The world is sitting on a $400 trillion financial time bomb

Financial disaster is looming, and not because of the stock market.

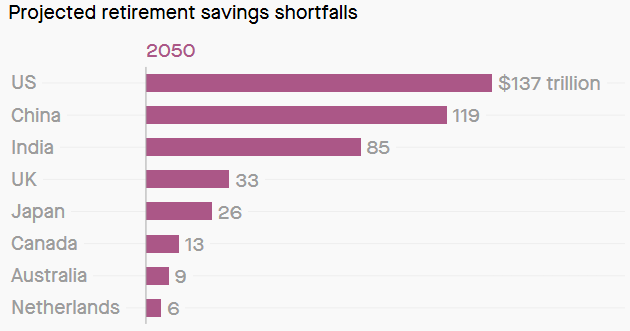

The World Economic Forum (WEF) predicts that by 2050 the world will face a $400 trillion shortfall in retirement savings. Asset returns will fall and life expectancy will rise. India will have the 3rd biggest hole in retirement savings, falling short by 85B to fund retirement needs in 2050.

Source: WEF, qz.com

Millennials may find it hard to maintain lifestyle when they retire

By 2050, India will be home to one of the largest populations of retirees in the world. However, its savings, as well as support from the government or employer pension plans, won’t be enough to live on.

This shortfall in retirement savings, measured in terms of the funds required to cover 70% of pre-retirement income for each person, will increase from $3 trillion in 2015 to $85 trillion in 2050, according to a study by the World Economic Forum. At 10%, the yearly growth of the gap in India’s retirement savings will be the fastest among the eight countries analysed by the WEF, including China, the US, and the UK. It will also be well above the global average of 5%.

Reason for this shortfall are primarily twofold. One, a majority of the Indian workforce operates in the informal sector with hardly any access to retirement saving plans. Second, middle class in Asia’s third-largest economy is rapidly expanding. As incomes and the quality of life improve, the quantum of money required for retirees will also go up.

While only 25% of Indians have some form of pension cover, the pension system itself is rated one of the worst in the world.

Why India could be one of the toughest place to retire

According to the 2015 Melbourne Mercer Global Pension Index , India ranks last among 25 countries when it comes to retirement income systems

India scored 40.3 on the index—lower than its score of 43.5 last year, while Denmark was on top, scoring 81.7.

The primary reason for India’s dismal score is decrease in the household savings rate, as savings rate in India, in recent years have “materially reduced”.

Moreover, United Nations has revised life expectancies at birth for all countries, and India has seen one of the highest surge. The life expectancy at birth for Indians will increase to 75.9 years by 2050, substantially higher than the current estimate of 69.1 years. This, in turn, has deteriorated India’s score further.

In 2010, about 8% of India’s population was 60 years and above, this is estimated to increase to 19% by 2050, according to the United Nations Population Division. Yet, the number of elders covered by pension schemes is dismal.

According to Mathew Cherian, chief executive of HelpAge India, a non-profit organisation, India spent 0.032% of our GDP on pensions. In terms of coverage, while India has 25% coverage by its own records, Nepal covers 47% & China 74%.

Another study, same result

And this isn’t a one off finding. Another recent (2016) study released by French asset management company Natixis Global ranked India last in a global retirement index. Switzerland, Norway, and Iceland topped the ranking, while the US ranked 14th.

The ranking includes 43 countries which included IMF’s 34 advanced economies, five OECD nations, and the four BRIC countries.

Study is based on factors like material means to live comfortably, access to financial services, access to health services, and a clean environment.

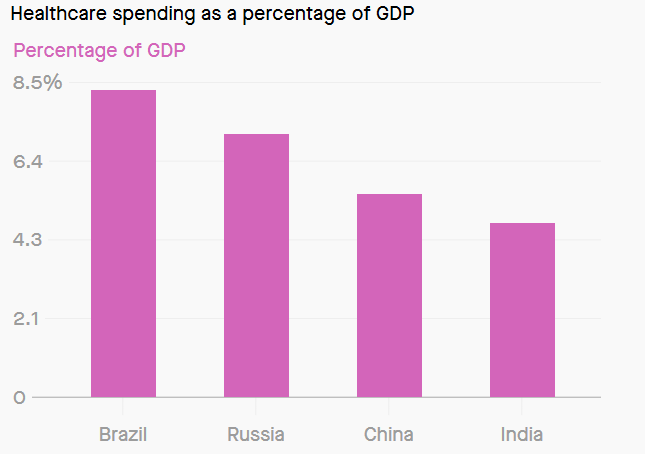

“India has the lowest ranks for health expenditure per capita, non-insured health expenditure and life expectancy out of all countries measured in this year’s ranking,” the report said.

50 is the new retirement age, but have we planned for it?

If this wasn’t bad enough, there is another hidden factor that the middle class has to worry about.

Retirement is just not what it used to be in the 1980s or 1990s, when people could easily retire at the age of 60 with a good pension. Things have changed a lot since then.

On one hand, too many people these days speak of getting burnt out because of working 13-14 hours a day and feel that their careers are taxing them mentally, emotionally and physically. On the other, organizations are increasingly letting go of older employees and replacing them with younger people at a lower cost.

Most of these older people find it difficult to find equivalent roles, and they don’t have a plan B.

Despite this environment, very few individuals actually have a formal financial plan in place for retirement. The problem is further compounded by growing aspirations and lifestyles. With couples having children late, they are getting into old age with huge financial responsibilities.

Time to wake up

Indian Government is trying to take baby steps to address the issue. The Narendra Modi government has sought to improve the situation through schemes like the Atal Pension Yojana. Launched in May-2018, scheme aims to bring 400 million+ Indians working in the unorganised sector under the pension umbrella.

For the middle class, it’s important to recognize the need of proper financial planning and take concrete steps before it’s too late.

So do You have any retirement concerns? Or are you struggling to figure out what to do with retirement savings? 🙂 . Whatever your concerns are, comment below and let us know!

P.S.

Have you estimated your retirement needs? Estimate your retirement corpus in 5 seconds by using this simple calculator.

P. P.S.

How does a financial / retirement plan look like? Here is an example.

P. P.P.S.

Questions? contact us here.

Reference & Credits

- qz.com

- WEF

- UN