohol content into strong (6-8%) and lager (4-6%). Despite IMFL having larger market share in value terms, beer has greater share in volume terms and is also the preferred drink among the youngsters. This creates enormous opportunity for the beer manufacturers in the near to medium term as India’s demographic profile is skewed towards younger population.

Beer Industry in India

Indian beer industry is primarily dominated by strong beer which accounts for over 85% of the total beer volumes sold in India. The beer consumption in the country is inclined towards the southern states which accounts for more than half of the volumes consumed in India.

In volume terms, Indian accounted for a consumption of 3,133 million litres or 402 million cases (9 bottles of 650 ml each) in CY2017, indicating a growth of 4.8% over same period last year. Beer volume is expected to grow at a CY2017-22 CAGR of 4.1% to reach 3,823 million litres or 490 million cases in CY2022. In value terms, beer industry stood at Rs. 562 billion in CY2017, indicating an increase of 7.0% compared to CY2016. Beer volume is projected to grow at CY2017-22 CAGR of 7.4% to reach Rs. 803 billion in CY2022. Higher growth rate of value compared to the volume growth is an indicator of shifting preference towards premium products.

(Source: Euromonitor International)

IMFL Industry in India

IMFL comprises of brown spirits which includes whiskey, brandy and rum and white spirits comprising of gin and vodka. Indian IMFL segment is dominated by brown spirits which accounted for 96% and 94% of the market share in volume and value terms, respectively in CY2017.In IMFL, whisky was the major contributor with 61% of the volumes followed by brandy and rum with 21% and 14% of the total volume, respectively. White spirits accounted for 4% of the total volume. In value terms, whisky accounted for 73% followed by brandy and rum with 11% and 10% of the total volumes, respectively. White spirits accounted for 6% of the total value consumption in CY2017. The increasing preference towards premiumization is evident from higher contribution by whisky and vodka in value terms compared to volume consumption. (Source: Euromonitor International)

IMFL volume stood at 2,688 million litres or 299 million cases in CY2017, a growth of 2.3% compared to the same period last year. The IMFL volume is projected to grow at a CY2017-22 CAGR of 2.6% to reach 3,051 million litres or 339 million cases. In CY2017 IMFL sales increased by 5.8% compared to the previous year to Rs. 2,186 billion. In value terms, IMFL industry is expected to grow at CY2017-22 CAGR of 6.0% to reach Rs. 2,920 billion. (Source: Euromonitor International)

Growth rates & drivers

Disposable Income: The middle-class population in India has evolved with higher disposable income which coupled with a younger demographic profile is playing a critical role in driving consumer demand. In addition, the growing purchasing power and rising influence of the social media have enabled Indian consumers shift their demand pattern towards more premium and lifestyle products. Various government initiatives undertaken over last few years such as direct benefit transfer and various agricultural reforms is also anticipated to increase purchasing power of rural India and drive consumption further. The Indian middle class is moving to an upper income group with changing lifestyles, luxury preferences and ability to pay more for premium products.

Young Population: India’s demographic mix is skewed towards younger generation and with inclusion of over 19 million people to the legal age for drinking every year, it provides a significant opportunity for the alcobev sector in India. Only one in eight women consume beer, compared to one in two in more mature markets.

Social Acceptance: Improvement in standard of living coupled with rising awareness has resulted in increased social acceptance of alcohol consumption. Drinking has now become part of social meetings and entertainment. Furthermore, a shift towards pubs and discotheques has also resulted in higher liquor consumption. Consumption of alcoholic drinks has also increased among women which is an encouraging sign for the industry.

Family Structure: Indian families are shifting towards more nuclear structure as compared to traditional joint family structure. As a result, the decision makers in houses are younger generation who are more inclined towards affluent lifestyle.

Alcohol Availability: Focus on premiumization coupled with entrance of international players in India has resulted in availability of a wide variety of choices for aspirational Indian population. Wider choice will enable to cater to a broader target audience resulting in increased demand for the industry.

Market share of the company

Bhopal unit has production capacity of 7.6m cases of beer + 0.6m cases of IMFL. Against 2017 consumption of 402m cases, market share is roughly 1.9%. IMFL share is 0.2%.

With the recent acquisitions made in Karanataka & Odisha, SDBL has potential to increase market share upto approx.. 3.1% in beer and 1% in IMFL. Estimates assume full capacity utilization by FY22 and consumption projections by Eurominitor above.

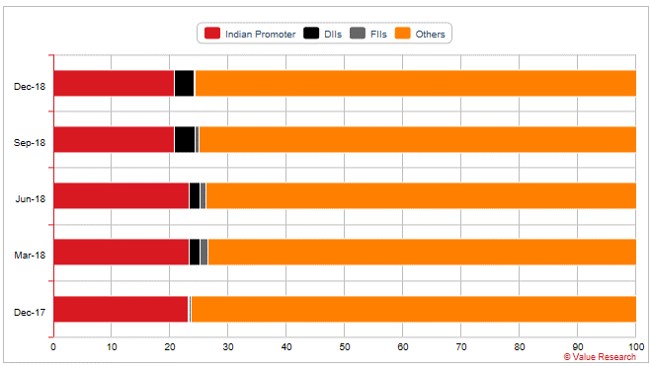

Shareholding

Promoter holding & recent changes

As of December 2018, promoters hold 20.77% of the company.

Promoters’ stake declined in Sep’18 quarter due to equity raise through preferential issue; subsequently promoters have been raising stake through market purchase and conversion.

Dec 17- 23.17%, Mar 18 – 23.23%, Jun 18 – 23.3%, Sep 18 – 20.67%

Graphic source: valueresearchonline.com

Since January 2019, promoters & directors have acquired 13,30,506 shares (4.3% stake) worth 35.61 crores.

- Nakul Kam Sethi, Director has acquired 1000 shares for 1,26,293 rupees, at Rs 126.3 per share through market purchase.

- Jagdish Kumar Arora, Director has acquired 41,600 shares at 61.8 lakhs, at 148.7 per share through market purchase

- Promoter group has acquired 12,88,906 shares for 35 crores at average price of 271.5 per share, through conversion.

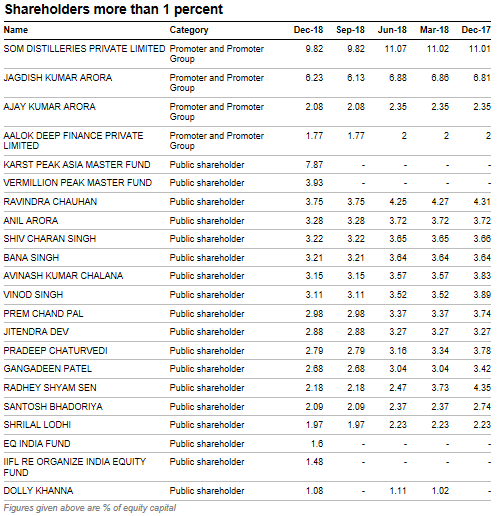

More than 1% shareholders

Unusually high # of public shareholders holding > 1% stake

Warrants/ Preference issues

In July 2018, SOM successfully completed a preferential allotment of Rs. 1,00 crores.

The key shareholders who participated in the fund raise were Karst Peak Asia Master Fund (Shares: 2.5 million, Value: Rs. 667 million) and Vermilion Peak Master Fund (Shares: 1.2 million, Value: Rs. 333 million).The shares of the company were allotted at a price of Rs.271.55.

The promoters of the company also have subscribed to 12, 88,906 warrants amounting to 12, 88,906 shares at a price of Rs.271.55. The company has received 25% of the total amount due from the promoters

Management Analysis

Directors

- J. K. Arora – MD & Chairman

- S. Lal – Director

- Rajesh Dubey – CFO

- Mayank Bhadauria – CS

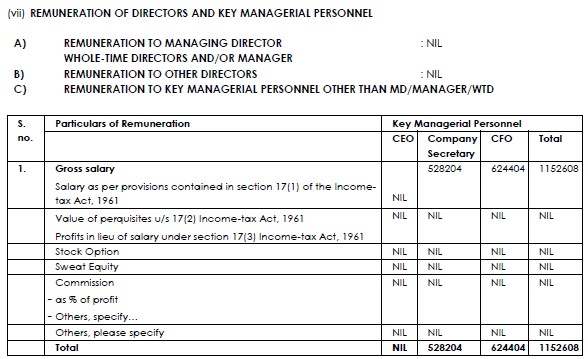

Managerial Remuneration

MD, Directors, do not draw any salary. CFO, CS have very modest salaries.

Related Party Transactions

Litigations

- 2017. Carlsberg accused SDBL of IP infringement, for using “Clockman shaped label” used in “Tuborg” brand. SDBL was accused of using the same in its popular “Hunter” brand

- 2012. Deputy MD of SDBL arrested and then released by CBI in fake bank draft scam.

- 2008. Excise raid. MD & Director accused of (not paying excise duty and) fraud by affixing forged holograms causing revenue loss to the government.

Scuttlebut

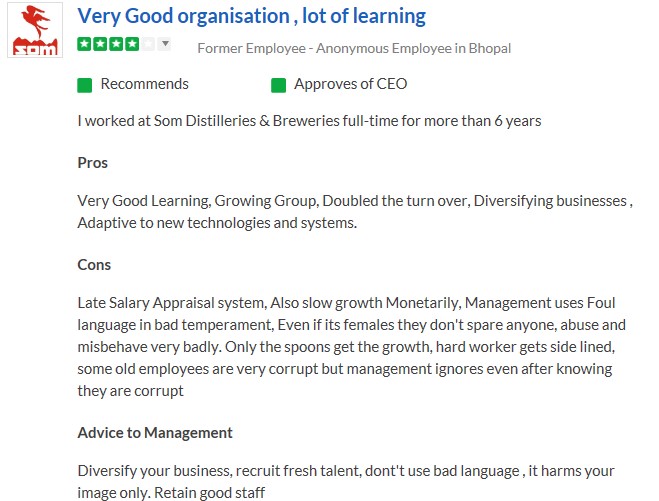

Employee Feedback

Despite the 4* rating and a positive headline, the detailed feedback contains lot of negatives, including allegations of unprofessionalism and corruption at management level.

Interviews

Some interviews of the MD!

- Feb, 2019 – Speaking on impact of excise duty hike on beers in Karnataka

- Jan, 2019 – Speaking on restrictions imposed by Rajastan government on illegal transportation of liquor

Financials

10Y historical financials

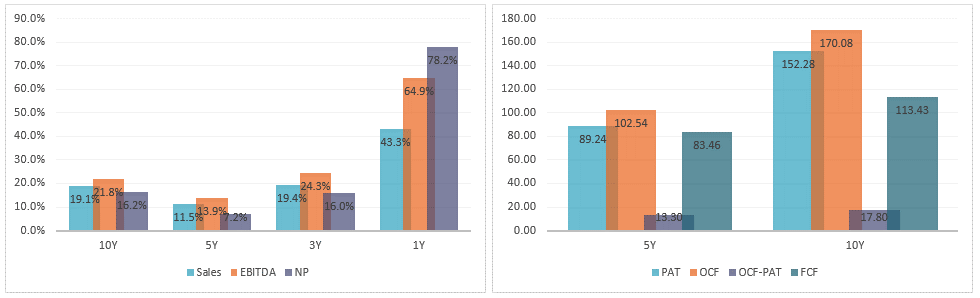

Growth rates

Sales has grown at the rate of 11.5 – 20%+ over past 10 years. EBITDA growth has been faster. However, PAT has grown more slowly than expected (why?)

Cash Flow

Free cash flow is positive for both past 5 as well as 10 years. Both past 5Y and 10Y OCF is higher than PAT

Profitability

OPM is steady and gradually improved from 13.5% to 16.7%

Significant spike in OPM (16.7%/14.5%) was due to lower cost of materials. NPM (7.2%/5.8%) received another kick from lower finance costs

Leverage & Liquidity, debt outlook

Leverage is 29%.

While company has around 46 crores debt, cash on book is 24 crores. Not sure why company hasn’t retired debts.

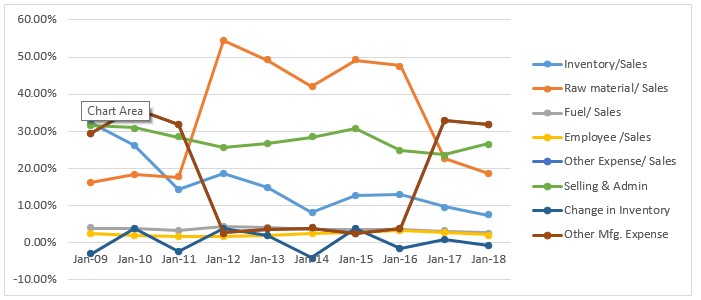

Cost analysis

Cost components have been fluctuating. Between FY12 and FY16, appears cost grouping may have been changed and then reversed?

Tax rates & benefits if any

Tax rates for alcohol industry are on the higher side, SDBL has 5Y average tax rate of 36% and last 2 years rate of over 40%

Applicable tax rate is 34.6%.

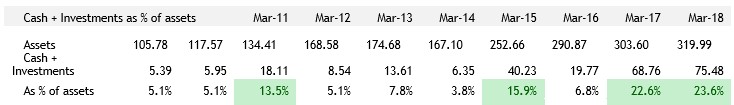

Cash + Investments

Company seems to have 25 crores in liquid cash, which is around 8% of company’s assets. Mistry why company hasn’t reduced debt?

Cash + Investments as a percentage of Total Assets is quite significant.

Auditors comments

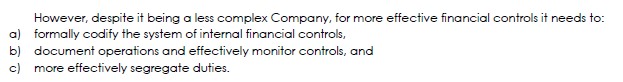

Below comment from independent auditor points to the lack of formalisation of controls, need for better documentation, SoD and generally more professionalism at operational level.

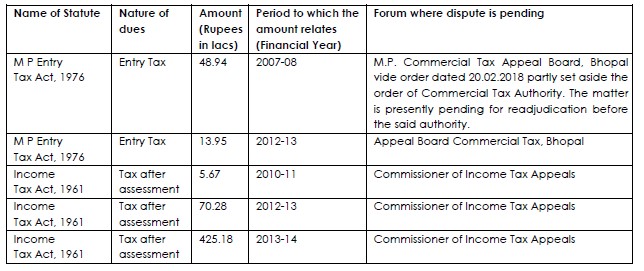

Disputes

5.15 crores outstanding due to various disputes.

SDBL has a history of tax related litigations. Fortunately, FY15 onwards there are no new/outstanding cases.

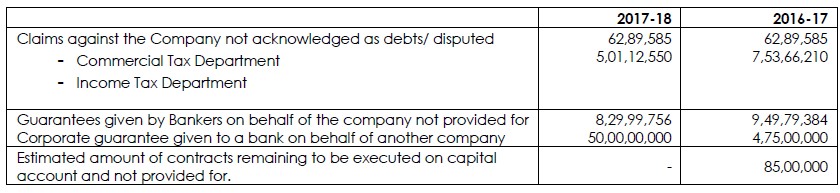

Contingent Liabilities

Total contingent liabilities are around 64 crores, which is 250%+ of FY18 PAT and 7.15% of Sales. In addition to disputes detailed above, this includes 58 crores in guarantees to banks.

This bank guarantees have been in the balance sheet for a while. Unfortunately the receiving company is referred merely as “another company” and no further details are provided. Guaranteed amount is around 2.5x last year PAT, therefore, significant.

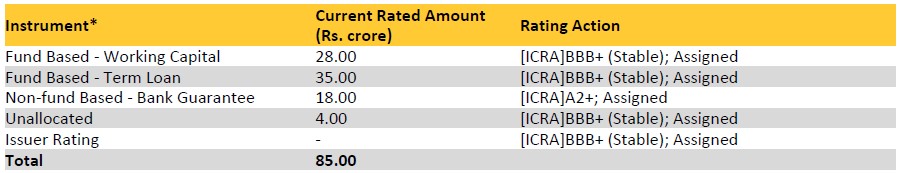

Credit rating

WC & Term Loans, both are BBB+ (stable)

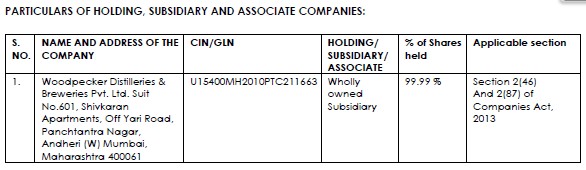

Corporate structure

Subsidiaries, Associates & JVs

Contribution of subsidiaries, JVs & associates to consolidated financials

No significant contributions in the past in FY18. Woodpecker started commercial production from June 2018, so contributions are not reflected in the past results.

Valuation, earnings estimates

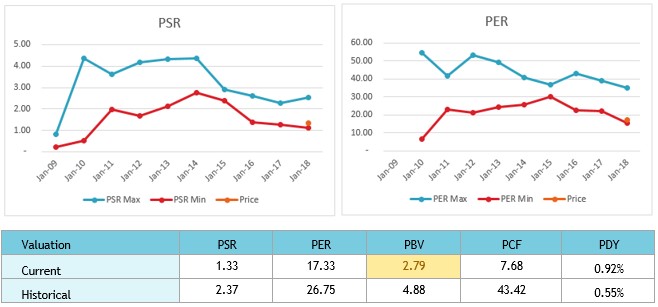

Relative valuations

SDBL is currently trading below historical valuations. Although, on absolute basis, stock isn’t very cheap.

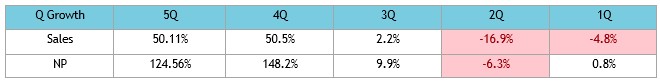

Trend Forecasts

Over the past 3 quarters, SDBL has shown flattish to negative top-line growth.

Competitors like Associated Alcohols have seen more steady performance during the same period.

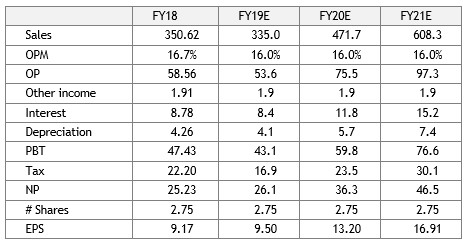

Just a theoretical back of the envelop exercise below, to gauge the possibilities. Assumed KN capacity to start contributing from FY20 and achieve full utilization in 3-4 years. Only the sales growth has been factored. Other parameters such as depreciation, finance cost, etc. hasn’t been fine-tuned.

Assumed that IMFL case will be 5.2x more expensive than beer.

Risk Analysis

High Capital Expenditure

High capital expenditure in FY2018 and FY2019 might impact returns during initial phase of operations – SDBL has incurred high capital expenditure during FY2018 and FY2019, which might impact its profitability and return indicators during initial phase of operation. It has incurred ~Rs. 122 crore in establishing WDBL and ~Rs. 75 crore for SDOPL. This apart, SDBL has proposed capital expenditure at the existing Bhopal manufacturing unit to increase its capacity. If the projected sales turnover is not achieved by the company, the profit margins and return indicators might decline in FY2019.

Limited geographical diversification

The company generates most of its revenues from Madhya Pradesh, Chhattisgarh and Delhi in the past. It is exposed to risk of any adverse policy changes in the state. However, the Group has diversified its business in the other states such as Karnataka and Odisha to expand its geographical presence expected to reduce the dependence on few markets.

Highly regulated alcohol industry

The liquor industry is highly regulated with the state government controlling the selling and distribution, which make the company susceptible to the changes in the government’s policies. Any change in government policies with respect to production, distribution of liquor, taxation, and state excise duty or any material changes in the duty structure may impact the liquor industry and the company.

Challenges

Restriction on direct promotion

Direct advertising of alcoholic products is restricted in India. As a result, the companies have to restrict promotion activity to point of sale or surrogate advertising (like glasses, mineral water, music items having identical brand names). This not only increases the cost but also adversely impacts the capability and time for new brand building.

Stringent Regulations

In India, every state has its set of regulations which govern the value chain of industry players including manufacturing, retailing, pricing and levies thereby, hindering the economies of scale. Furthermore, regulations pertaining to licensing, setting up or expansion of new facilities, existing brewing or distilling and bottling capacities, manufacturing processes, marketing, sales & advertising and distribution poses additional challenge for the industry.

Low Penetration

Alcohol is sold through a meagre 86,000 outlets, which is extremely low when compared to the rest of the world. One of the reasons for a low per capita consumption of liquor in India is the low affordability levels, which is a direct fallout of high taxation.

Limited Pricing Power

In many states, where the government is also the biggest distributor, it fixes the prices at which it buys products from the alcoholic beverage companies and the prices at which they will sell to the end consumers. The state governments decide the end consumer price, leaving manufactures with no say in determining their selling price. On the other hand, the recent increases in duties and taxes has led to increase in the end consumer price which has adversely impacted the purchasing power. Furthermore, the regulatory barriers also pose challenges for offsetting cost inflation. Companies in the sector has to represent their case to state governments to get price increase, which is a time-consuming process.

Alcohol Ban

Some of the states have banned alcohol with the objective of improving public health and responsibility. In past, such bans have not been very successful and even the social objective is also defeated as it gives rise to illegal trading of liquor in states where it is banned. Such bans impact the volume in short term but in medium to long term the decline in volume is compensated by higher volumes in the neighbouring states.

Irregular and High Taxation

The alcohol industry has been kept outside the purview of GST. However, the industry would be liable to pay GST on the input raw materials, which may impact the gross margins. Taxation by volume continues to adversely impact the beer segment. The tax structure for alcoholic drinks does not adjust for the level of alcohol in a particular drink. Considering the ratio of excise duty adjusted to alcohol content, IMFL appears to be more affordable than beer because it has a higher alcohol/price ratio. This makes beer an expensive drink compared with other spirits in terms of price per unit of alcohol. The excise and other taxes put together comprise over 50% of the final retail price. There is a complex multi-layer taxation structure and this makes the alcohol industry less affordable and also restricts the pricing power.

Barriers to Scale

Every state government has its own rules and regulations in addition to the regulations by central government. As a result, tax and duties are imposed on inter-state movement of alcohol which restricts consolidated operation and resulting synergy benefits.

Volatility in Prices of Key Raw Material

The beer and IMFL industry can be adversely impacted due to volatility in key input raw material prices. Since the pricing power is limited, companies would not be able to fully pass on the higher costs to consumers.

Competition

Over last few years many international companies have entered the Indian market due to the immense potential prevailing in the country. These players could impact volumes primarily in the metros as their products are well known among affluent or lifestyle seeking consumers. Furthermore, increasing trend of craft beer among urban population also increases the competition as beers can be manufactured with very limited investment in a smaller size brewery as compared to significant investment required in traditional breweries.

Historical price chart

1 Year Chart

5 Year Chart

ITD Chart

Conclusion

The alcoholic beverage space has huge prospects in India due to low penetration, positive demographics and changing lifestyles. This has drawn significant investor interest over the last one year, with marquee investors storming into the space and raising sizable stake in undervalued stocks. SDBL has seen interests from Porinju Veliyath of Equity Intelligence; also, Dolly Khanna’s mopped up more than 1% stake as of Q3FY19.

SDBL has been growing fast and expanding its facilities quickly to tap into this opportunity. However, concerns on corporate governance & integrity of promoters; lack of adequate formalization of internal processes and controls, has potential to de-rail this story.

While this stock also has potential give decent returns over long term, investors should be mindful of the risks involved, track them closely and take corrective actions, in case risks turn into issues.