Kolkata-based Basant Maheshwari is a well-known value investor, portfolio manager and author.

Mr Maheshwari took to full-time investing in 2001 after his family business failed to take off. Between 2001 and 2017, he successfully spotted and invested in multiple multi-baggers.

He is the founder of investment portal The Equity Desk and author of “The Thoughtful Investor”.

He also runs Basant Maheshwari Wealth Advisors LLP, a SEBI registered PMS Company.

Early life

Basant was born in a Marwadi family in Kolkata who were into mining business

His maternal uncle was a broker at the Calcutta Stock Exchange. As a kid, Basant would visit the exchange with his uncle and this made him curious of the market

In 1991 Basant enrolled in St. Xaviers College, Kolkata to study commerce. When in college, he had a couple of friends who were deeply into stocks. It was the Harshad Mehta era and stocks were soaring. Basant & his friends would miss classes to look at the stock markets.

In 1994, Basant graduated with B.Com degree and the following year successfully cleared the Cost Accountancy exam.

After completing studies, he joined the family business which was then doing well. Basant wanted to be an investor, but his father (considered stock markets as gambling and) advised was against it.

His father however used to give him a salary and Basant would take that money on the 1st of every month to put into the market. This is how he got started.

The plunge

By 1998-1999, the tech fever had started, and stocks were surging again. Basant started chasing the second-liners. Zee TV was the darling of the market at that time. In 1999, Shree Adhikari Brothers were starting a channel, after having done a lot of good programmes on Doordarshan. Basant thought this will also do well because Zee TV was doing well. So he bought the stock at Rs 130. The stock went to around Rs 2,000. DSQ was another stock which he picked up at 300 and it went to 2800.

2000 & beyond

However in 2000 things turned for the worse. Basant would pledge his shares to borrow funds which he invested back in stocks. When the markets plunged, margins got triggered & eventually he got wiped out. In his words:

I still remember those evenings when I went to the bank to pledge shares and withdraw shares. One fine day, we were in Jammu and I was at the mines (we were a mining company), and there was a complete dislocation of communication there. The market fell in the meanwhile, the bank would have sent me a margin call letter at my home here, there was nobody and the letter got returned, and then the bank sent a telegram, and then they sold all the shares.

In 2000, around April or May, everything got drained out. But that was one part of it. The second part was that when I got to know that my bank had sold all my shares, I went and bought all those shares at Rs 100-200 higher prices. So that is how it happened.

To make matters worse, government took away the mines his family owned. Basant had lost everything.

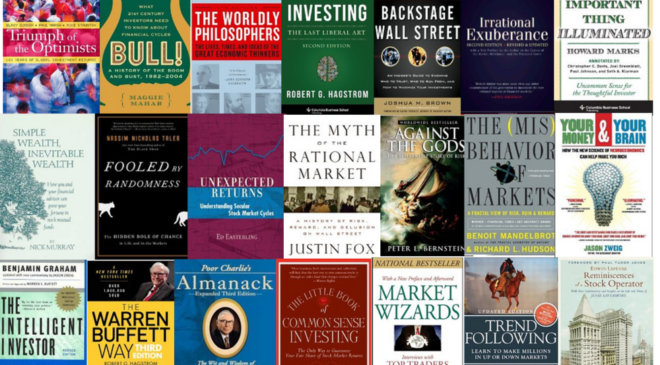

Basant started teaching to make a living. It was that time he was introduced to ‘One Up on Wall Street’. This book turned out to be an eye opener for him in terms of how to select stocks. Basant read up a lot of books and came back to stock market in 2001 better prepared.

Between 2001 and 2014, Mr Maheshwari invested in companies such as Bharti Airtel, Trent, Pantaloon Retail, Axis Bank, Titan, Page Industries, Hawkins Cookers and Gruh Finance (successfully) – which turned out to be multi-baggers.

Investment strategy

Basant’s basic philosophy is to never buy a stock unless he thinks he can make 10-times out of it. This is because if you play for a 50% game and you get it wrong, you can also lose 30%. But if you play for a 1,000% game and you get it wrong, you will at least get 100%, 200%, or 300%. That is assuming all your analysis is correct. Of course, he looks at additional financial and operating parameters such as the following:

- Invest in companies that have a return on equity (in excess of 30 per cent) and that pay regular dividend. These two factors are a sign of sound management, he says.

- Invest in companies with high sales growth: Companies that generate 25-30 per cent sales growth for 5-6 years are unlikely to be loss-making propositions, he believes.

- Never buy into a company which is not a sector leader.

- Buy companies, which are trading at market price/face value of more than 100.

- Companies with debt can also be good bets provided the growth in debt is significantly less than growth in sales.

Risk management

He believes that careful risk analysis and management is crucial particularly if you are planning to use leverage.

Basant believes that it is very hard to lose money on positive cash flow companies.

For example a company that is growing at 40% per annum and generating free cash would use its free cash flow to fund capex and to expand business. When growth slows however, to say 15% or 10%, its cash requirements to fund capex would reduce which can now be diverted for dividends.

This would provide downside protection to the stock-price providing investors’ with adequate time to get out whenever they want.

Basant had learnt this the hard way. He was holding Pantaloon Retail, a negative cash flow company. And when it fell, it fell like a stone in water. His initial price was Rs 7 and the stock went to Rs 875 – by the time he actually sold it was Rs 300.

Multi-baggers from Basant Maheshwari

Mr Maheshwari’s multi-baggers and his rationale for investing in them:

- Page Industries: bought at Rs.350; return of 20 times between 2008-14. Criteria for selection: Consistent growth of 40 per cent for 11-12 years and kept on capturing market share. Best growth in the industry. Did not take debt or dilute equity.

- Hawkins Cookers: bought at Rs.350; return of 8 times between 2008-14. Criteria for selection: Bought the stock for dividend yield and stability in portfolio after the 2008 global financial crisis. The kitchen appliances markets was growing at a fast pace.

- Pantaloon Retail: Held between 2003 and 2008, return of 40 times. Criteria for selection: It was a bull market story, which ended with the global financial crisis. Initial thought that it could be India’s Wal-Mart, but later convinced that it required heavy doses of cash, which would have been difficult in a bear market.

- Titan: Bought in 2008 after selling Pantaloon as a retail play. Between 2008 and 2013, it gave return of 6 times. Criteria for selection: Big brand, high RoE. Sold last year after announcement of restrictions on gold imports.

- Gruh Finance: Held between 2011 and 2014 for return of four times. Criteria for selection: A home finance company that outgrew HDFC. It lends in semi-urban and rural areas, where there is little competition from big lenders. Small ticket-size of loans and good risk management. Repco Home Finance is another good bet.

Story That Did Not Go As Planned:

Mr Maheshwari bought Voltas in 2008 and had to sell the stock at a 60 per cent loss. He says, “It was a bad decision and I paid the price.” Criteria for selection: Voltas fell from Rs.250 to Rs.160 and after the sharp fall it appeared cheap. However, the stock continued to slide.