In this article we present an overview of value investing. We also share 25 top value stocks to buy now in India (2023):

What is Value Investing?

The essence of value investing is quite simple and intuitive. Buy an asset (stocks in this case) at a price significantly less than its actual worth. Over time, market will re-rate the stock to its intrinsic value when you sell for a profit.

There is only one small problem though – how do we know what is the intrinsic value of a stock?

Well, there can be various ways to measure it, as we discuss below.

Liquidation Value

Liquidation value represents the proceeds that would be received by simply shutting down the company and selling off it’s assets.

After the 1929 stock-market crash and the great depression that followed, investors were very sceptical about investing in stock market. Consequently prices of stocks remained extremely depressed. Ben Graham, the legendary investor and father of value investing, would purchase stocks whose prices were less than the liquidation value and sell them back once they attain their intrinsic value for a profit.

According to Graham, if you buy 20-30 companies that meet this requirement without doing further analysis, and sell them when they eventually reach their true value, the results would be ‘quite satisfactory’. Graham used this method with success for over 30 years.

This method works well in extremely depressed markets. Unfortunately in normal market conditions it’s very difficult to find stocks of decent companies quoting below their liquidation value.

Discounted Cash Flow (DCF)

Graham disciple Warren Buffet defined intrinsic value of a business as present value of future cash-flows added together, based on works of Williams & Weise. There is a subtle difference though, Buffet used earnings to represent cash-flows in-place of dividends used by William & Weise.

American economist Myron J. Gordon came up with simplified equation popularly known as the Gordon model, to estimate value. Assuming stable dividend growth, price of a dividend paying stock can be represented as:

Price per share = D1/ (r – g)

- D1 = estimated value of next years’ dividend.

- g = constant growth rate of dividend till perpetuity.

- And r = expected rate of return on equity

DCF Example

Let’s say you want to buy an apartment for renting-out. Your expected rental income is 1L per year and you wish to increase rents by 5% every year.

Assuming you expect 10% RoI on real estate, fair price as estimated by Gordon’s model should be 1/(0.01–0.05) = 20L.

Now, let’s say, due to downturn in real estate sector you find the apartment selling at 15L. Your rate of return will improve to r = 1/15 + 0.05 = 11.67% nominal.

DCF or DDM lets you calculate the intrinsic value of an asset, be it stock or real estate. It also helps you estimate returns based on current price.

Limitations of DCF

Unfortunately DCF or DDM can be difficult to use in most industries as it requires estimating future cash-flows or dividends many years into future. Generally this is not very practical except for very few situations (such as rental type of businesses, etc). Additionally, the formula becomes meaningless in cases where growth rate in earnings is more than cost of equity.

Interestingly, while Buffett accepts the principle of discounting cash flows, Charlie Munger once said in public that he has never seen Buffett perform a formal DCF analysis himself (1, 2).

Munger: Warren often talks about these discounted cash flows, but I’ve never seen him do one. If it isn’t perfectly obvious that it’s going to work out well if you do the calculation, then he tends to go on to the next idea.

Buffett: It’s true. If [the value of a company] doesn’t just scream out at you, it’s too close.

Relative Value

With absolute measure of value of a business being hard to determine, except for academic purposes, contemporary fund managers tend to rely on relative valuation approach while practicing value investing.

According to Institutional Investor Magazine, most pension fund consultants’ group value managers into 4 categories, based on the criteria they use to identify cheap stocks. These are:

- Low PE manager, normally looking for out-of-favour stocks

- High Dividend Yield Investor

- Low P/BV (often leading to depressed cyclicals)

- Low P/CF Manager (much the way takeover specialists work)

Research findings (3)

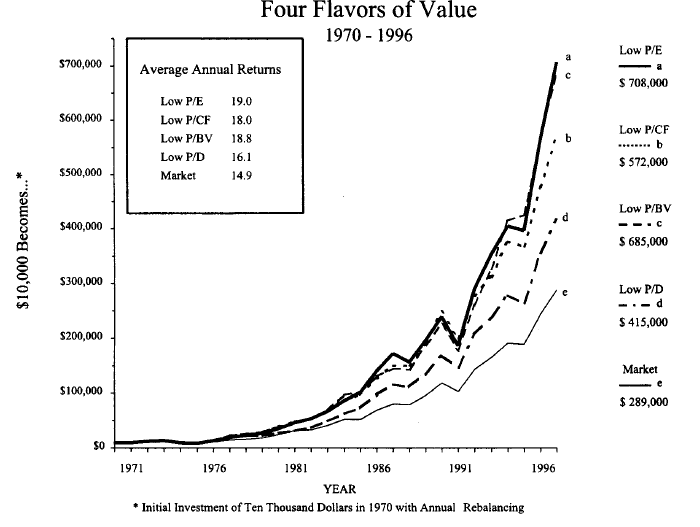

According to study performed by David Dreman and Eric Lufkin, contrarian value strategies beats the market consistently with lower draw downs. The study measured the Compustat 1500 – largest 1500 stocks publicly traded – for a 27 year period ending December 1996. 10K dollars invested in the bottom 20% of the above 4 value measures generated 708K for low P/E stocks, 572k for low P/CF, 685K for low P/V and 415K for high Dividend Yield stocks compared to 289K generated by the market.

Further, each of the strategies performed better than the market (-7.5%) in the down period, with high dividend yield stocks declining the least (-3.8%), followed by low P/CF (-5.8%), P/E (-5.7%) and P/BV (-6.2%).

With all this global statistics in context, lets turn our focus to Indian markets.

Value Investing in India

First, the obvious question: how well has value investing fared in India?

To check that, we adopt a simple strategy: we compare total returns (i.e. price gains + dividends) of Nifty 50 benchmark with Nifty 500 Value 50 Index. The later is a strategy index that invests in 50 value stocks from Nifty 500 stocks.

Over 12 year period starting 2008 through to 2019, Value Index significantly under-performed the market, generating only 4.78% per year compared to 7.15% generated by Nifty 50.

As one can see from the chart, over the past 12 years, their were periods when value index did out-perform Nifty, but the performance wasn’t consistent.

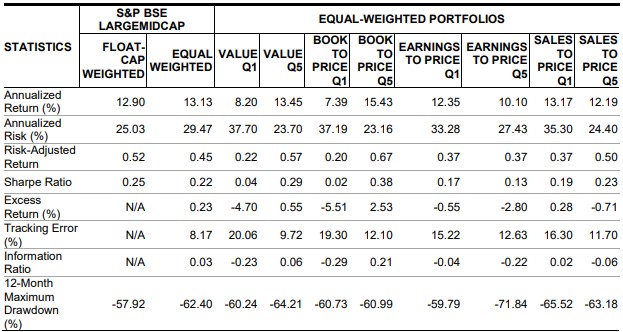

Formal research on Factor Risk Premia in India market shows that a screen using classic ratios for identifying value did not yield a premium in the Indian market during the period from Sept. 30, 2005, to April 30, 2016. In addition, the value portfolios had higher volatility than the market.

Source: S&P Dow Jones Indices LLC. Performance data is based on total return in INR. Data from Sept. 30, 2005, to April 30, 2016. Past performance is no guarantee of future results. Table is provided for illustrative purposes and reflects hypothetical historical performance.

This might come as surprise to many, given the huge fan-following of value investing Gurus.

And while Buffet might not have ever done a DCF according to his partner Charlie, Ben Graham, the celebrated father of value investing, had the following words for security analysis in general towards the end of his career:

I am no longer an advocate of elaborate techniques of security analysis in order to find superior value opportunities. This was a rewarding activity, say, 40 years ago, when our textbook “Graham and Dodd” was first published; but the situation has changed a great deal since then. In the old days any well-trained security analyst could do a good professional job of selecting undervalued issues through detailed studies; but in the light of the enormous amount of research now being carried on, I doubt whether in most cases such extensive efforts will generate sufficiently superior selections to justify their cost.

It’s not surprising that Quantitative strategies are gaining popularity now.

25 Value stocks to buy now

Given pure value investing hasn’t been very consistent in India, to design a portfolio of value stocks, we combine “value” with two other factors: growth and quality as in the following screen.

We filter stocks using relative value techniques, using Price To Earnings and Price to Sales ratios, and then further, check for reasonable growth, profitability and earnings quality.

As of January 2023, our screen returned the 25 stocks listed below:

| Name | PSR | PER | PBV |

|---|---|---|---|

| Tanfac Inds. | 3.24 | 25.93 | 7.28 |

| Guj. Themis Bio. | 6.03 | 16.07 | 6.73 |

| Supreme Petroch. | 1.36 | 13.03 | 4.48 |

| Sandur Manganese | 1.12 | 6.54 | 1.53 |

| Godawari Power | 0.91 | 4.82 | 1.52 |

| Vinyl Chemicals | 0.71 | 16.95 | 7.35 |

| Monarch Networth | 5.52 | 15.3 | 4.09 |

| Sonata Software | 1.27 | 20.18 | 7.59 |

| Rajratan Global | 4.28 | 33.83 | 10.4 |

| Nikhil Adhesives | 0.68 | 28.04 | 5.77 |

| Jindal Stain. | 0.58 | 9.22 | 2.45 |

| Shivalik Bimetal | 6.15 | 36.49 | 10.97 |

| Apcotex Industri | 1.96 | 18.66 | 4.85 |

| ION Exchange | 2.36 | 22.02 | 6.15 |

| Permanent Magnet | 3.97 | 25.31 | 7.33 |

| Lords Chloro | 1.31 | 6.2 | 2.67 |

| Themis Medicare | 3.41 | 20.65 | 3.8 |

| Roto Pumps | 4.78 | 33.05 | 6.47 |

| Avantel | 4.39 | 24.64 | 6.93 |

| Redington | 0.19 | 9.88 | 2.26 |

| Sr.Rayala.Hypo | 0.51 | 6.64 | 1.09 |

| Allcargo Logist. | 0.45 | 9.67 | 2.79 |

| Cigniti Tech. | 1.15 | 12.79 | 3.67 |

| Saksoft | 2.48 | 20.75 | 4.47 |

| Stylam Industrie | 2.17 | 22.66 | 5.36 |

Disclaimer: This is not a recommendation of buy any of these stocks, please do your research or speak to financial advisor before investing

Conclusion

Value investing is intuitive. It tells us to buy business at prices significantly less than its intrinsic value and sell once prices reach their true worth. Challenge arises in accurately estimating value of a business. Absolute measures such as liquidation value or present value of future cash flow determined by DCF model tends to have practical limitations. Contemporary value investors therefore rely on relative valuation techniques such as low P/E, low P/BV, low P/CF and high dividend yield metrics to identify stocks. We ran a simple screen to demonstrate how value picks can be identified in the Indian market following this concept.

If you liked reading this article, share it with a friend.

Reference

- Discounting future cash flows – Buffett & Munger approach

- http://buffettfaq.com/

- Contrarian Investment Strategies – The Next Generation, by David Dreman, 1988 Simon & Schuster, pp155