“As in all successful ventures, the foundation of a good retirement is planning.” – Earl Nightingale.

Many people erroneously think that financial planning is something to start when nearing retirement. Nothing can be further from truth.

Under-preparedness from misguided complacency

India is set to become the world’s youngest country by 2020 with 64% of its population in the working age group*(15-64 years). While this might sound encouraging for the world’s fastest growing large economy, there is also a flipside.

In a few decades from now, India will have one of the largest elderly population. The number of people aged 60 and above in India is estimated to grow from 8% of the population in the year 2010, to 19% in the year 2050 according to UN estimates – which translates to 32.3 crore people who are aged and out of job and hence potentially income-less and exposed to financial exigencies.

What is even more shocking is the level of under-preparedness of Indians for their retirement years. According to a Max Life and Nielsen study, despite 60% Indians not having any retirement plan, 63% feel that they will have sufficient money during their retired years. Such confidence is extremely misplaced in the context of a country where social security is grossly inadequate, life expectancy is on the rise, where hospitalisation expenses have increased (by 176% between 2004 and 2014), inflation is high and where joint family system has given way to nuclear families.

Retirement Planning: The benefit of starting early

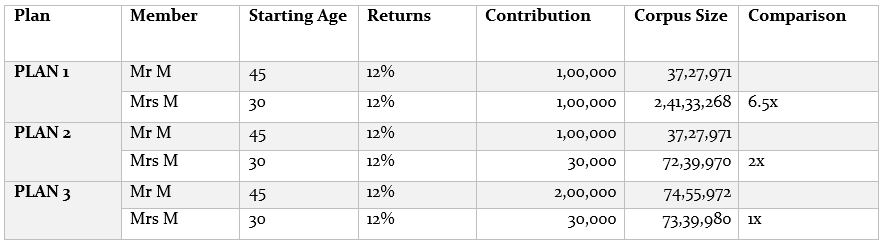

The key to retirement successful planning is to start early and gain the benefit of compounding. Einstein once said, compound interest is the eighth wonder of the world, and that is not without reason. To understand the impact of time on compounded returns, consider the following example of Mr. and Mrs. Money, both aged 30, making their respective retirement plans [1].

Mr. Money plans to invest Rs. 100,000 every year starting from age 45 for 15 years (i.e. he will withdraw the money at the age of 60) and he is expecting a return of about 12%. Mrs. Money invests Rs. 100,000 every year starting from age 30 for 30 years (i.e. she will withdraw the money at the age of 60) with a similar return expectation.

Note that both are planning to invest the same amount and expect the same rate of return, but Mrs. Money plans to keep her funds invested for double the time (30 years versus 15 years).

The Future Value (FV) of retirement corpus of both can be calculated as follows.

In Plan 1, Mrs. Money’s corpus has grown by more than 6.5 times than of Mr. Money, due to the longer compounding period. In fact, even if she reduces her annual investment to one-third of the original, say Rs.30,000, her corpus is double that of Mr. Money (Plan 2). For Mr. Money to grow his corpus at the same compound rate, given his shorter investment horizon, he needs to invest 6.5 times more than Mrs Money (Plan 3). The power of compounding allows Mrs. Money’s corpus to grow more rapidly.

Conclusion

Successful retirement planning is a very simple and mathematical exercise. The key is to start early and let compounding do the magic. As we observed:

- For a 75L corpus, starting at 45 instead of 30 increases the annual contribution by 6.5x to 200,000 instead of 30,000

- Alternatively, starting at 30 instead of 45, with 1L yearly contribution, increases the final corpus by 6.5x to around 2.5 crores inplace of a paltry 37L

Of course, one needs to build a reasonably diversified portfolio that ensures capital protection and supports growth. Proper asset allocation and product selection is critical, and that can be the subject matter of another post.

View Retirement Plans from ViniyogIndia.com