This post provides a step-by-step guide on how to estimate retirement corpus for an individual, and concludes by presenting a downloadable retirement calculator that can be used in India.

‘How much money should I have when I retire?’ This is perhaps the most common question people ask while planning for their retirement. And while it is easy to assess the size of retirement corpus, unfortunately, people usually struggle to estimate it, and even worse, settle for a grossly inadequate sum. In this article, we will explain a simple method to accurately estimate the size of retirement corpus in less than 5 seconds.

OK, Let’s get started!

The first step in estimating retirement corpus is knowing how much money you spend each month to support your lifestyle. Let’s say you earn 2 Lakhs per month, of which you spend 50% on average and save the rest. Then you need plan for a corpus that will generate 1 Lakh per month at today’s value of money.

In reality, your monthly fund requirements after retirement will differ slightly from the present. This is because certain expenses that you have now, may not be relevant or change after you retire. This may include EPF payments, other pension premiums, employment related expenses, viz.transportation and likes. On the other hand, your medical expenses are expected to increase and this need to be provisioned. You can break these up to come up with an accurate number on the monthly spend, although, for simplicity, we have assumed that the reductions current expenses will be offset by increase in the medical expenditure, and as such, the fund requirements before and after retirement will remain more or less unchanged, at constant purchasing power.

However, purchasing power of money reduces with time. So if you need 1Lakh per month today, and you are 40 years old, you will need 1 Lakh x (1+0.05)^20 ~ 2.65Lakhs per month at retirement, assuming 5% inflation and 60 years of retirement age.

Assuming life expectancy of 85 years, you will then need to build a corpus that will generate inflation adjusted equivalent of Rs2.65 Lakhs pm for the next 25 years. Additionally, your retirement corpus should generate interest income after offsetting inflationary effects. This is called inflation adjusted returns on the corpus and needs to be accounted for. To calculate this, the concept generally used is called present value of future annuities. This is usually done with the help of a financial calculator or a lookup table.

Unless you are good in math, you must be wondering by now that how am I supposed to calculate all these in less than 5 seconds?

Simple. We have created a calculator that will do all the work for you.

All you need to provide is:

1. Your average monthly expenditure as of date, and

2. Your age

That’s all! Tool will calculate the corpus for you automatically.

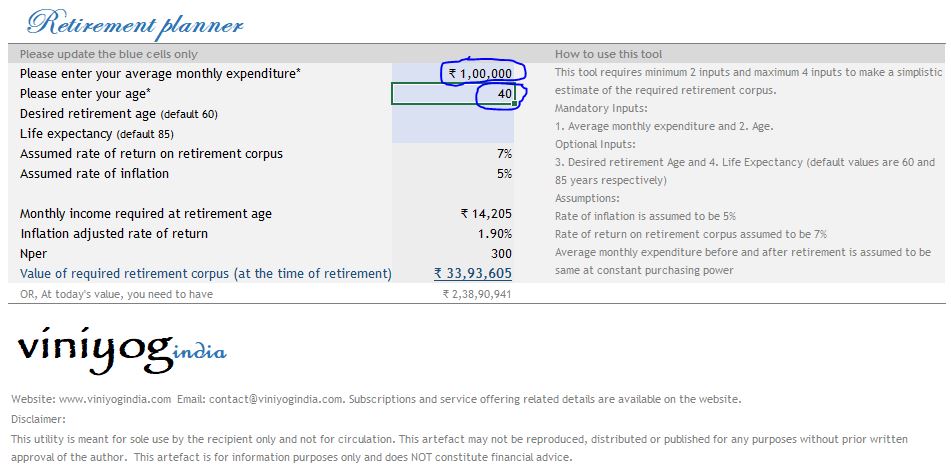

So, assuming you spend 1Lakh pm today, and you are 40, then you will need to a corpus to ~ 6.34 Cr at 60 when you retire, to support you till 85. This is equivalent to 2.39 Cr at today’s value. Calculations assume inflation of 5% and 7% per annum return on retirement corpus.

Fig.1 Retirement corpus calculation using 2 parameters (click to enlarge image)

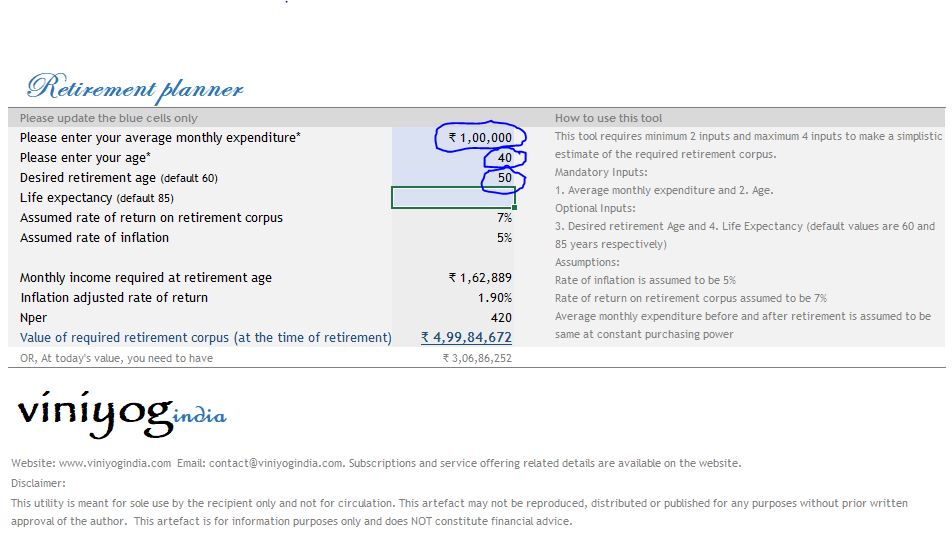

Optionally, you can also change the retirement age and life expectancy values. For example, you intend to retire early, say at 50, you need to have approx. 5 Cr when you retire, which is equivalent to 3.07 Cr at today’s value.

Fig.2 Retirement corpus calculation for early retirement (click to enlarge image)

Here lies an apparent paradox. Above examples show that your corpus should be 6.34Cr if you retire at 60 and 5Cr if you retire at 50. Shouldn’t you need more funds if you intend to retire early? Of course yes. Remember, the value of the corpus represents money one should have when you retire. To make things easy to relate, we have also indicated how much that comes to at today’s value of money. For above example, you will need 3.07Cr and 2.39 Cr at today’s value, if you wish to retire at 50 and 60 years respectively, at retirement (i.e 10 & 20 years from now).

Remember, retirement corpus is a function of 3 variables: monthly expense, age and inflation adjusted return. Ignoring any one of them makes the estimate meaningless.

Feel free to get this utility using the link below. Play with the parameters if you like, and find out how soon you can retire to pursue your dreams!

Download Retirement Calculator Now!

Disclaimer:

This utility is meant for sole use by the recipient only and not for circulation. This tool makes certain assumptions for the purpose of calculation. This artefact is for information purposes only and does NOT constitute financial advice.

If you have any comments or feedback on this utility, including errors, omissions, or improvements, please send them to contact@viniyogindia.com.