ViniyogIndia Smallcaps Portfolio offers a curated basket of high performing smallcap stocks. This portfolio is suitable for aggressive investors only.

ViniyogIndia offers model portfolios based on Quantitative Factor Investing strategy. Factors are quantitative attributes that can be used to explain asset returns.

Mathematically, if we try to model Asset Pricing behavior as a liner multivariate function, then factors represent the independent or explanatory variables of the function.

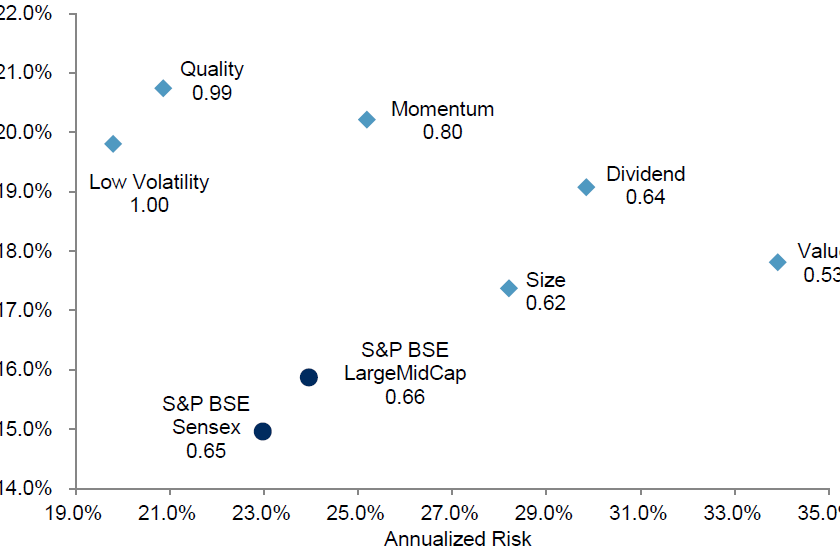

Factor strategies have been extensively researched globally as well as in India. The below chart for example, summarizes the risk-return characteristics of single-factor portfolios in India between October 2005 and June 2017. Over the period, all major single-factor portfolios outperformed the S&P LargeMidCap.

ViniyogIndia’s factor portfolios use a combination of factors that are proven to work well in the Indian markets.

Source: S&P Dow Jones Indices LLC. Data from October 2005 to June 2017. Index performance based on total return in INR. Past performance is no guarantee of future results

Portfolio Design Rules

ViniyogIndia Smallcaps Portfolio is based on a multifactor strategy that uses Size as one of its key factors.

- Portfolio of approximately 20 stocks picked from the NSE universe.

- Multifactor strategy based on combination of fundamental and technical factors to enhance risk adjusted returns.

- Uses size as one of its primary factors.

- Illiquidity filter to remove low volume| turnover stocks.

- Rebalanced half-yearly to reduce portfolio churn.

Risk Management Rules

Limits on exposure to any single stock or sector

Suitability

Suitable for aggressive investors ONLY.

Performance measurement & attribution

To interpret the sources of return for our strategy we perform a regression analysis using Carhart 4 Factor Model. The results are shown in the table below:

| ALPHA | MKT | SMB | HML | WML |

|---|---|---|---|---|

| 2.94 | 0.98 | 0.91 | 0.39 | 0.23 |

| ~0.0 | ~0.0 | ~0.0 | ~0.0 | 0.0004 |

The monthly alpha or excess return for the strategy is 2.94%. This is generated using a combination of secondary factors that tries to enhance portfolio returns while reducing risks.

Additionally, exposure to standard factors such as market beta, size, value and momentum also contribute to the overall portfolio returns.

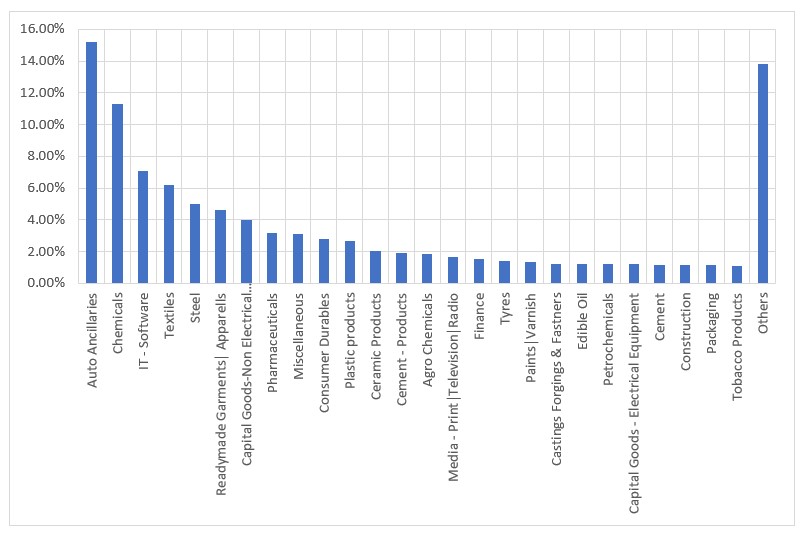

Sector Allocation

Historical sector allocation of the strategy shows adequate diversification. Analysis of historical sector allocation shows greater allocation towards sectors, such as Auto Ancillaries, Chemicals, IT Services, Textiles & Steel.

Subscribe to this portfolio @ Rs 3599/ 6m

Investments in securities markets are subject to market risks. Read all the related documents carefully before investing. Registration granted by SEBI, membership of BASL and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Credits

Featured image: Image by storyset on Freepik

Max drawdown seen in backtest?.