When K. M. Mammen Mappillai started a toy balloon manufacturing unit in 1946 at Tiruvottiyur, Madras (now Chennai), little did he know that he was about to begin a long and glorious journey.

Madras Rubber Factory, popularly known today by its abbreviation MRF, is the 16th largest tyre manufacturer in the world and the largest in India.

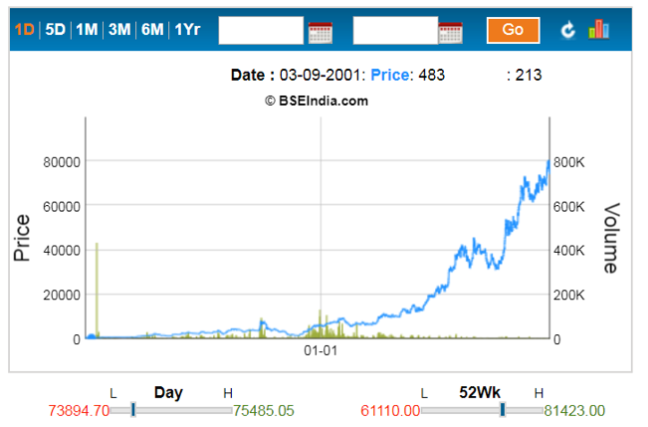

The share price of MRF which was trading at Rs 483 per piece on September 03, 2001, has in April 30, 2018 touched a mammoth high of Rs 81,423 on BSE. This blockbuster performance means in 18 years MRF has grown by a whopping 16,757.76% or 168.58 times on stock exchanges.

An individual investor named Ravi of called Zee Business news channel to get experts’ opinion on what he should do with the stock. His grandfather had bought 20,000 shares of MRF in the year 1990 and has relevant physical certificate as proof. At the price prevailing when he called, his grandfather’s investment in MRF was worth around Rs 130 crores!

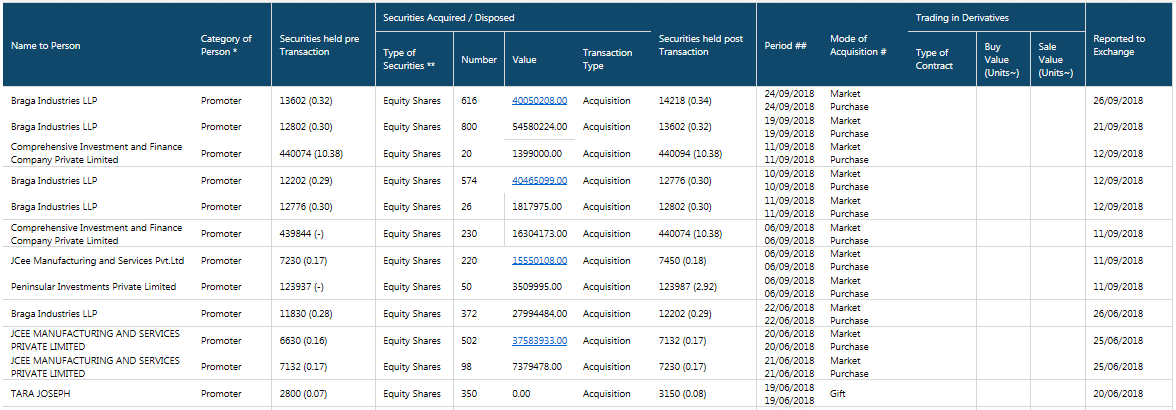

Promoters are buying

Between 22nd June and 25th September 2018, promoters bought 10.88L shares worth Rs 22.66 crores from the market. Although these transactions are marginal and less than 0.1% of the market cap, it does invoke curiosity as to what the prospects of the stock is.

Prospects of auto component industry

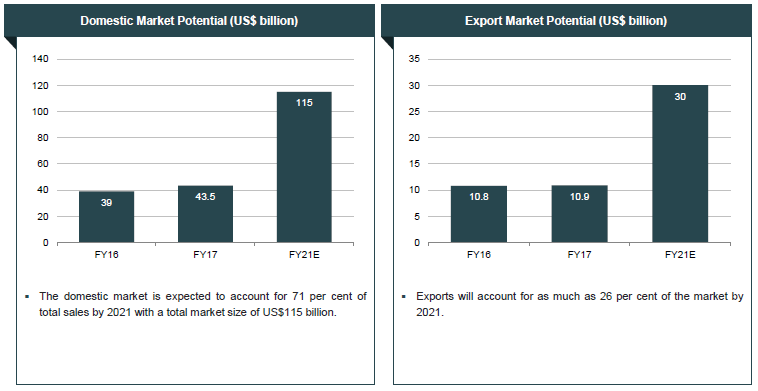

The auto-component industry is expected to grow at 10-12% in the long term as per industry reports. The domestic and exports market has potential to grow to USD 115B and 30B in FY21E from 43.5B and 10.9B in 2017.

Source: IBEF

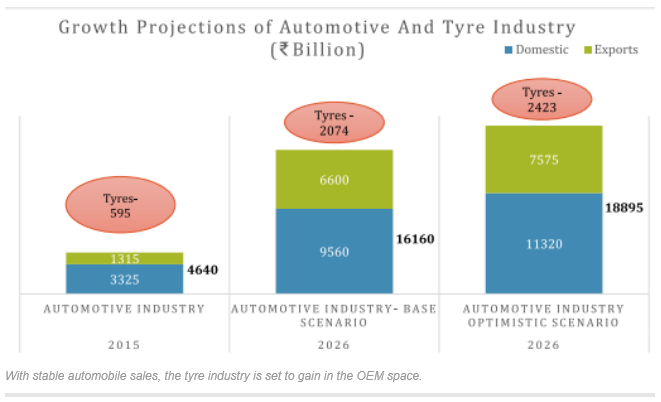

The Indian tyre industry is estimated to be approximately Rs 60,000 crores in 2017-2018 with the top eleven tyre companies accounting for more than 90% of the volume. Top three companies – MRF, Apollo Tyres and JK Tyres – have 55 per cent of the market share, with MRF commanding around 25% of the market. Industry is projected to grow at around 12 to 14% between 2015 and 2026.

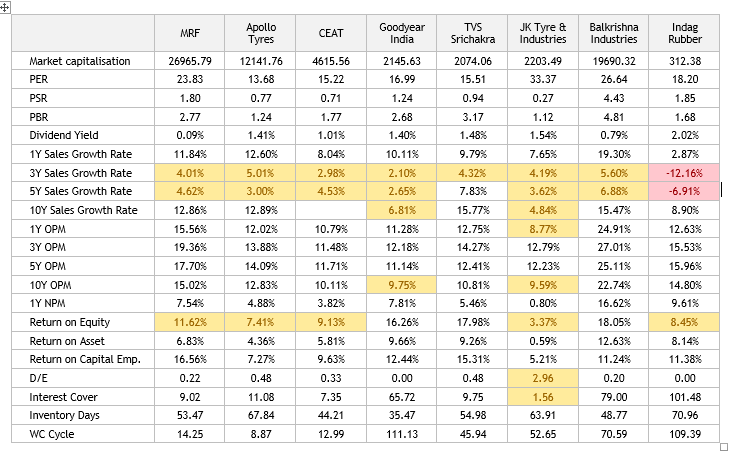

Performance of major tyre manufacturers

Domestic tyre industry is extremely competitive in nature with multiple players vying from space. Performance of the key players over the past 5 years have been moderate.

- Top-line growth has slowed down over 10 year period & has been mostly stagnant in the past 5 years

- OPM has declined for most companies from the 5 year averages

- Balkrishna is most profitable (and also most expensive)

- Balkrishna also does best in terms of inventory management

- JK Tyre appears to be the weakest of the pack in terms of profitability & leverage

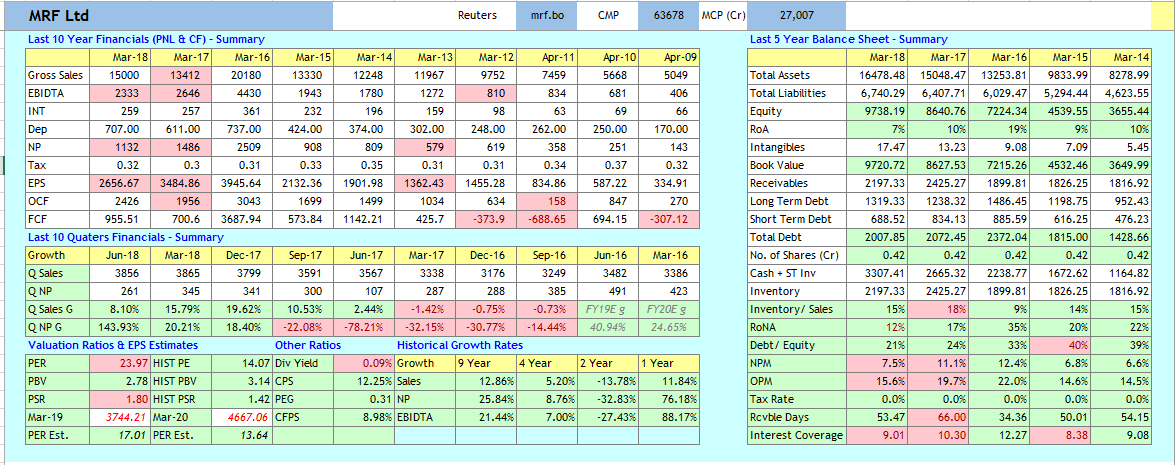

Performance of MRF

- MRF has witnessed decline in profitability from over 20% to around 12% in FTY18

- Growth has slowed from past 5 year averages, before witnessing an uptick in FY18

- Company is cash guzzler with FCF averaging around 1250 Crs over the past 6 years

- Company has extremely strong balance sheet and is net cash positive

- MRF has earmarked an investment of Rs 45 billion in Gujarat over the next decade.

- Going by past 5 years growth records, valuation appear to be relatively on the expensive side, particularly in view of the prevailing market sentiments

Challenges in the tyre industry

Imports from China

A DIPP report highlights that rubber (tyres) industry has been affected by large imports from China. Due to slowdown in the Chinese economy, Chinese manufacturers have been dumping their products in the Indian market which is affecting the domestic industry.

Although the government has imposed anti-dumping duty, but that is based on loss of profit and is not a deterrent.

Besides, reports suggest that illegal or illicit imports are also a cause for concern.

The share of imports from China has gone up to over 50 per cent from just about 20 per cent in the last five years, as per the data available with Automotive Tyre Manufacturers Association (ATMA).

Due to rising imports, the domestic industry has been lingering with decline in production and the capacity utilisation of plants has remain subdued.

Inverted duty structure

Other challenge in India is the inverted duty structure for the tyre industry which adds pressure to the players.

Inverted duty structure is where the key raw material attracts higher customs duty than the finished product. In this case natural rubber attracts more customs duty than the completely built tyres.

Analyst feel that the duty structure needs to be corrected by increasing the customs duty on tyres to keep it at par with the duty attracted by natural rubber, which will help the domestic industry to be competitive.

Also, import of natural rubber needs a prior license and declaration, which increases holding costs making the tyre industry non-competitive.

Free Trade Agreements

Furthermore, trade agreements have affected the domestic industry as concessions are provided on customs duty on finished tyres from countries with which India has an FTA (Free Trade Agreement) but not on natural rubber. Natural rubber falls under the negative list and therefore it increases the cost of tyres made in the domestic market.

Income Tax

Besides, the corporate income tax in India is higher than many other countries, which reduces competitiveness in the Indian tyre industry.

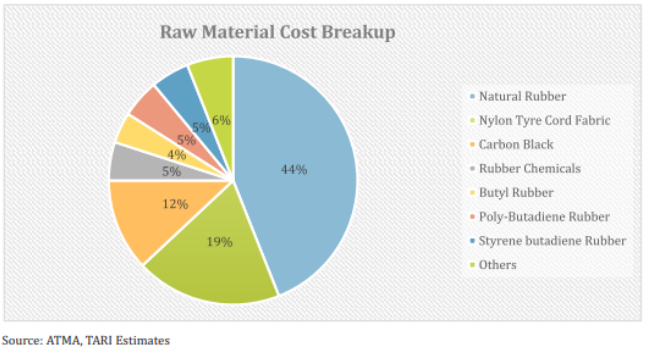

Raw Material

In terms of raw material, both natural rubber and crude are controlled by the external environment and little can be done to control the raw material price movement.

Rubber including (natural and synthetic), nylon tyre cord fabric (NTC) and carbon black constitute a significant portion i.e. 60-65 per cent of the overall raw material cost of the industry, as per CARE Rating, hence any change in the prices of these materials impact the overall industry’s profitability.

Conclusion

Even after the challenges mentioned above, the tyre companies have managed to remain profitable in the Indian market. However, the potential of growth is almost two times than what it is now if the hurdles are taken care off.

MRF has grown by 1651% over past 18 years which represents a phenomenal 32.9% CAGR over 18 year period. The auto component industry is growing by around 12-14% a year and has potential to do better. Tyre industry in particular is fiercely competitive with presence of multiple strong players and is witnessing relatively weaker traction over past 5 years. Multiple factors such as cheaper imports from China, inverted duty structure, tax rates, FTAs etc. have been contributing to this sluggishness. On the face of it, the stock might appear relatively on the expensive side, particularly in context of the recent carnage in mid and small cap stocks, but the underlying business and brand remains as solid as ever.