An index fund is a type of mutual fund with a portfolio constructed to match or track the components of a market index, such as the S&P BSE Sensex Index.

Investing in an index fund is a form of passive investing as these funds merely track predefined indices.

Active Vs Passive Investing

Multiple research in US markets have revealed that majority of mutual funds fail to beat broad indexes, such as the S&P 500.

- According to Morningstar, number of Equity Mutual Funds that failed to beat the market over 10 year period is 74% or more(1)

- Average Equity Fund investors performed worse, returning of 3% annual gains against 13% for the markets over 20 years’ period ending 2004(2)

- In 2007, Buffett famously placed a million dollar bet, challenging Hedge Fund industry to put together a portfolio that would outperform S&P500 index fund over 10 years. He won by a wide margin. By the end of the bet, $1 million invested in the funds chosen by Seides, who accepted the bet, would have gained $220,000 against $854,000 for the low cost S&P500 index fund.(3)

Since the fund managers of an index fund are simply replicating the performance of a benchmark index, they do not need the services of research analysts and others that assist in the stock selection process. The primary advantage to such a strategy is the lower management expense ratio on an index fund.

Due to these benefits, Index funds are generally considered ideal core portfolio holdings for retirement accounts in the US.

In emerging markets like India though, underperformance of actively managed funds relative to broader market indexes could not be established.

This is partly due to inefficiencies inherent to an emerging market, and also due to limited availability of data for conclusive research.

None the less, index funds in India have provided decent returns historically to automatically deserve a place in core portfolios of investors.

Further, as we shall see, exchanges are creating interesting variations within their basket of Index offerings which have inherent ability to beat the primary indices such as Nifty & Sensex over long term.

Types of Equity Index Fund in India

Equity index funds in India can be one of the following types:

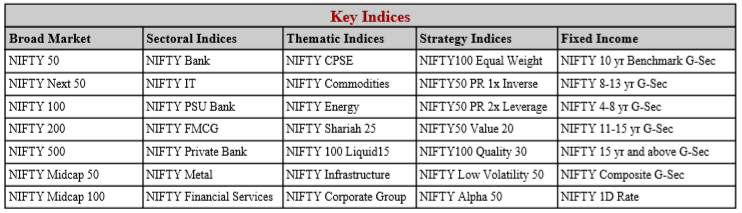

1. Broad Market – Nifty 50, Nifty Next 50, Nifty 100, etc. Largecap indices

2. Sectorial indices – such as Bank, PSU Bank, etc.

3. Thematic indices – CPSE, Shariah, liquid, infra etc.

4. Strategy indices – such as value, equally weighted indices, quality, volatility, etc.

5. International – NASDAQ, Hang Seng

6. Midcap indices

7. Etc.

Key indices offered by NSE

5 best performing Index funds in last 1 year

Performance

Best performer based on past 1Y performance (is an index fund belonging to International category) that tracks NASDAQ 100. It has a 1Y return of 36% and fantastic 2Y, 5Y and ITD returns

The next 3 positions are taken by funds from 3 separate AMCs that track Nifty Value 20 index. This index consists of 20 ‘Nifty 50’ companies which are selected on the basis of Return on Capital Employed (ROCE), Price-Earnings (PE), Price to Book Value (PB) and Dividend yield (DY). This is like index investing with a value twist.

4 out of 5 top performing funds are not based on broader index (such as Nifty for Sensex). Only the 5th position is taken by HDFC Sensex ETF which is based on S&P Sensex.

AUM & TER

3 of the above 5 funds have AUM less than 10 crs, while 2 have AUM less than 5 crs.

Yet, most of them are extremely frugal. For example, HDFC Sensex ETF has a TER of 0.05% on an AUM of around 5+ crores, which translates total expense of around 27K for the fund!

Conclusion

Index Funds are an attractive investment option by virtue of their low costs and decent returns.

The basket of indices offered by the exchanges have become richer over the years. AMCs are offering funds based on these indices, as a result, investors have an interesting mix of strategies, sectorial indices, themes, beyond the broad market indices to choose from.

Strategy indices like value, EWI are by design expected to provide higher returns over long term than the base indices.

It has become difficult now to not include index funds within the core portfolio.